Everyone is wondering whether New Zealand’s RBNZ will raise rates 25bps or 50bps when they meet later today. They were the first of the large country economies to raise interest rates.

On the other side of the coin Is Sweden’s Riksbank. At their September meeting, the central bank left interest rates unchanged at 0.00% and are expected to do the same when they meet on Thursday. They noted that inflation is expected to rise above their 2% target in the near-term and pull back in the medium term. Since then, Sweden’s CPIF (Consumer Prices measured with a fixed interest rate) was 3.1% YoY in October, which is the highest since September 2008! The GDP Q3 was also stronger than expected at 1.8% vs 1.3% expected and 0.9% in Q2. They also did not have an interest rate hike forecast through Q3 2024! Could an interest rate hike now be in their guidance over the next 2 years?

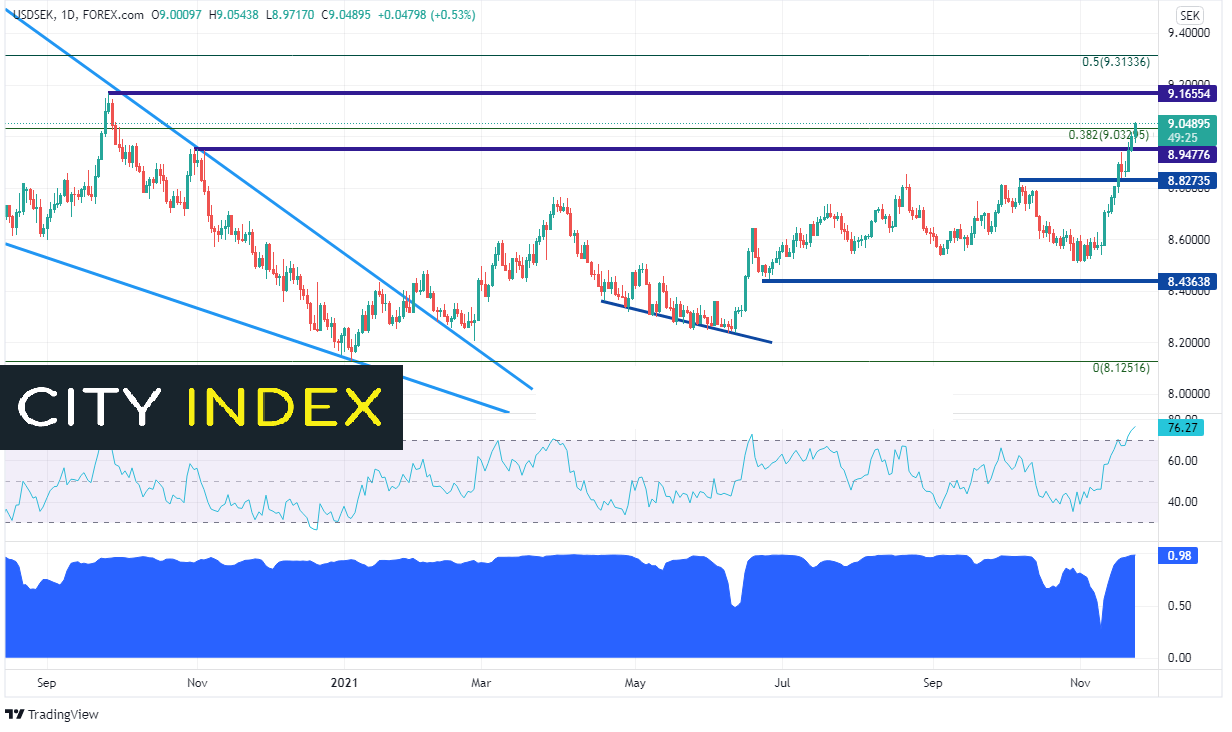

With the US Dollar Index moving higher since the 6.2% CPI print was released on November 10th and an expected dovish Riksbank, USD/SEK has been on a tear! The pair has moved from a November 10th low of 8.5743 to a high on Tuesday of 9.0544, which coincides with the 38.2% Fibonacci retracement level from the highs of March 2020 to the lows from January 6th. Notice that USD/SEK has an extremely high correlation with the US Dollar Index (+0.98!!). Therefore, if the DXY continues to move higher, USD/SEK is likely to move higher with it. However, the RSI is in overbought territory at 76.27, an indication that the pair may be ready for a pullback. (For comparison, the DXY RSI is at 72.18.)

