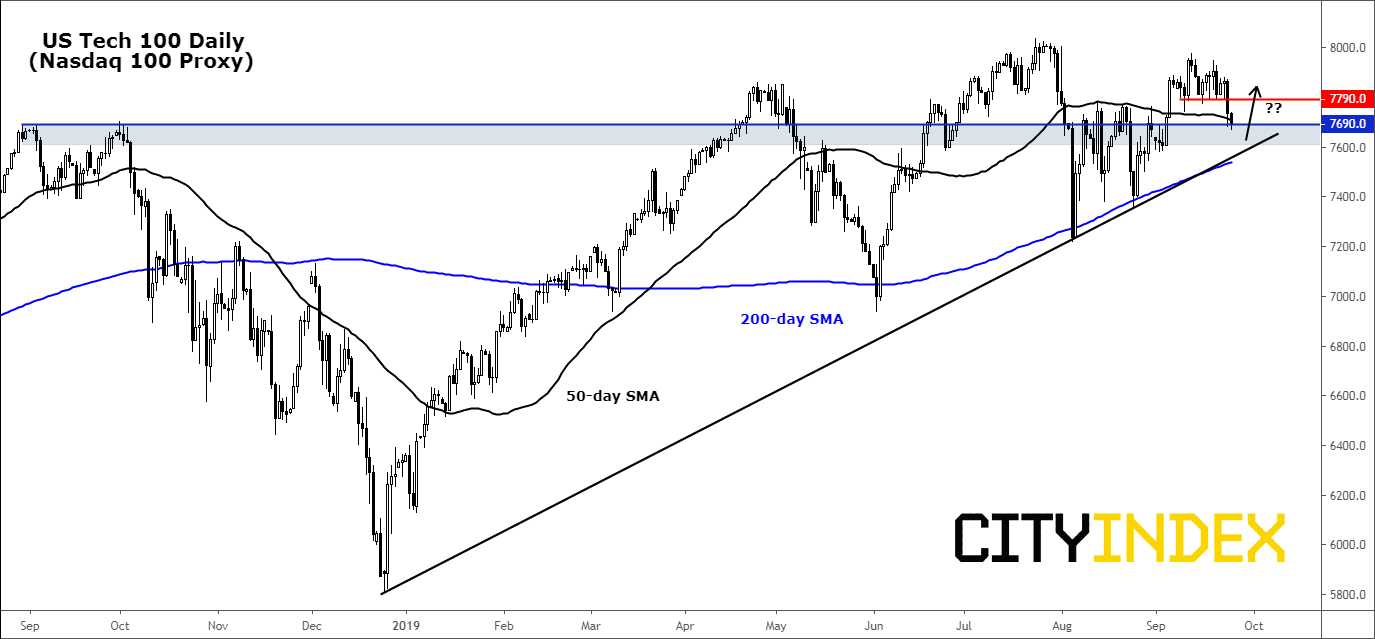

Risk remained off the table this morning. European stocks dropped further lower and haven currencies such as the Swiss franc and Japanese yen remained supported against some rivals. The pound and the euro eased back after yesterday’s gains against the dollar. The Dollar Index was therefore trading higher at the time of writing. This prevented gold from making further gains, with the yellow metal holding below key resistance at around the $15330/35 area. Following yesterday’s big drop in the stock markets and some further downside follow-through this morning, bearish speculators were now wondering whether to ease off the gas or put the pedal to the metal amid a flurry of worries ranging from raised geopolitical tensions to slowdown in global growth and the potential impeachment of a business-friendly US President, Donald Trump. They know too well that all it takes is a tweet or two from Trump to cause an abrupt move in the markets, especially on the issue of US-China trade. What’s more, the decision by the US House Speaker Nancy Pelosi to launch a formal impeachment inquiry into Donald Trump may end up being a non-event after all. Indeed, it will require at least 20 Republican’s to flip on Trump to officially oust him. Furthermore, the recent policy U-turn by many central banks – many of whom have returned to an easing bias from neutral or hawkish – means yields are falling again and so many stock market bulls will be lurking around for opportunities to pick up some bargains following this mini correction. Admittedly, there is still a good chance we may see a more profound correction in the markets, but this will probably require something more significant to happen. As such, we are on the lookout for the markets to potentially form bullish reversal sticks in the days ahead as the major indices near key support levels.

Source: Trading View and City Index.