Wall Street ended lower after Fauci and the Fed set a sombre tone. Risk aversion then spilled into Asia and is setting the path for a lower start in Europe.

US Health official Anthony Fauci warned that reopening the US economy too quickly could in fact delay the road to recovery. His comments served as a reminder of the uncertainties that still lay ahead not just for the US economy as it attempts to navigate the easing of restrictive lockdown measures, but for global economies as they attempt the same.

US Health official Anthony Fauci warned that reopening the US economy too quickly could in fact delay the road to recovery. His comments served as a reminder of the uncertainties that still lay ahead not just for the US economy as it attempts to navigate the easing of restrictive lockdown measures, but for global economies as they attempt the same.

UK slowly reopens

Today the UK will start to take small steps to reopen the economy. Real estate market will reopen, people are encouraged to return to work if they can’t work from home and unlimited outdoor exercise is permitted. Despite, these moves the fact that the Chancellor has extended the furlough programme through to October means that the government is expecting this crisis to last, with any return to normality expected to take months. With this in mind the FTSE’s 25% rally from it March low looks overdone.

Today the UK will start to take small steps to reopen the economy. Real estate market will reopen, people are encouraged to return to work if they can’t work from home and unlimited outdoor exercise is permitted. Despite, these moves the fact that the Chancellor has extended the furlough programme through to October means that the government is expecting this crisis to last, with any return to normality expected to take months. With this in mind the FTSE’s 25% rally from it March low looks overdone.

Retailers. restaurants fragile as spending collapses

Data is starting to lay bare the extent of the damage that coronavirus crisis is having. British retail sales plunged by 19.1% in April, the biggest fall ever recorded by the BRC. Whilst Barclaycard announced that credit card spending tanked by 36.5% as spending in restaurants, pubs and travel collapsed overnight. Online spending has also soared amid lockdown and social distancing measures. Non-essential online spending jumped 60%. The longer that these restrictive measures stay in place and non-essential retailers remain shut the more deeply entrenched these habits will become, endangering the already very fragile UK high street. Retailers could remain under pressure for some time yet.

Data is starting to lay bare the extent of the damage that coronavirus crisis is having. British retail sales plunged by 19.1% in April, the biggest fall ever recorded by the BRC. Whilst Barclaycard announced that credit card spending tanked by 36.5% as spending in restaurants, pubs and travel collapsed overnight. Online spending has also soared amid lockdown and social distancing measures. Non-essential online spending jumped 60%. The longer that these restrictive measures stay in place and non-essential retailers remain shut the more deeply entrenched these habits will become, endangering the already very fragile UK high street. Retailers could remain under pressure for some time yet.

UK GDP in focus

Today will see a slew of UK data released, including GDP, trade balance and industrial production. Expectations are for the GDP Q1 to show -2.5% contraction QoQ, and the more volatile monthly reading to reveal an 8% contraction reflecting the start of the lockdown. Whilst a weak number is expected to the reality of seeing that figure could still send jitters through the market, as the UK heads into what is expected to be the deepest recession in 300 years. The Pound is heading cautiously higher ahead of the release.

Powell speaks as negative rate speculation swirls

Today will see a slew of UK data released, including GDP, trade balance and industrial production. Expectations are for the GDP Q1 to show -2.5% contraction QoQ, and the more volatile monthly reading to reveal an 8% contraction reflecting the start of the lockdown. Whilst a weak number is expected to the reality of seeing that figure could still send jitters through the market, as the UK heads into what is expected to be the deepest recession in 300 years. The Pound is heading cautiously higher ahead of the release.

Powell speaks as negative rate speculation swirls

Looking ahead to the US session, full attention will be on Fed Chair Powell as he live streams a speech on economic issues amid swirling expectations that the Fed will eventually go negative on rates. After inflation dived -0.8% the most since the Great Depression, Trump was quick to jump on the negative rates bandwagon. So far, the Fed has pushed back against the idea citing the damage that it would cause the financial sector. Fed fund futures, on the other hand, see rates negative by this time next year. The dollar is holding steady ahead to Powell’s appearance.

FTSE levels to watch

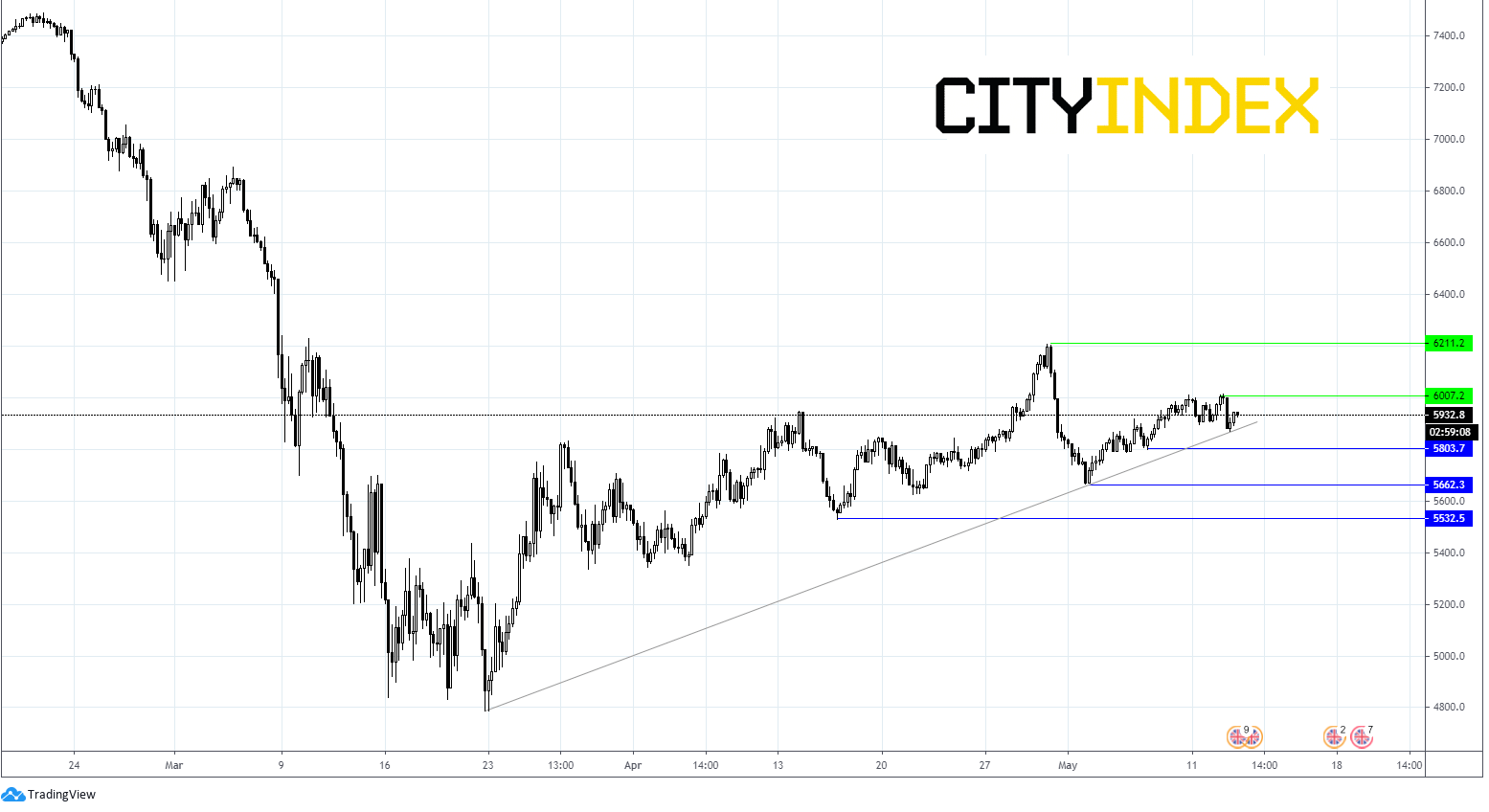

FTSE looking to open 60points lower, however bullish trend remains in tact.

Immediate resistance at 6000, key pscyological figure, prior to 6200 (high 30th April)

Support seen at 5875 (trendline) prior to 5800 (low 6th May) and 5666 (1st May).

FTSE looking to open 60points lower, however bullish trend remains in tact.

Immediate resistance at 6000, key pscyological figure, prior to 6200 (high 30th April)

Support seen at 5875 (trendline) prior to 5800 (low 6th May) and 5666 (1st May).

Latest market news

Yesterday 08:33 AM