Asian markets traded lower and European bourses are set to open on the back foot as US – Chinese tensions, in addition to worrying trends surrounding the Chinese consumer, drag on market sentiment. Negativity in the market is overshadowing better than expected Chinese economic growth and better than forecast UK jobs data.

Chinese GDP rebounded strongly in the second quarter, +3.2% from Q1’s record contraction. This was ahead of the +2.5% forecast. However, more worryingly retail sales fell for a 5th straight month. The data highlights the caution being exercised by consumers, who are still choosing to avoid places of possible large crowds and who are reining in their spending over concerns of what lies ahead.

China was the first nation to suffer from covid-19 and go into lockdown. They are ahead of the West on the recovery curve. However, the cautious consumer could well be a signal of what we can expect across the UK or the US and ties in with BoE policy maker Silvana Tenreyo’s forecast that wary consumers and unemployment could prevent a full economic recovery.

UK unemployment remains at 3.9%

For now, Tenreyo’s concerns are not being played out in the labour market. Jobs data continues to defy the reality of the deepest economic downturn in 300 years. Unemployment remained steady at 3.9%, the number of people claiming unemployment benefits actually declined by 28,000 rather than increasing by 250,000 and average earnings excluding bonuses jumped +0.7%.

Even with the governments job retention scheme clouding the true impact of the coronavirus crisis on the labour market, these are still robust numbers which defy the reality that the UK economy is 25% smaller now compared to February.

Despite today’s surprise, there is little doubt that the worst is yet to come for the labour market. The support from the government has delayed the impact of the crisis on the labour market, which will start showing through as the furlough scheme tapers. Rishi Sunak will be hoping that the tapering happens in conjunction with rising demand which could save the jobs market from any harsh blows.

But rest assured the unemployment level will rise going forward. The Pound hasn’t been fooled, and GBP/USD trades -0.25%, whilst sterling dropped -0.1% versus the Euro.

US retail sales

US retail sales later today will be watched closely. Expectations are for a 5% mom in June, after a 17.7% surge in May. There is a good chance that we are still seeing pent up demand being released here. However, any weakness particularly after China’s data could deeply unsettle investors.

Risk appetite has also taken a hit as US – Chinese tensions have notched up a level as the White House threatens more sanctions on Chinese tech firms, with TikTok and WeChat now in the firing line.

ECB

The Euro is trading on the back foot versus the safe haven USD but advancing versus GBP as investors look ahead to the ECB monetary policy announcement. The ECB are not expected to move on policy after increasing the Pandemic Emergency Purchase Programme by a more than expected €600 billion last month and amid tentative signs of economic recovery in the region. We can expect the ECB to return to the familiar wait and see mode.

