Swiss Franc – Flight to Safety?

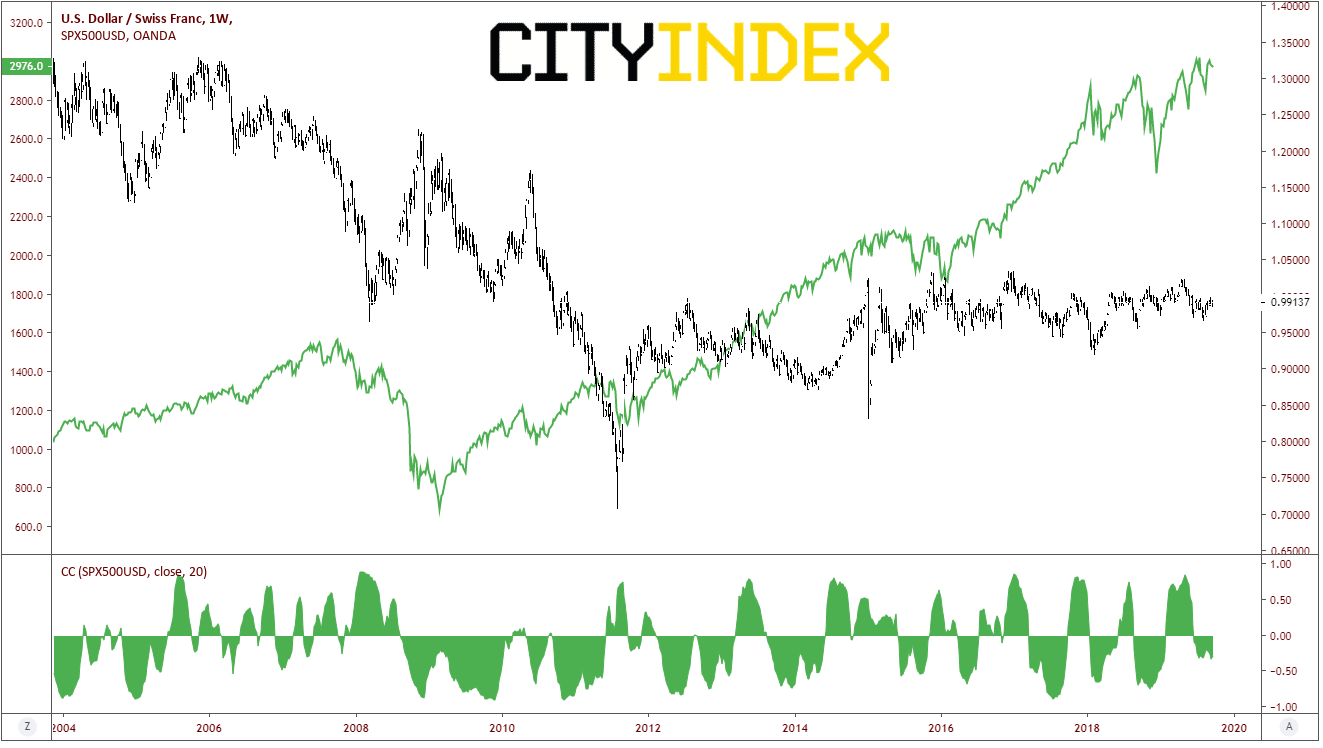

The Swiss Franc has long been considered one of the currencies to buy when the markets are in risk off mode: Stocks lower, Swiss Franc higher. In theory, stocks and USD/CHF should move together. However, if we look at the USD/CHF over time, we can see that isn’t always the case. The green line in the chart below is the SPX500. On the bottom of the screen is the correlation coefficient, which is a statistical measurement which shows how 2 assets move together. The scale ranges from -1 to +1. A -1 means that two assets move in complete opposite directions all the time. A +1 indicates that two instruments move together 100% of the time. A reading of 0 means that there is no correlation between two assets.