Source: Tradingview, Stone X

Trade USD/SEK now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

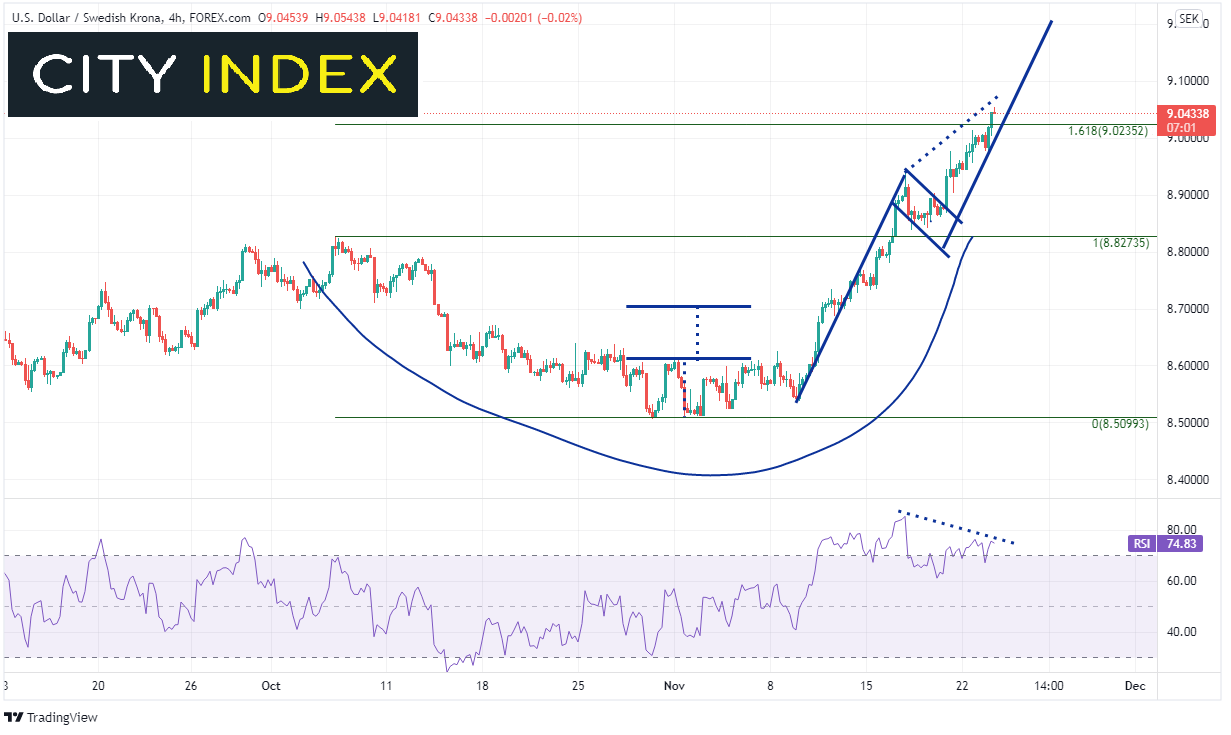

On a 240-minute timeframe also notice that USD/SEK is at the 161.8% Fibonacci extension from the highs of October 6th to the lows on October 28th and November 2nd, near 8.5099. (This is a double bottom however the target has been met). As USD/SEK moved higher off the lows, it formed a flag formation. The target for the breakout of a flag is the length of the flagpole added to the breakout point, which in this case is near 9.2050.

Source: Tradingview, Stone X

If USD/SEK is to reach target, it must first pass through horizontal resistance at 9.1655. Above the target is the 50% retracement from the previously mentioned timeframe near 9.3134. Support is at Monday’s low and prior highs from October 30th near 8.9478. Below there is horizontal support at 8.8274.

If the US Dollar continues to move higher, USD/SEK has a good chance to move with it because of the strong positive correlation between the two assets. In addition, the Riksbank meets on Thursday and is expected to maintain its dovish tone. However, the overbought RSI indicates that their may be a pullback in the near term, before USD/SEK heads towards its flag target at 9.2050.

Learn more about forex trading opportunities.