Tech earnings in focus after a tough start to the year

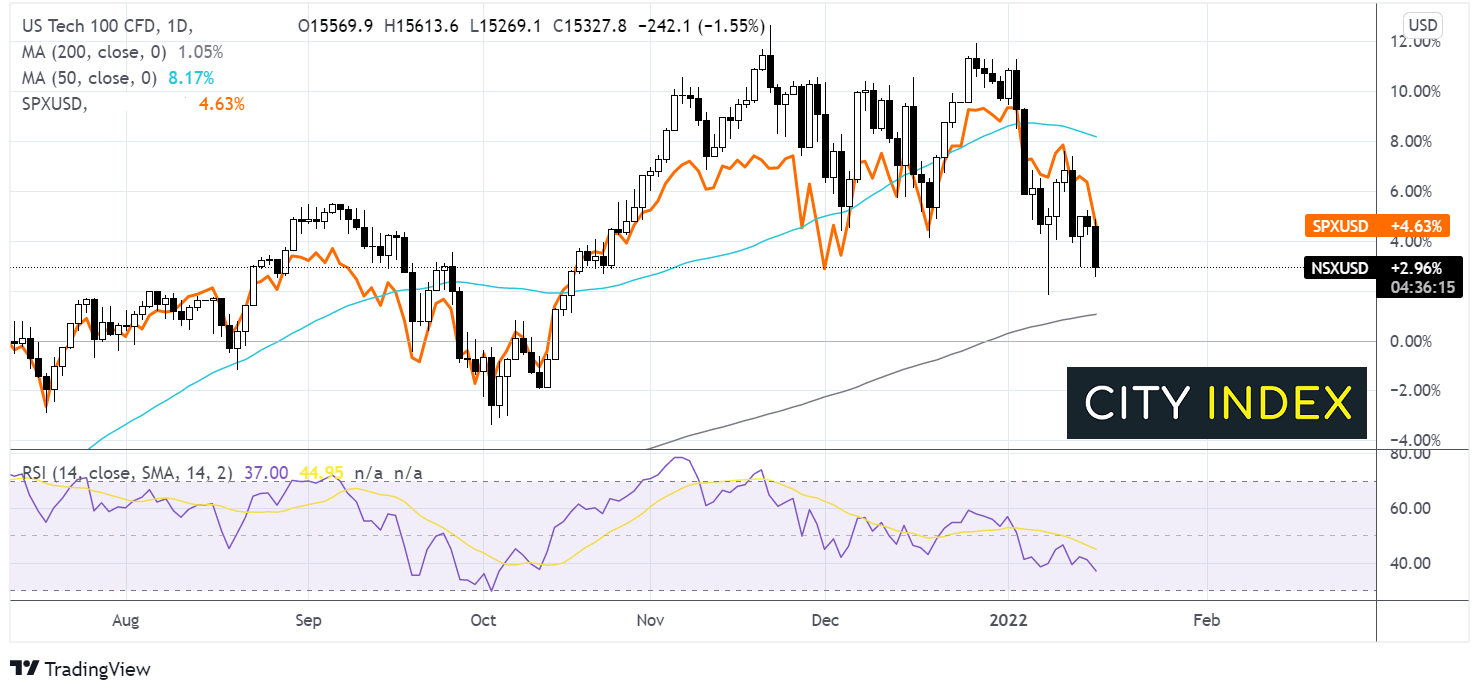

Tech stocks have had a rough start to 2022 putting more pressure on the upcoming earnings as investors search for reasons to buy into tech stocks, even as the Fed looks set to raise interest rates 3 or 4 times across the year.

Expectations of higher interest rates have seen investors rotate out of high growth tech and into value stocks, which are more likely to outperform in a higher interest rate environment.

The tech heavy Nasdaq trades down 4.8% since the start of the year. Meanwhile, the technology sector in the S&P is also down around 5% since the start of the year, with some big tech such as Microsoft trading down 7%. The S&P 500 is down a more moderated -2.7%.

What to expect from tech stocks in 2022?

What to expect from tech stocks in 2022?

A reason to buy tech?

Investors will be looking to earnings for guidance over whether big tech is a buy even as the interest rate environment is expected to change unfavorably for the behemoths. For these stocks to rise when higher interest rates are pressuring stretched valuations, demand for the product or service needs to be strong.

Wall Street needs to see encouraging 2022 guidance, which could include signs that the chip shortage is easing, in order to put the bulls back in control. However, let’s not forget that tough comparisons from 2020 and concerns over a pull forward dynamic in the pandemic could still prove to be headwinds too.

Tech earnings growth to underperform the broader S&P

According to FactSet overall S&P earnings are expected to rise by 25% in Q4 compared to the same period in 2020. However, tech stocks are expected to see earnings rise 15.6%, as other sectors are expected to have benefited more from the economy’s rebound – such as banks and industrials.

That said, a strong earning season could at least offset some of the pain from rising treasury yields which steeply discount the value of future profits.

Areas of tech which could outperform

The broad expectation is that early play work from home stocks such as Zoom, Citrix and Docusign could see growth moderate significantly. However, cloud and software companies could lead the way as far as earnings are concern. Daniel Ives analyst at Wedbush considers that cloud-based workloads will increase to 55% by the end of 2022, up from 43% currently. This bodes well for the cloud service giants such as Amazon and Microsoft. Meanwhile large caps Apple and Alphabet could find themselves falling into a safe haven large tech play on the back of reasonable numbers.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.