Asian markets edged higher overnight and European bourses are pointing to a mildly higher open as hopes of further stimulus from governments across the globe overshadow rising global coronavirus cases.

In the UK localised lockdown measures in Leicester are being eased as covid numbers decline. The first localised lockdown appears to have brought the flare up quickly under control bringing a sense of relief and optimism. Adding to the mildly upbeat tone, Boris Johnson said he will pour £3 billion into the NHS to ensure that it is prepared for what will almost certainly be a very challenging winter and a possible second wave. Boris Johnson will also lay out plans to drive the UK back to normality over the coming 9 months in an attempt to guide the economy out of its deepest recession in 300 years.

The Pound is rebounding on Friday, although trades within familiar levels.

Will EU leaders agree at summit?

Stimulus will also be in focus as EU leaders physically meet in Brussels to discus the coronavirus recovery response and a new long-term budget.

Differences remain between some nations regarding the EU recovery fund; a fund which is planned to help those EU countries most affected by the coronavirus pandemic. Thee happen to be mainly southern European countries. The Frugal Four, Sweden, Denmark, Austria, and the Netherlands want the fund to be smaller and more focused on loans rather than grants.

Expectations are low that an agreement will be reached over the coming 2 days of the summit. However, the reality of failure to agree could still add downward pressure on the Euro and on sentiment for European stocks. On the flip slide, if a deal is agreed we could expect to see a boost to both the Euro and risk appetite in general lifting European equities.

US stimulus and consumer confidence

Across the Atlantic optimism the US policymakers will agree to additional stimulus as the world’s largest economy battles rising covid numbers, is helping offset the fear that the economic recovery will be undermined.

Across the Atlantic optimism the US policymakers will agree to additional stimulus as the world’s largest economy battles rising covid numbers, is helping offset the fear that the economic recovery will be undermined.

Next week US Congress will debate such a rescue deal, as some US states re-impose lockdown measures. The number of new daily cases in the US has topped 70,000 accompanied by rising fatalities in Texas and Florida.

Looking ahead US consumer confidence data will be in focus. Analysts are expecting sentiment to lift to 79 in July, up from 78.1. A strong reading could help distract investors from spiralling covid numbers. However, there is a sense that unless the outbreak is brought under control, economic data could soon start to deteriorate again.

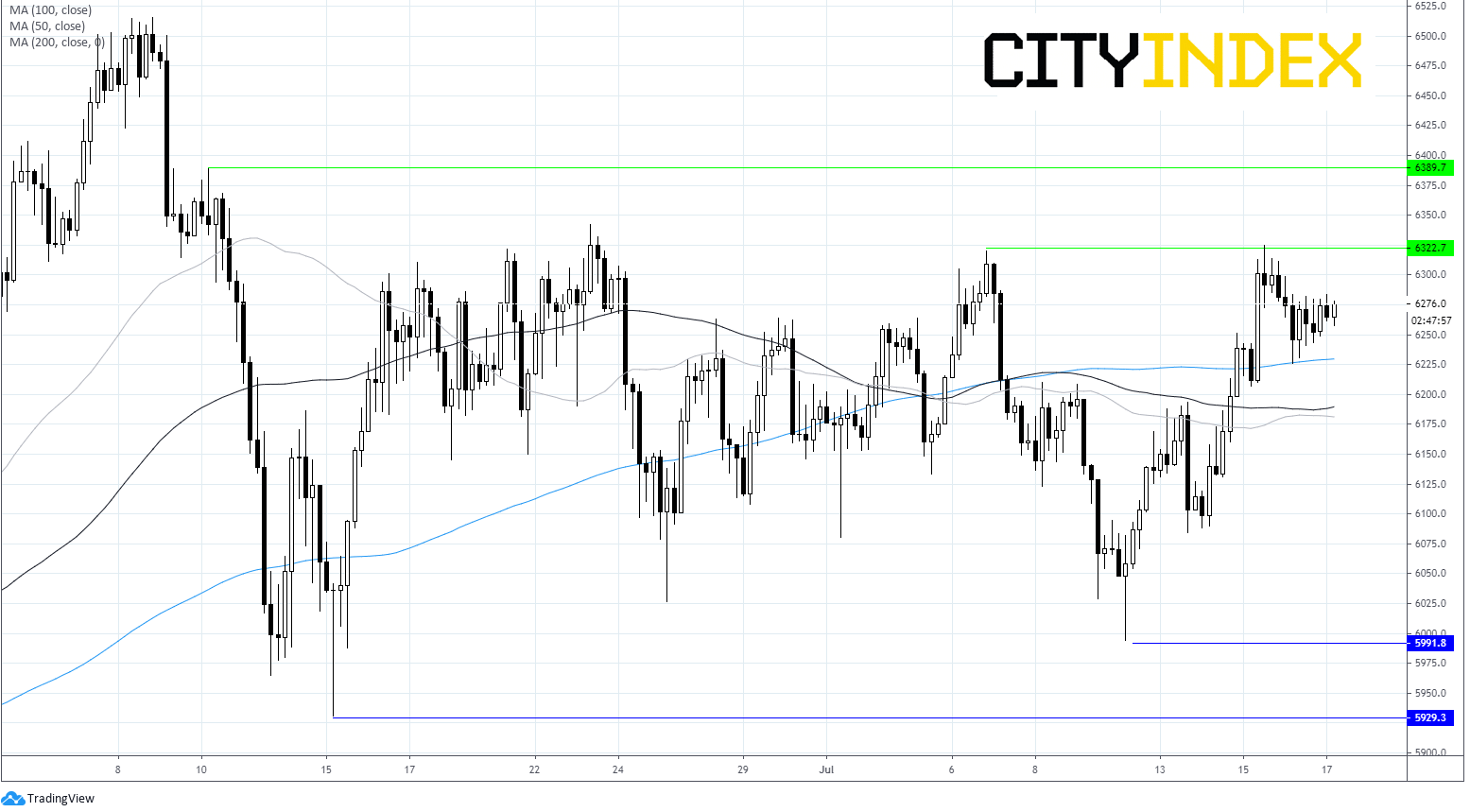

FTSE Chart

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM