The parliament is expected to take a sombre tone, with China already dropping its GDP target for the first time and pledging additional spending as its economy takes a hammering from the covid-19 outbreak. The Chinese economy contracted -6.8% in Q1 its first contraction in decades after the coronavirus outbreak paralysed production and hit spending.

Oil has dropped 5% in early trade, snapping an impressive 6 session winning streak, on the back of worsening US – China relations and China’s commission of a GDP target. Despite WTI heading back towards support at $30, it remains on target to gain 9% across the week.

GBP unfazed by grim retail sales

The Pound is showing impressive resilience in the face of dire retail sales data. Retail sales slumped by a record breaking -18.1% month on month in April, worse than the 16% decline forecast. On an annual basis, retail sales plunged -22.6% worse than the -22.2% expected.

The data made for grim reading. However, the pound was unfazed, holding onto its gains versus the Euro and maintaining its -0.1% decline versus the US Dollar, finding support at $1.22. The data comes following better than expected service sector and manufacturing PMI’s in the previous session.

Dire data has been firmly priced in. Pound traders are more interested in the easing of lockdown restrictions and any headaches that Brexit will bring ahead of the key deadline next month.

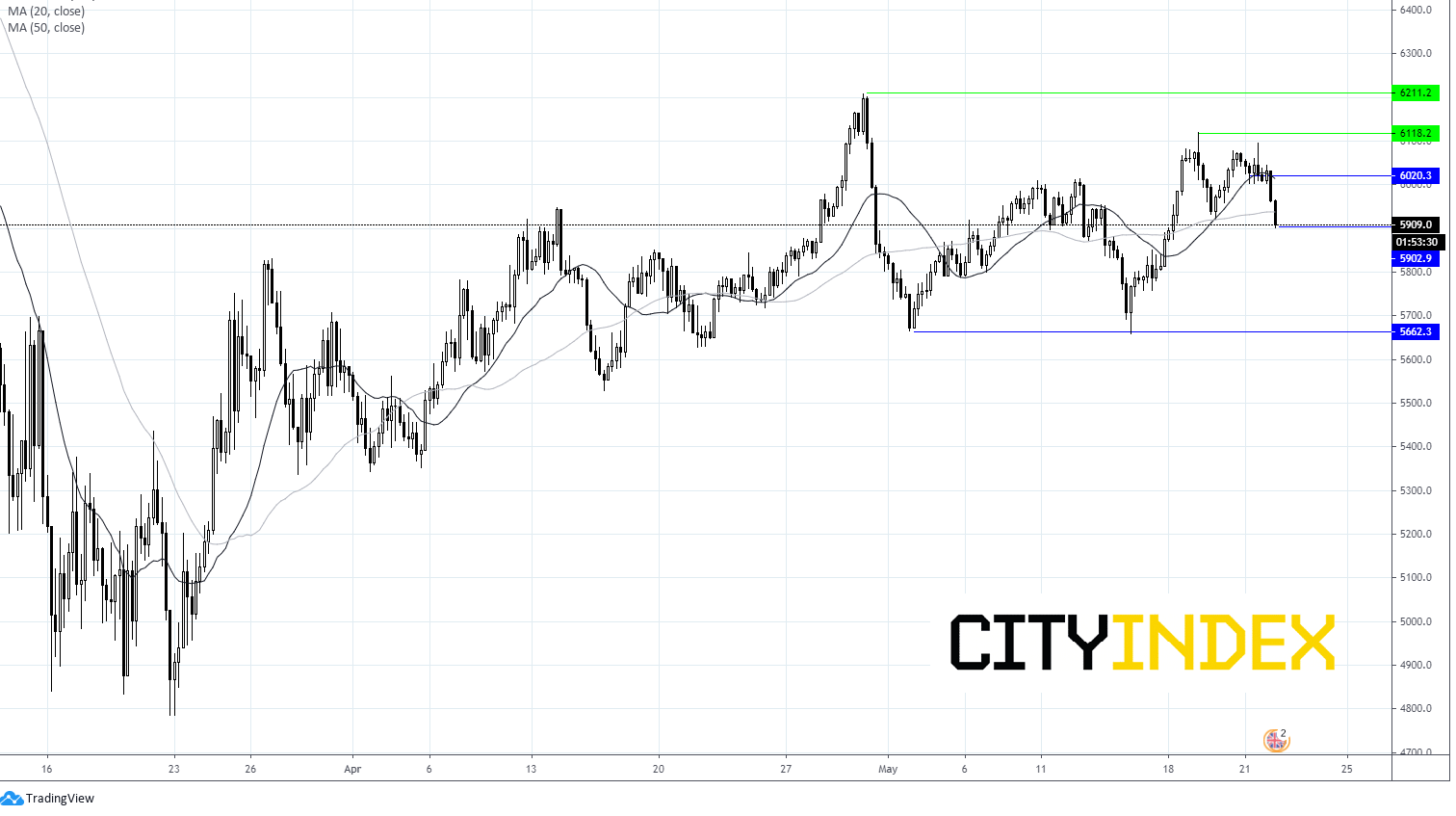

FTSE levels to watch:

The FTSE is trading -1.7% lower, dropping through the key 6000 level. It trades below its 20 & 50 sma on 4 hour chart.

Immediate support can be seen at 5907 (day’s low) prior to strong resistance at 5665.

Support can be seen at 5935 (20 sma) prior to 6020 (50 sma) and 6120 (high 19th May)