Vaccine euphoria sent European stocks to 8-month highs. Wall Street surged to record highs on vaccine optimism, before closing off the highs. A calmer more questioning mood is dominating on Tuesday as European bourses are heading out of the blocks mixed as the market acknowledges that there are still many questions surrounding Pfizer’s vaccine announcement.

There is no doubt that the Pfizer vaccine news has altered the market’s outlook on the covid pandemic, there is now some light at the end of the tunnel and the equity indices are holding the majority of their gains. However, the blind euphoria of yesterday has been replaced with a more cautious mood, there are still plenty of questions over the vaccine’s durability and distribution which need answering.

UK unemployment rises even before lockdown 2.0

The unemployment rate jumped higher to 4.8% in the three months to September, up from 4.5% in August as the covid pandemic continued to hit the labour market. This was even before new lockdown restrictions were brought in. The number of people in work fell by 247,000 the largest annual decrease in over a decade.

Unemployment marked its fastest quarterly increase since 2009 financial crisis over the end of the summer, with 1.6 million people out of work between July – September.

Joblessness has pushed higher and a string of well-known companies, such as Sainsbury last week have announced large scale job cuts in recent weeks and months.

The unemployment rate jumped higher to 4.8% in the three months to September, up from 4.5% in August as the covid pandemic continued to hit the labour market. This was even before new lockdown restrictions were brought in. The number of people in work fell by 247,000 the largest annual decrease in over a decade.

Unemployment marked its fastest quarterly increase since 2009 financial crisis over the end of the summer, with 1.6 million people out of work between July – September.

Joblessness has pushed higher and a string of well-known companies, such as Sainsbury last week have announced large scale job cuts in recent weeks and months.

Chancellor’s furlough extension came too late?

The disappointing data comes after the Chancellor extended the government’s furlough scheme just as it was running out. It seems that the lastminute extension until March was too last minute for many companies, which had already taken decisions regarding the future of their workforce and head count.

The disappointing data comes after the Chancellor extended the government’s furlough scheme just as it was running out. It seems that the lastminute extension until March was too last minute for many companies, which had already taken decisions regarding the future of their workforce and head count.

Brexit optimism

GBPUSD trades +0.15% ticking a few pips lower on the release. Instead the Pound remains broadly supported by Brexit optimism. Reports of progress between the EU and the UK suggests that a trade deal could still be achieved. With Biden entering the White House and a quick trade deal with the US looking less likely Boris Johnson will now have extra motivation to get a deal done.

With a less confrontational President heading to the White House, a covid vaccine in the wings we just need a Brexit trade deal and 2021 is looking like a significantly better place that 2020!

GBPUSD trades +0.15% ticking a few pips lower on the release. Instead the Pound remains broadly supported by Brexit optimism. Reports of progress between the EU and the UK suggests that a trade deal could still be achieved. With Biden entering the White House and a quick trade deal with the US looking less likely Boris Johnson will now have extra motivation to get a deal done.

With a less confrontational President heading to the White House, a covid vaccine in the wings we just need a Brexit trade deal and 2021 is looking like a significantly better place that 2020!

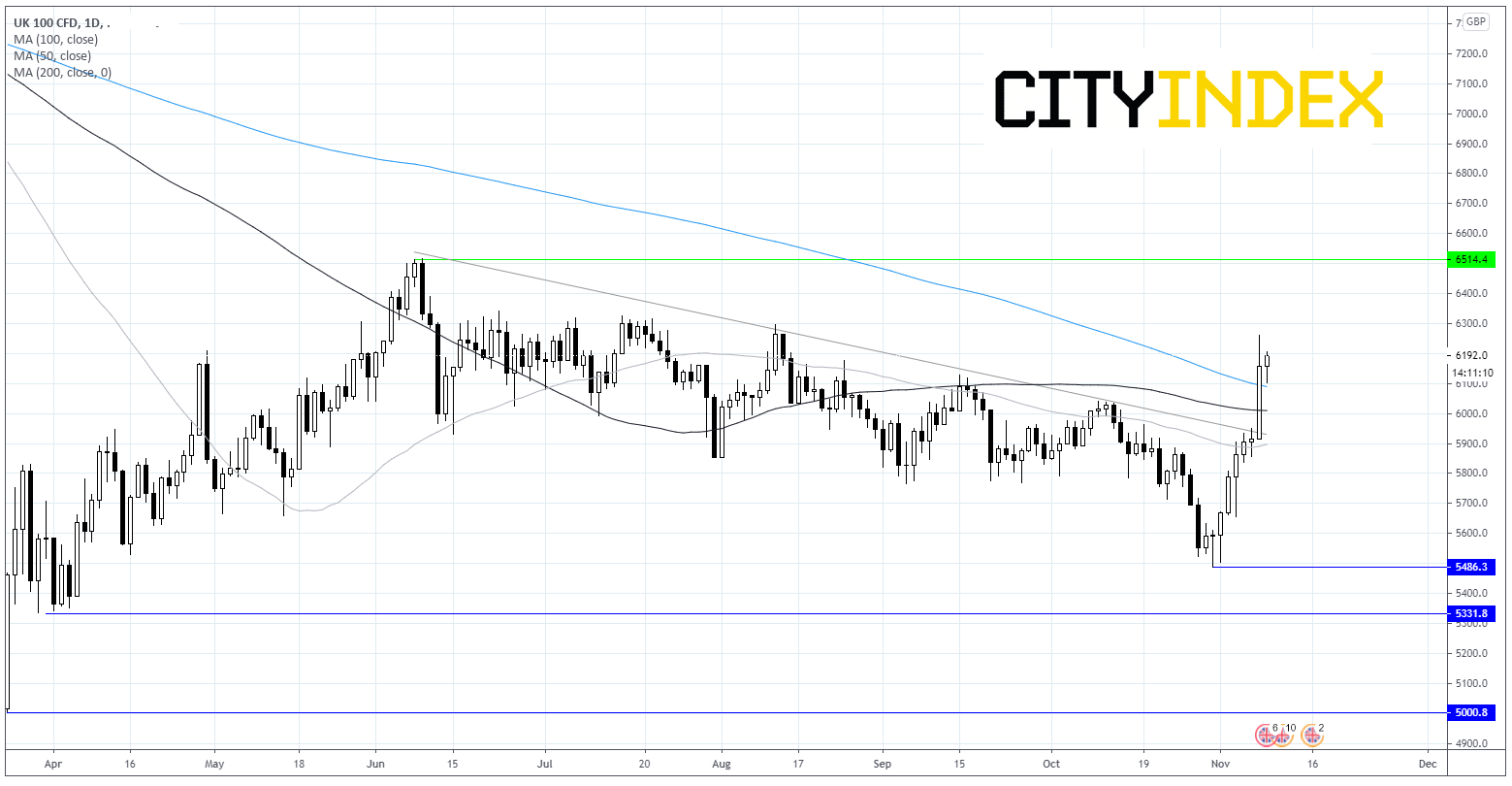

FTSE Chart

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM