European indices are following in Asia’s footsteps, moving higher on Thursday, in their last day of trading ahead of the long Easter weekend. Despite some pretty awful coronavirus statistics traders are optimistic that the outbreak is nearing its peak and that governments would roll out more stimulus. A jump in oil prices amid expectations of an oil output cut at today’s OPEC meeting is also playing its part.

In the UK daily deaths jump to 938, even higher than Italy at its peak. However, hospital admissions are falling. In New York, Mayor Andrew Cuomo said that the social distancing measures were working. These signs that the pandemic is peaking are leading to a change in market sentiment.

Recession coming

Clearly there is still a deep economic hit which is coming, and which will keep gains capped. Germany’s economy is set to shrink by 10% in Q2, the sharpest decline since records began in 1970 and double the size of the biggest drop of the 2008 financial crisis. However, for now sentiment and the prospect of more government support is driving gains.

Clearly there is still a deep economic hit which is coming, and which will keep gains capped. Germany’s economy is set to shrink by 10% in Q2, the sharpest decline since records began in 1970 and double the size of the biggest drop of the 2008 financial crisis. However, for now sentiment and the prospect of more government support is driving gains.

Finance ministers Eurogroup meeting

Today the Eurogroup of finance ministers is meeting again after failing to agree on the coronavirus stimulus package earlier in the week. The ECB has called for fiscal stimulus in the region of 1.5 trillion euros. However, EU ministers have failed to agree due to a persistent stand-off between norther and southern European states. Failure again to agree a joint deal could hit sentiment hard, whilst signs of a deal could lift stocks higher.

Today the Eurogroup of finance ministers is meeting again after failing to agree on the coronavirus stimulus package earlier in the week. The ECB has called for fiscal stimulus in the region of 1.5 trillion euros. However, EU ministers have failed to agree due to a persistent stand-off between norther and southern European states. Failure again to agree a joint deal could hit sentiment hard, whilst signs of a deal could lift stocks higher.

Jobless claims to hit sentiment?

Whether current uplift in sentiment can last the release of US Jobless claims this afternoon remains to be seen. Expectations are for 5.25 million to sign up for unemployment benefit in the week ending 3rd April. This would put the total jobless claims over the past three weeks at 15 million, or 10% of the US workforce. Another disastrous reading could see investors flock back towards safe havens, dragging stocks lower.

Whether current uplift in sentiment can last the release of US Jobless claims this afternoon remains to be seen. Expectations are for 5.25 million to sign up for unemployment benefit in the week ending 3rd April. This would put the total jobless claims over the past three weeks at 15 million, or 10% of the US workforce. Another disastrous reading could see investors flock back towards safe havens, dragging stocks lower.

Dax levels to watch:

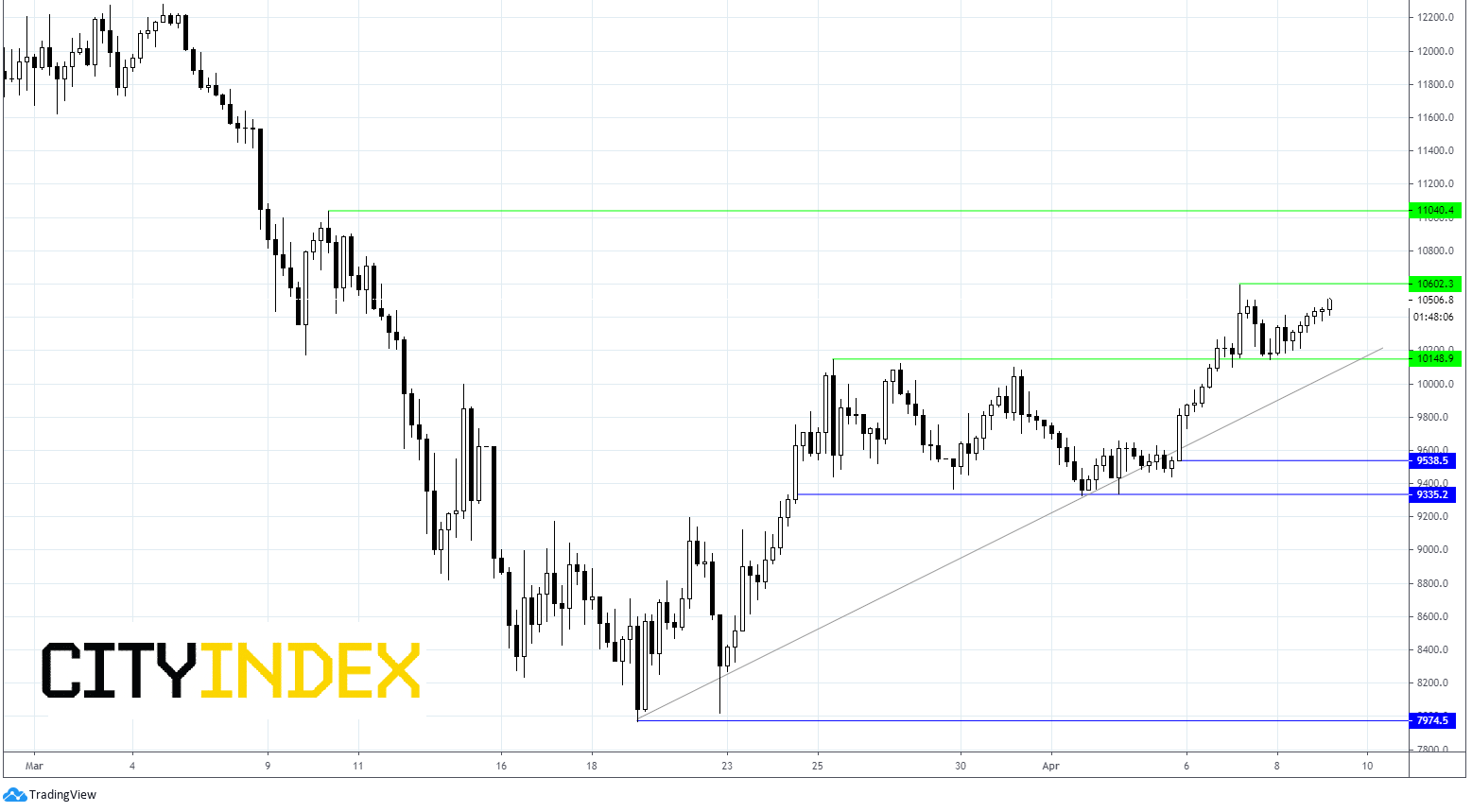

The Dax has jumped 1.9% on the open, breaking out of the horizontal channel which dated back to 25th March. The short term trend is bullish.

Immediate resistance can be seen at 10600 (yesterday’s high) prior to 11038 (high 10th March).

Support can be seen at 10150 (resistance turned support, upper bound of horizontal channel and trend line support) prior to 9540 (low 5th April) and 9335 (lower bound of horizontal channel)

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM