Sweden's Riksbank Leaves Rates Unchanged with a Hawkish Slant

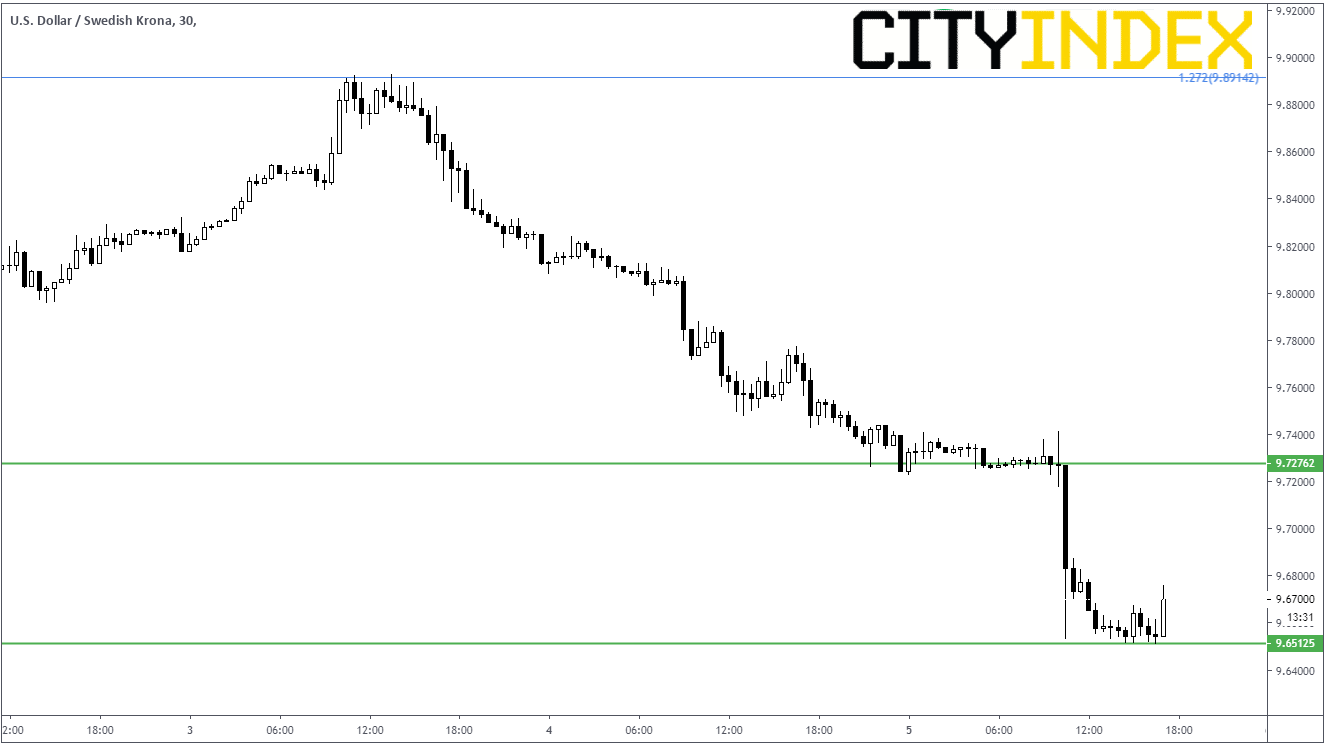

Sweden’s Riksbank left rates unchanged today at -0.25bps, as expected. In the accompanying statement, the Bank was clear to mention that “the interest rate is expected to be raised towards the end of the year or at the beginning of next year”. Many were expecting the Central Bank to reduce expectations of a rate hike this year. However, did they also note that “low interest rates abroad and worsened sentiment mean that the interest rate is expected to be increased at a slower pace than in the previous forecast”. On the announcement USD/SEK continued its 2 day move lower, trading immediately from 9.7276 down to a low of 9.6512.

Source: Tradingview, City Index

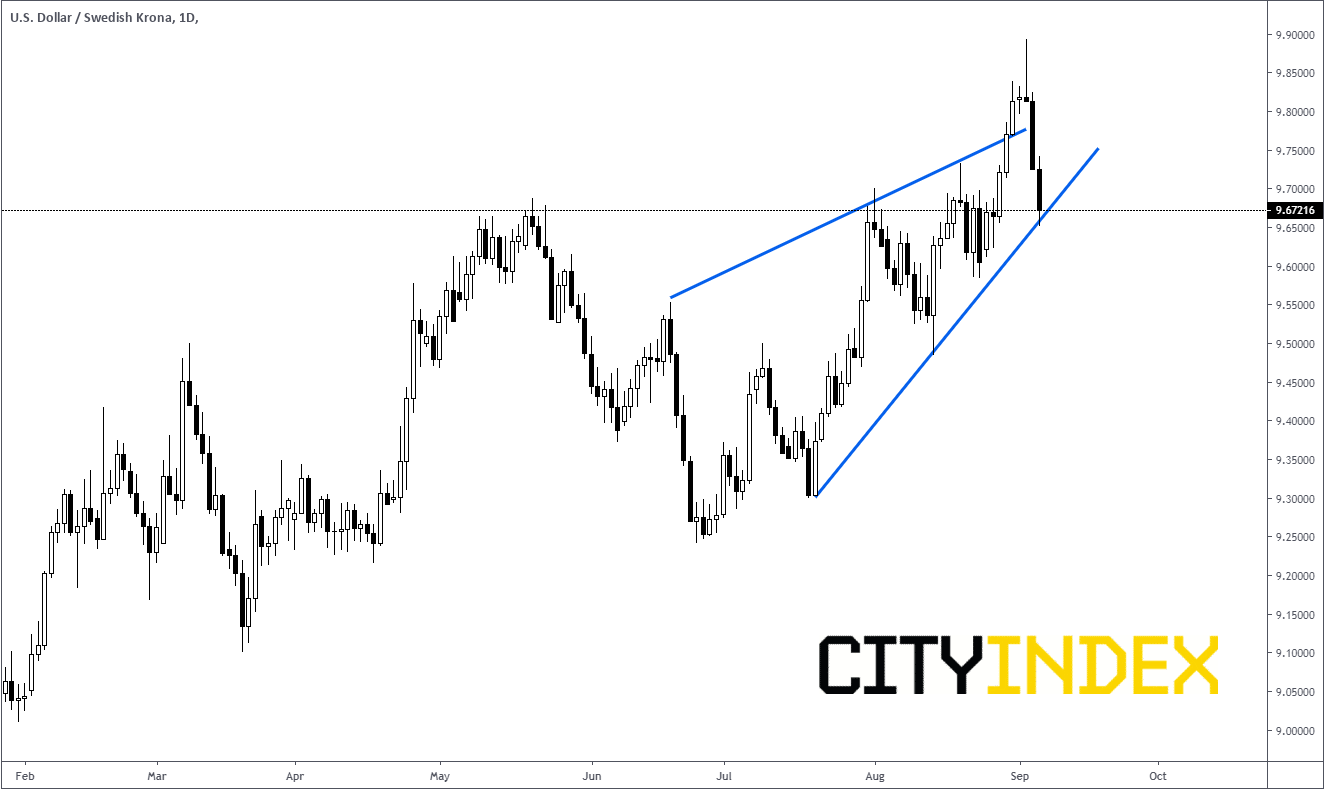

On the days leading up to the meeting, USD/SEK moved out of the top of rising wedge and put in a shooting star candle formation on Tuesday. A false breakout of a rising wedge usually leads to a test of the trendline of the other side, which was the case here. Price traded back into the wedge and tested and held support at the bottom trendline, near 9.65. If USD/SEK breaks the bottom trendline, the target for a rising wedge is a full retracement of the wedge, which is near 9.30. Resistance on the upside is at Tuesday’s highs of 9.8929.