Source: Tradingview, City Index

On this weekly chart, one can see that correlation coefficient has varied over time for USD/CHF and SPX500. Currently, the WEEKLY correlation between the 2 assets is NEGATIVE, at -.29, which indicates that the 2 assets move in OPPOSITE direction more times than not on a weekly timeframe.

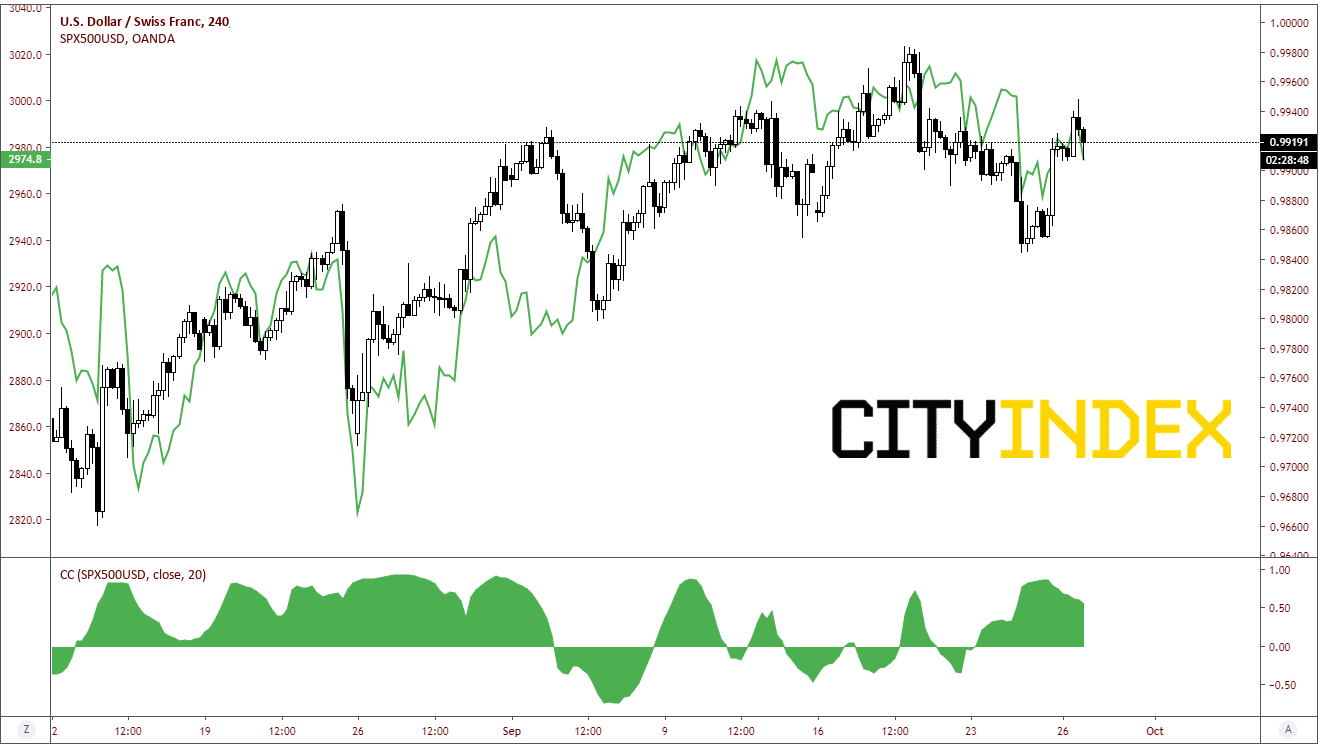

Let’s zoom in and look at a 240-MINUTE chart, which may be a little more useful for shorter term traders. Currently on a shorter timeframe, the correlation coefficient is POSITIVE, at +.55, which indicates that the 2 assets move in SAME direction more often than not on a 240-minute time frame.

Source: Tradingview, City Index

Keep in mind that the correlation coefficient is dynamic and changes with each new price bar, so these correlations will change over time.

