Though a Nasdaq crunch approaches in coming days

Technology remains at the heart of a U.S.-China dispute that is rooted in disagreements on trade but also intellectual property and more. Over the last few months, aside from steadily ratcheting up duties on goods produced in China and sold in the U.S., Washington has moved closer to an outright ban on supplying Huawei and added several other Chinese firms to an entity list. In recent days, the U.S. moved to blacklist more Chinese tech groups. Whilst Beijing has appeared more hesitant to levy specific measures against U.S. firms, these can’t be ruled out, leaving giant groups like Apple, Intel, NVIDIA – the manufacturer of specialist processors – and others, potentially in the firing line.

There is therefore a lot riding on substantive trade talks scheduled for the end of the week in Washington. Markets give every indication that expectations are low. So even if the only outcome is a very limited communique—for instance a pledge to hold off/suspend further retaliation pending more talks—market reaction ought to be positive. The obverse could yet upend sentiment further. Even after falling some 5% since late-July, the tech-focused Nasdaq 100 still leads U.S. indices with a 21% gain this year. That compares with second-best performer, the S&P 500 which has risen 16%. The NDX won’t sidestep further volatility if even limited trade-talk hopes are dashed.

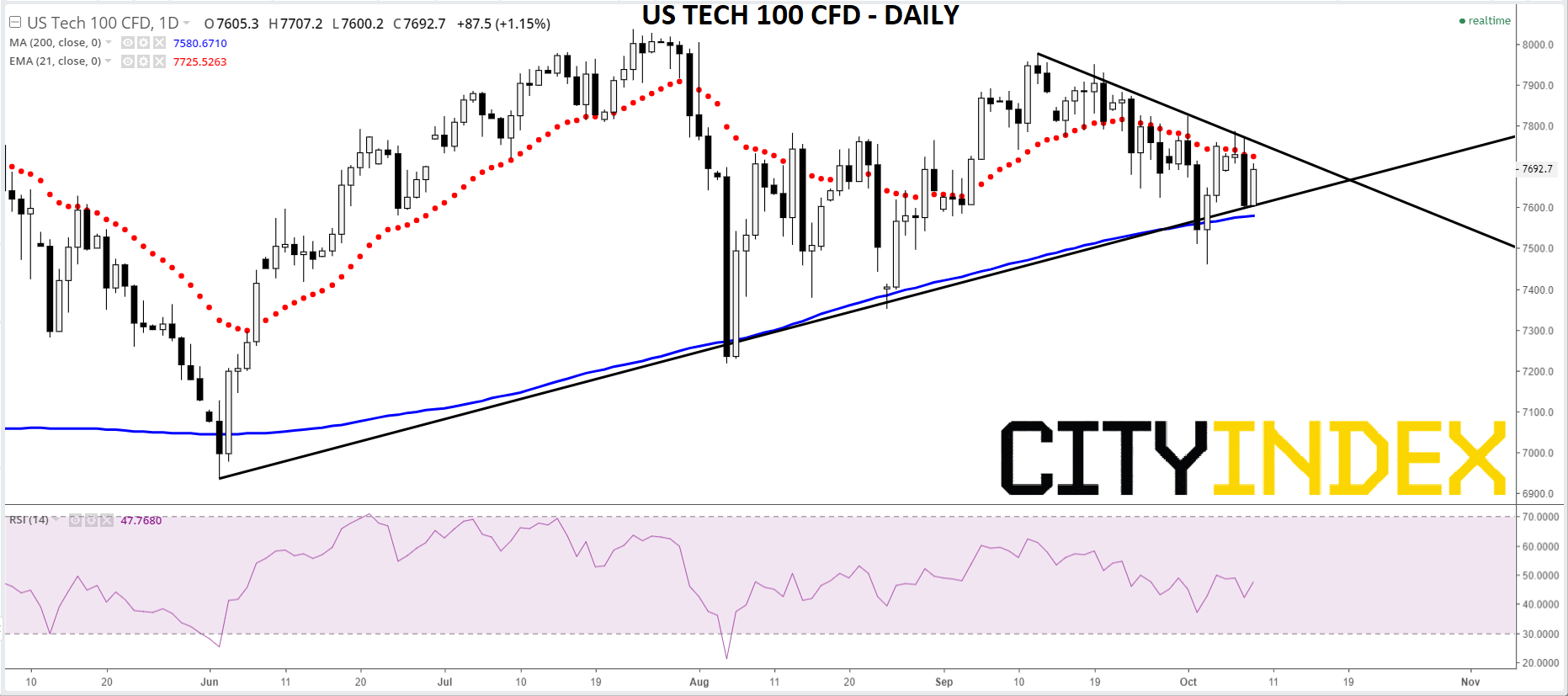

NDX’s key trends remain broadly supportive, though some over-lying caution has crept back in since late last month, reflected by the market’s drop below its 21-day exponential average. The index continues to largely climb atop its 200-day average, which is now reinforced by the rising trend line off June lows. The best-fitting overhead counterpart of the rising trend draws an apex that is almost coincident with the week’s upcoming risk events. Nasdaq will thereby have an opportunity to mark the outcome of talks as constructive, or not, in the very near term.

US Tech 100 CFD – Daily [09/10/2019 17:33:19]