European bourses are looking towards a mildly softer start after a mixed session on Wall Street. European stimulus news boosted sentiment and stocks in the previous session. However, in the US the Republicans and Democrats are struggling to reach an agreement over the next relief package, causing optimism to stutter.

Whilst the Republicans are supporting another $1 trillion package, the Democrats are supporting a significantly larger $3 billion stimulus bill. With still considerable distance between the two sides an agreement still looks to be some time off. When an agreement is within reaching distance, we can expect to see the markets run on the stimulus high. We are not there yet.Gold hits 9 year high

All this talk of stimulus and the US Dollar trading at a 4 month low has seen gold and silver shoot higher. Gold reached a nine year high of $1858.60 as US coronavirus cases passed the grim 4 million milestone, over stimulus uncertainty and as US – China relations soured after the US Justice department accused China of sponsoring hackers who were attempting to steal covid-19 vaccine data. Silver is trading at a 6 year high

Oil snaps winning run

Oil is sliding lower in early trade, shedding almost 1% after 3 straight days of gains after data showed larger than forecast inventory gains in the US and following Trump’s covid warning. Coronavirus cases in the US continue to climb with 60,000 new daily cases. California is heading back into lockdown raising fears of oil demand being dented further and President Trump warned that the situation could get worse before it improves, in his first acknowledgement that the problem is spreading.

Brexit fears linger

In the UK, Brexit concerns continue to haunt Pound traders amid reports that the British government has given up hope of reaching an outline deal by the self-imposed July deadline. Negotiations remain deadlocked over fishing waters, the role of the European Court of Justice and the so called level playing field, with the British government now assuming that the two sides with trade on the unfavourable WTO terms after the transition period ends.

Looking ahead the economic calendar is quiet in the European session and with existing home sales in the US. Attention will also fall on Tesla and Microsoft as they report later today.

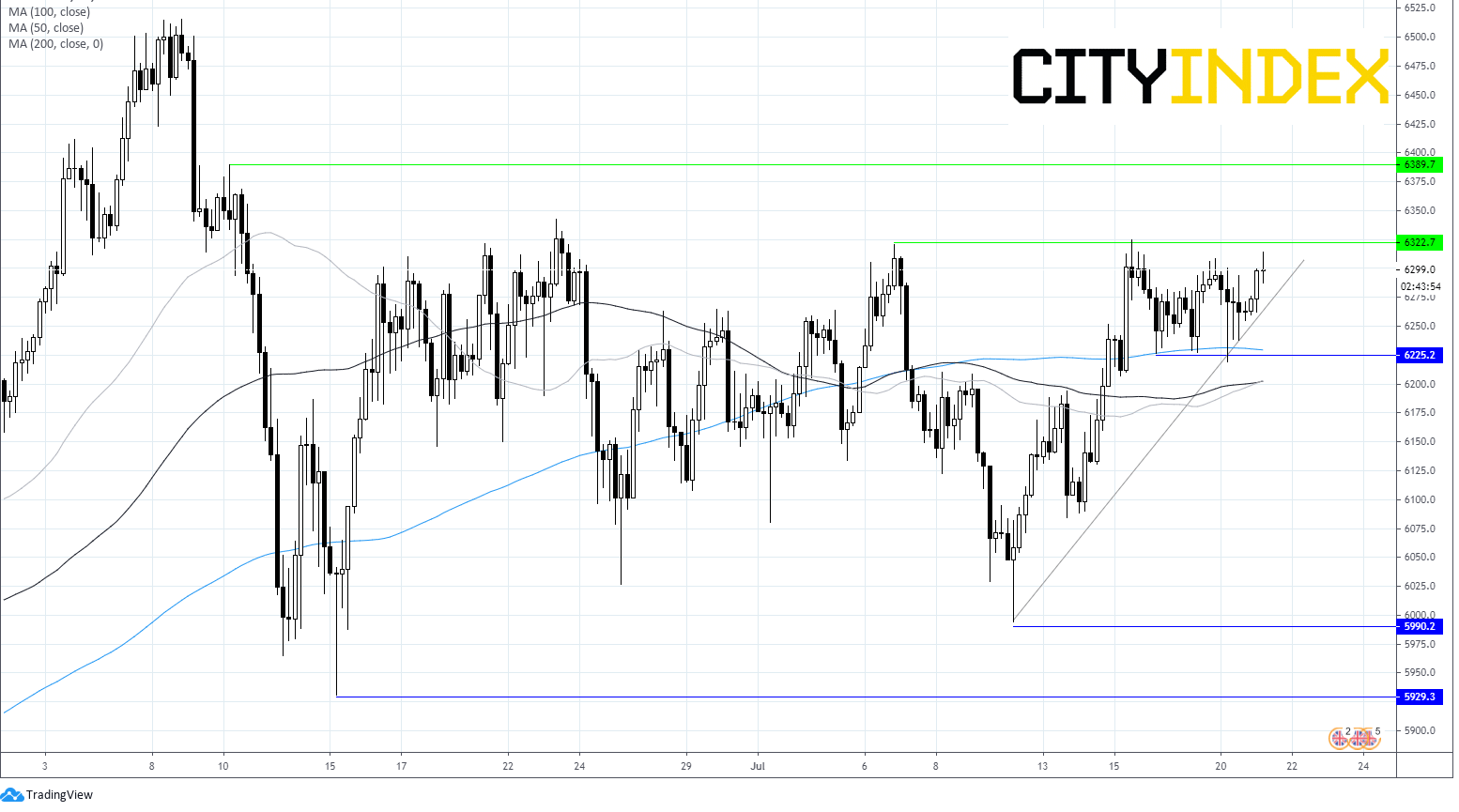

FTSE Chart