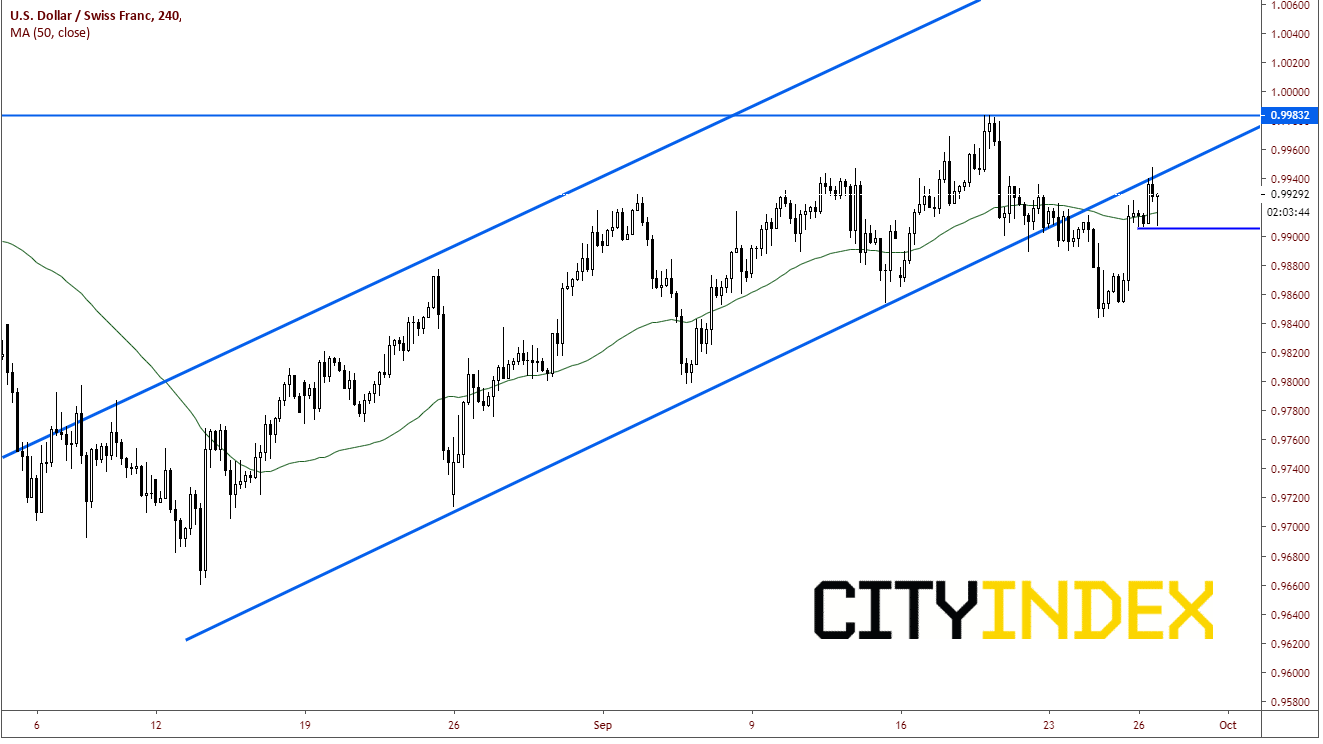

Looking at a simple 240-minute chart of USD/CHF, price has currently broken lower out of a rising channel dating back to early August and is retesting the lower trendline. Horizontal support comes in at .9906. Next support is the September 24th lows near .9845. Resistance is back at today’s highs and trendline resistance at .9948. Next resistance level is prior highs from September 19th at .9983.

Source: Tradingview, City Index

We know the correlation coefficient for USD/CHF and the SPX500 is +.55 on a 240-minute timeframe. Therefore, if SPX500 begins to move lower, shorter timeframe traders can look to USD/CHF to see if the pair is moving in the same direction. If so, this can give added confirmation to traders on their shorter term SPX500 decisions, as this may be considered a flight to safety.