There isn’t a lot on the economic calendar today, with the exception of a couple of Fed speeches and the minutes of the FOMC’s last policy meeting. So expect to hear more US-China trade-related headlines ahead of the high-level talks set to start tomorrow. Already, we have heard at least two headlines today, causing a decent rally in European stocks. The FT reported an hour or so ago that China has offered to buy an extra $10 billion worth of US agricultural goods to ease the trade war. Bloomberg had reported earlier that China was open to a partial deal. Sentiment has been partially lifted, too, by the Fed’s announcement that it will resume its balance sheet expansion.

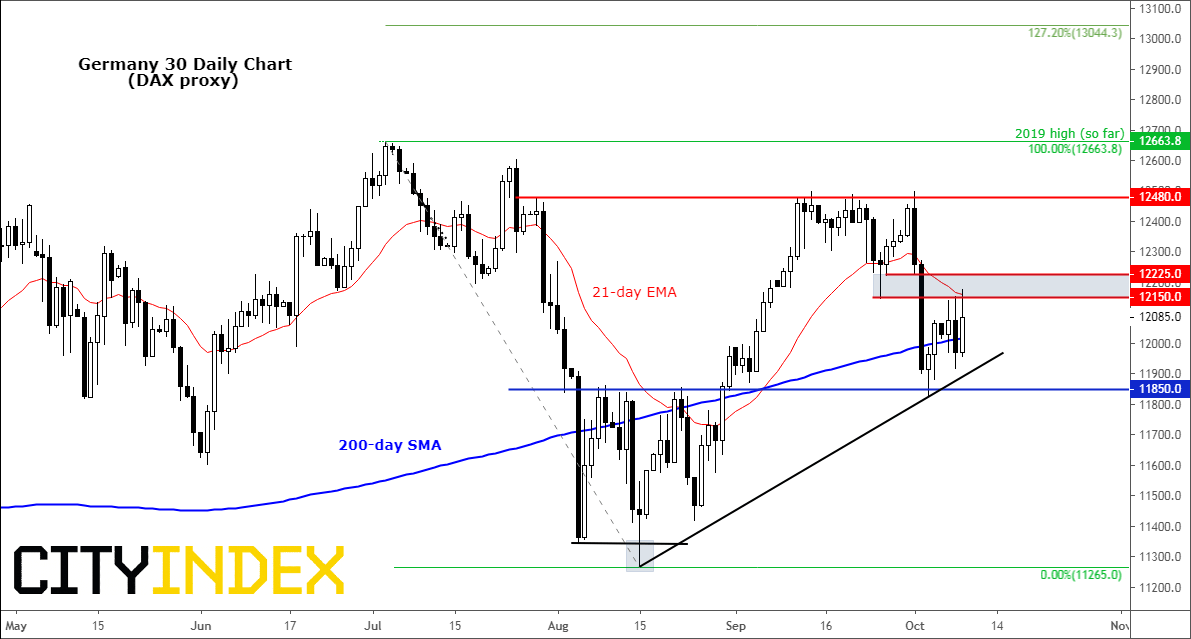

But despite this morning’s rally, the German DAX hasn’t quite managed to break through key resistance in the 12150 region, which was an old support level. If the index closes above this hurdle either today or in the coming days then that would tip the balance back in bulls’ favour. Right now, the index is in neutral territory between the key 11850 support and 12150 resistance, making it ideal for range traders. However, if this 11850 support breaks down then we could see a sizeable correction.

Source: Trading View and City Index.