France’s Q3 GDP was significantly better than forecast recording a record 18.2% growth in the July – Sept period, after -13.7% contraction in the Q2. Expectations had been for 15.4% growth. However, with France back in national lockdown, these figures are already out of date. French consumer spending in September declined a worse than forecast -5.1%, much worse than the -1% decline forecast.

Yesterday the ECB highlighted the headwinds faced by the Eurozone economy and said it is ready to increase monetary stimulus in December to cushion the economy.

The Dax managed to book a positive close in the previous session, on stimulus optimism. However, the upside was short lived and the DAX is looking at sharp losses on the open. The Dax is in line to shed just shy of 10% across the week in its worst week of trading since early March when it crashed 20% on pandemic fears.

The FTSE is set for a smaller drop on the open and weekly losses of around 5.5% as the UK is still not in national lockdown. Furthermore, the FTSE’s recovery lagged its peers, meaning the Dax has further to fall.

UK mini housing boom continues, for now

UK housebuilders will be in focus as the booming housing market shows no signs of easing despite the deteriorating outlook for the UK economy. Nationwide’s house price index showed house prices jumped 5.8% in October compared to the same month last year. This was ahead of the 5.2% increase forecast. On a monthly basis, house prices jumped 0.8%, roughly on par with last months impressive 0.9% jump and well ahead of the 0.4% increase expected. The mini housing boom which started after the last lockdown is showing few signs of easing up. However, with the generous furlough scheme coming to an end tomorrow, the second wave of covid growing, tighter lockdown restrictions on the way and rising unemployment expected, it would be very surprising if this rate of house price growth continues.

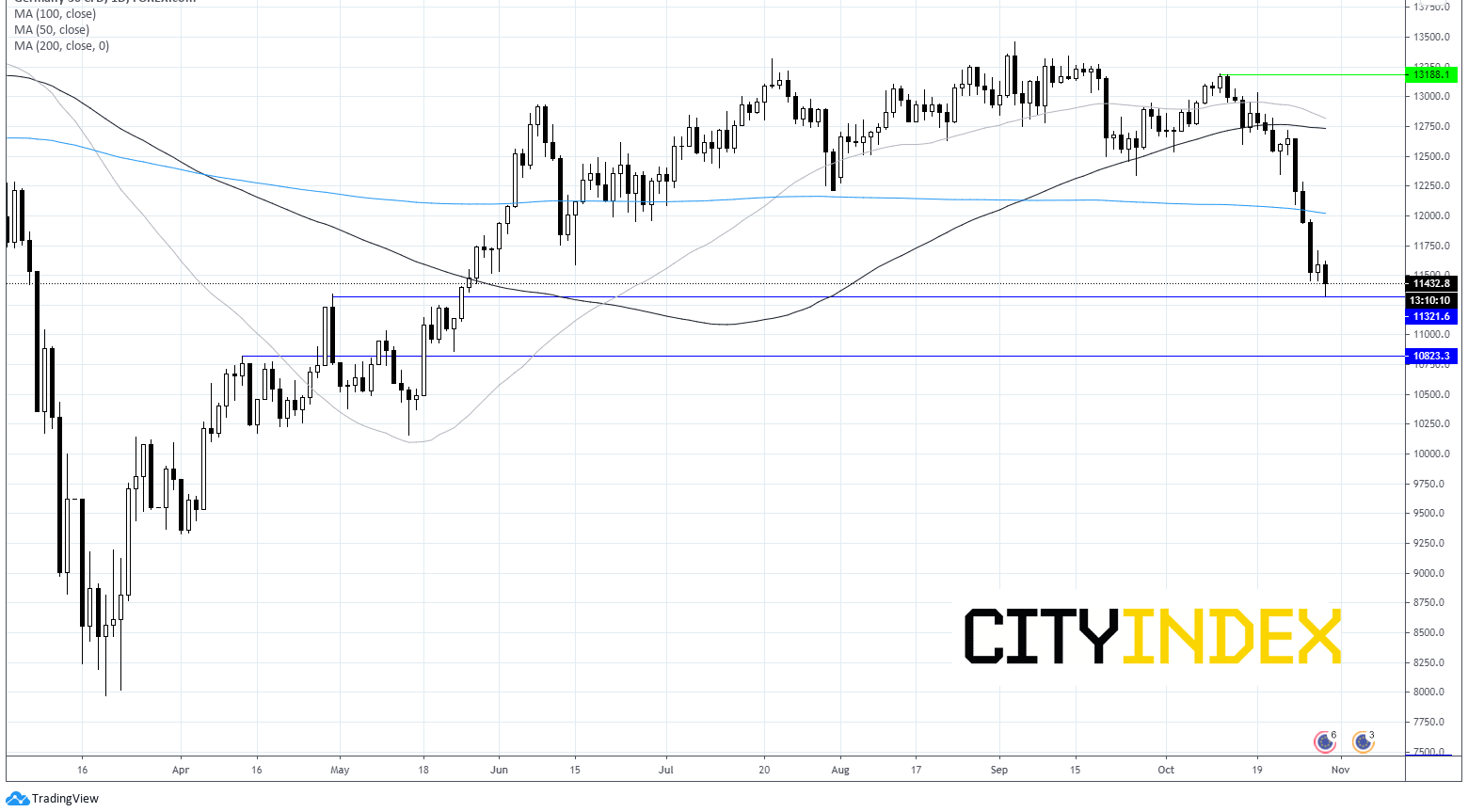

Dax chart

Dax is trading sharply lower through 200 sma trading at levels last seen in May. The index now trades below its 50,100 & 200 sma in a bearish chart. The price respected horizontal support at 11330 a swing high on April 30. Immediate resistance can be seen at 12000 200 sma.

Dax is trading sharply lower through 200 sma trading at levels last seen in May. The index now trades below its 50,100 & 200 sma in a bearish chart. The price respected horizontal support at 11330 a swing high on April 30. Immediate resistance can be seen at 12000 200 sma.