Source: Tradingview, City Index

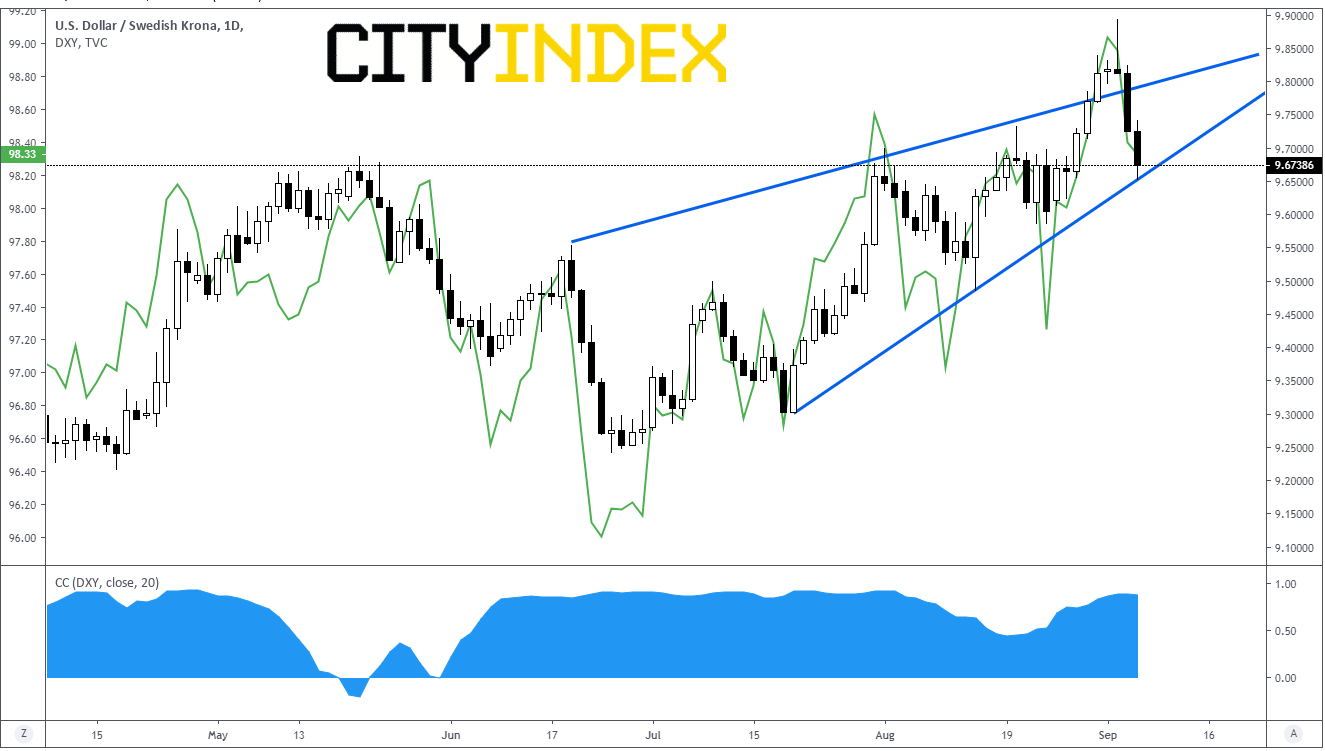

As we had discussed last week, USD/SEK tends to move with the US Dollar, or the DXY. The DXY has been moving lower over the last few days on renewed hopes of easing China-US trade tensions. This helped to further the bid in the Swedish Corona. The current correlation between the USD/SEK and the DXY is .89 (+1.00 is a perfect positive correlation.)

Source: Tradingview, City Index

If there is continued progress in the China-US trade war, and the Riksbank continues to signal they are going to hike by the end of the year, USD/SEK may retrace the rising wedge quickly. Just remember though, nothing moves in a straight line!!