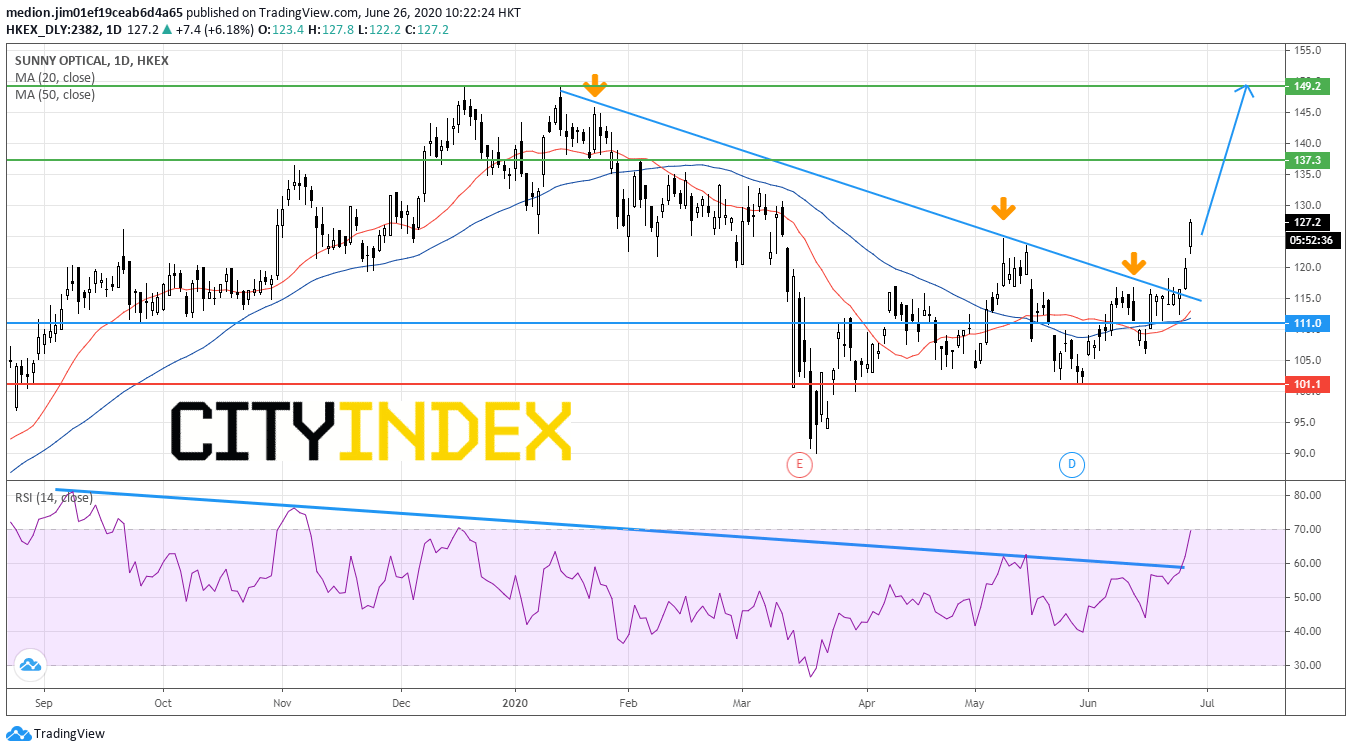

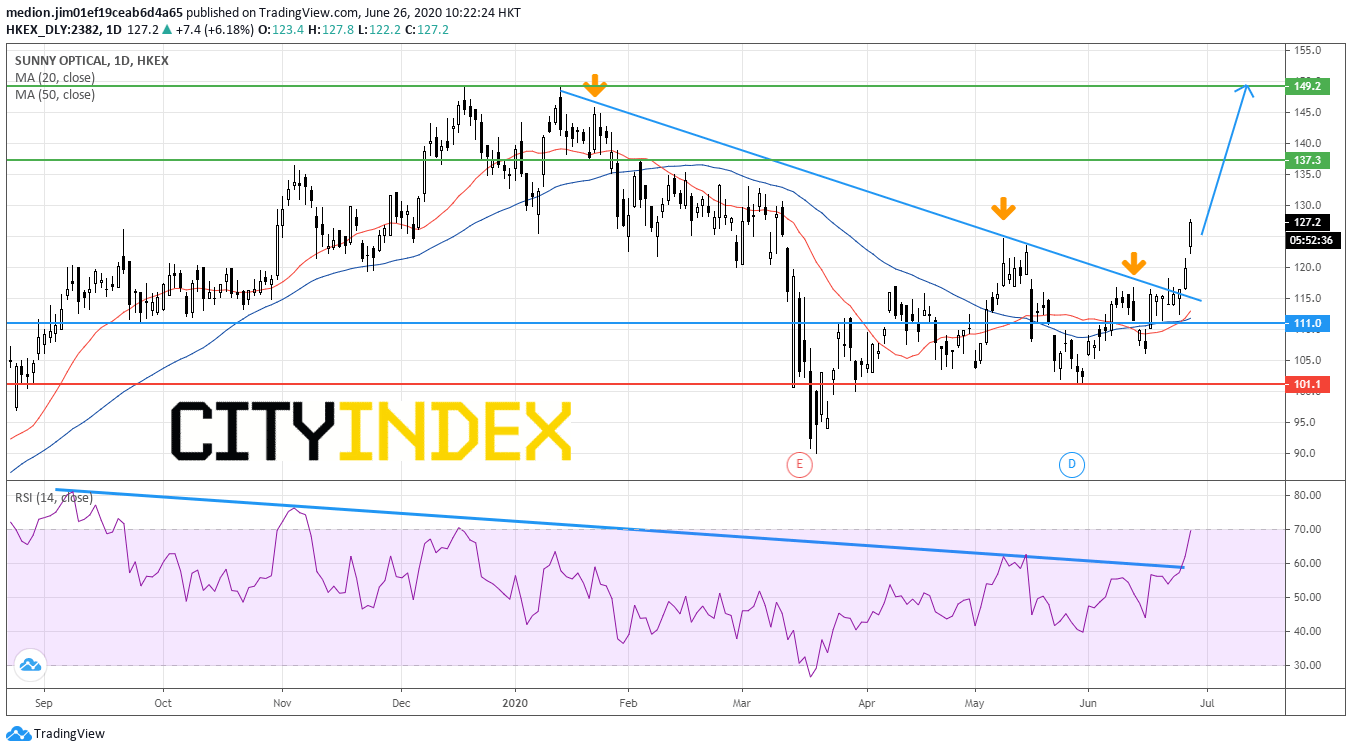

Sunny Optical (2382.HK) Emerges a New Uptrend After Breaking Above the Declining Trend line

Sunny Optical (2382.HK) bounced more than 30% from the March on the expectation of economic recovery after the outbreak of COVID-19. Meanwhile, the Hang Seng Index rebounded around 15% from March low. It shows that this stock is outperforming the market.

Recently, Fitch Rating projected that global smartphones may drop 15% - 17% this year. However, the ratings agency projected that the smartphone demand is set to embrace strong recovery next year. Sunny Optical, producing optical lenses for smartphones, would be benefited by the recovery of the smartphone market.

On the daily chart, the stock broke above the declining trend line drawn from January top, indicating a bullish outlook.

The bullish readers could set the support level at HK$111.00 (the low of June 18), while the resistance levels would be located at HK$137.30 (the high of February) and HK$149.20 (the high of January)

Source: GAIN Capital, TradingView

Recently, Fitch Rating projected that global smartphones may drop 15% - 17% this year. However, the ratings agency projected that the smartphone demand is set to embrace strong recovery next year. Sunny Optical, producing optical lenses for smartphones, would be benefited by the recovery of the smartphone market.

On the daily chart, the stock broke above the declining trend line drawn from January top, indicating a bullish outlook.

Besides, the RSI also broke above the declining trend line drawn from September 2019. It also suggests the upside momentum for the prices.

The bullish readers could set the support level at HK$111.00 (the low of June 18), while the resistance levels would be located at HK$137.30 (the high of February) and HK$149.20 (the high of January)

Source: GAIN Capital, TradingView

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM