Geopolitical tensions are also back in focus amid reports that the White House is toying with the idea of striking against the Hong Kong Dollar peg in retaliation for China’s national security law. Whilst the Hong Kong Dollar has shrugged off the reports, HSBC is under pressure as the Trump administration also considers sanctions against banks in the city.

Rishi Sunak’s Summer Statement in focus

The Chancellor Rishi Sunak is set to take centre stage as he delivers his Summer statement, outlining the economic stimulus package which he will implement to steer the UK economy through the coronavirus crisis. The focus is set to be on jobs, both the protection and creation of jobs as he attempts to pull the UK economy out of the deepest economic downturn in 300 years.

In addition to jobs focus on business costs would be beneficial with immediate effect. More business rate relief, the pre-announced stamp duty holiday and targeted VAT cuts, particularly for the leisure and hospitality sectors would be well received. These measures could see house builders and leisure and hospitality stocks rally, whilst business rate cuts could see battered retail sector rise.

Should Rishi Sunak underwhelm, stocks, particularly on the FTSE250 could come under pressure among with the Pound.

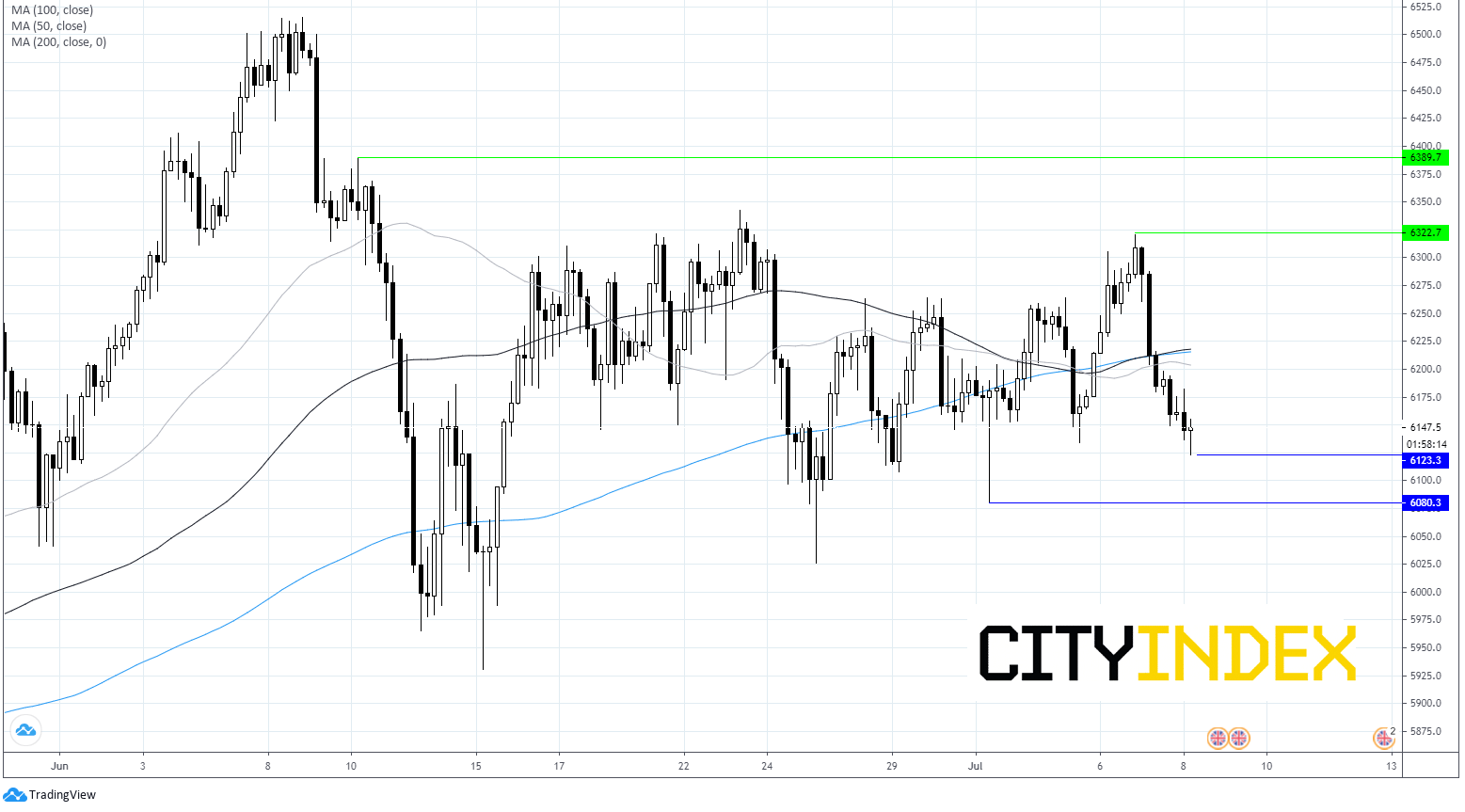

FTSE 100 Chart