Ahead of a busy week, the US stock markets have opened sharply higher with the S&P 500 hitting fresh virgin territories. Once again it was Donald Trump who helped to spark panic buying after the US President said he expected "today will be a good day in the stock market," adding that "the China deal is moving forward ahead of schedule." Lo and behold, the markets gapped higher and have pushed upwards since, with the major averages tacking on gains of 0.6 to 0.9%. While it is may be a sea of green, I wonder whether the market has gotten too ahead of itself. With Google, Facebook and Apple earnings to come and not to mention the upcoming Fed and BoJ meetings or the potential for further Brexit drama, sentiment could turn sour very quickly.

Trade-related headlines likely to have diminishing returns

Indeed, there is a possibility that the US-China trade optimism is now fully baked in or very close to being so. In any case, I certainly think trade-related headlines will at best have diminishing returns going forward. Thus, for the markets to remain at these lofty reasons, we will need to see some big surprises in company earnings/outlooks or more central bank loosening. Again, I can’t help but think rate cuts might be limited going forward. Meanwhile the recent slowdown in global macro data points to weaker earnings growth. So, apart from momentum I am struggling to think where the next support will come from in order to keep the markets elevated. Granted, we could still see several further green days on Wall Street, but ultimately the macro concerns might derail the rally. It should be noted however that I am not necessarily trying to call the market top – rather, I think a correction looks imminent. I don’t have too strong a long-term view, anyway.

Should the Fed cut rates with markets at record highs?

In terms of the Fed, while it looks set to cut interest rates by another 25 basis points on Wednesday, the need for doing so has arguably been reduced with the stock markets at record highs again on apparent progress in the trade talks between the US and China. Still, the FOMC wouldn’t want to cause unnecessary turmoil in the markets by not acting now given the recent slowdown in global economic activity. However, if the Fed decides against cutting or provides a forward guidance which is not as dovish as some expected, then the stock markets could fall back in the second half of the week.

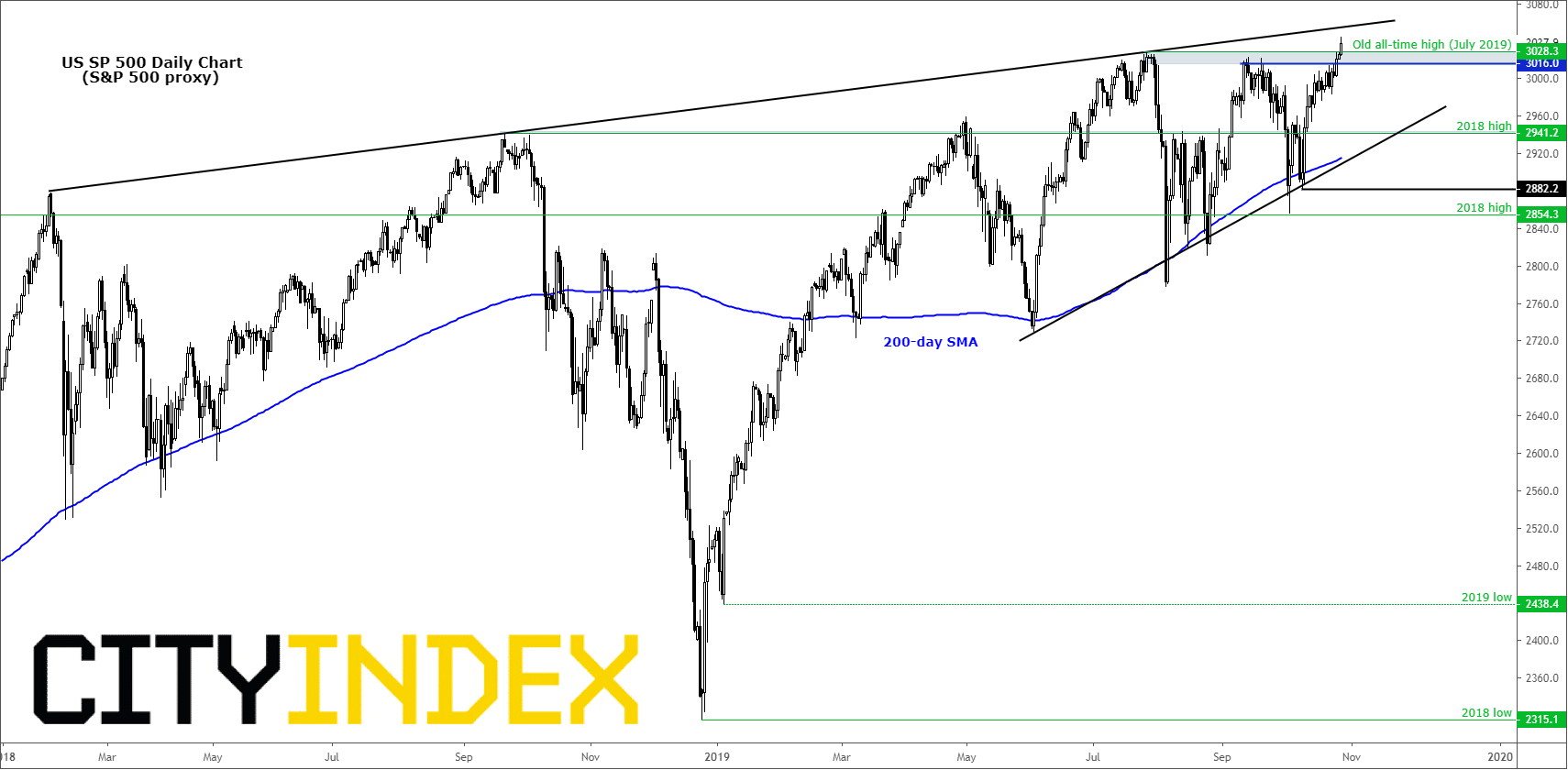

S&P approaching rising wedge top

Source: Trading View and City Index.

From a technical point of view, with the S&P 500 breaking to a new record high today, the bears have little or no reason to stand in the way of the rally at the moment. The bulls are in control and will be taking advantage of any dips to reload until this strategy stops to work.

However, when we have the first sign of bullish exhaustion or reversal stick on the daily time frame, then we could see a sharp drop in the markets as the bulls rush for the exits. While it is not a good idea to pre-empt a potential sell-off, it is a good idea to highlight certain areas where the sellers may step in. One such zone is around 3050-55 where the top of the rising wedge pattern comes in top play. Otherwise, the bears may wish to wait for a key support level to break and then look to get on board on the re-test of such a level.