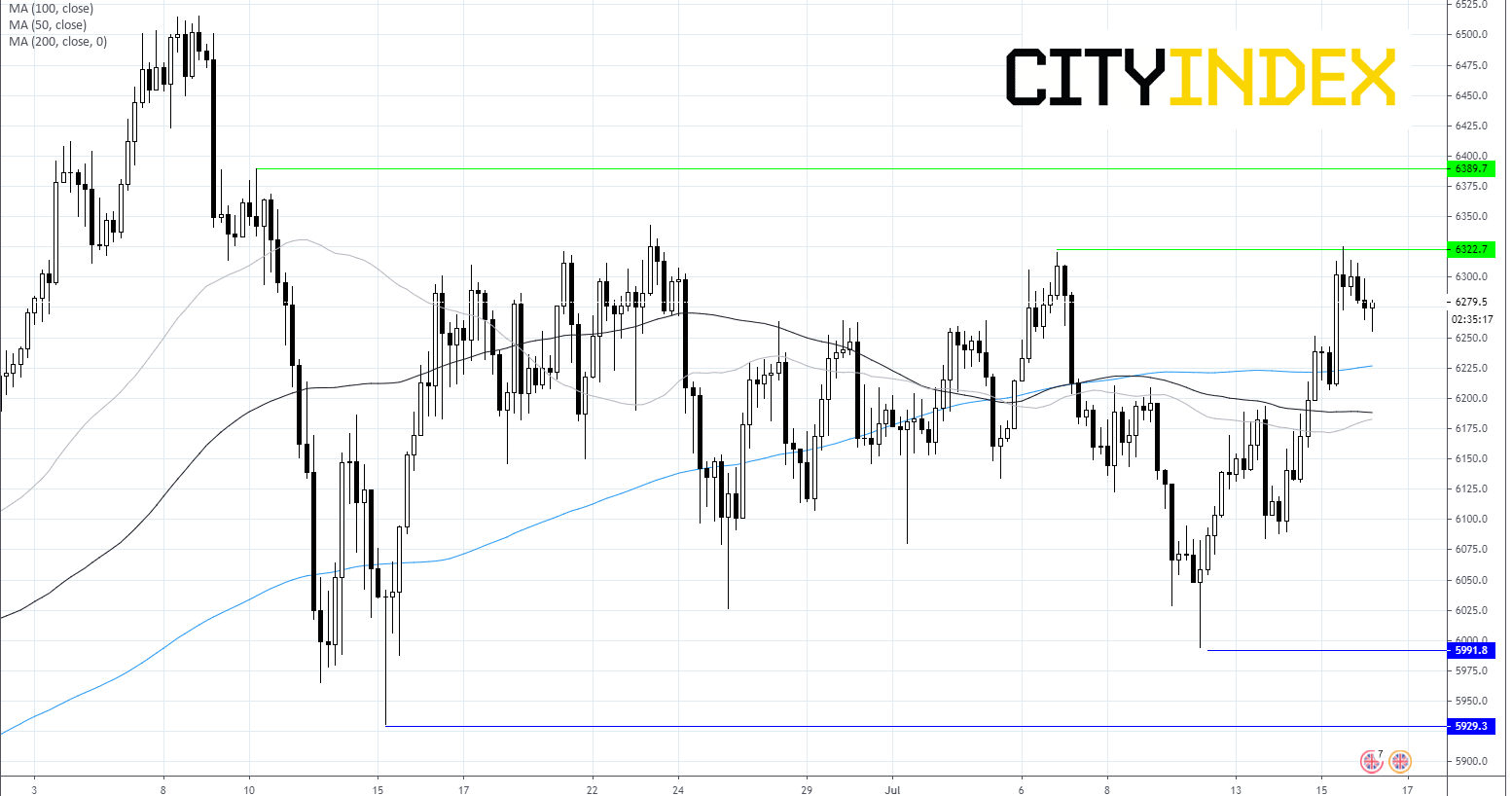

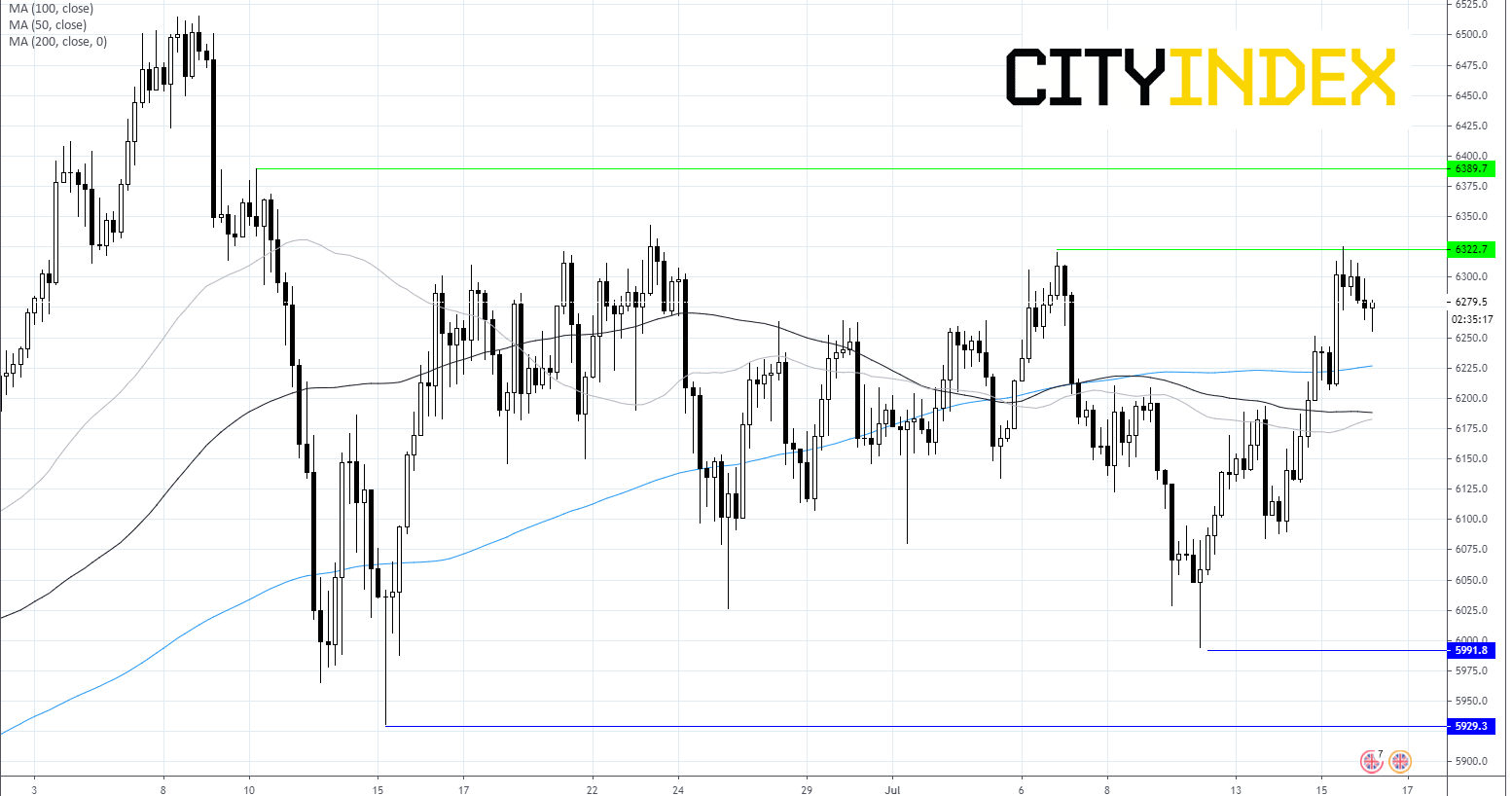

FTSE Chart