AAC Technologies Holdings (2018 HKG)

click to enlarge charts

Key elements

- AAC Tech, one of the component stocks on the benchmark Hang Seng Index has continued to bleed due to weak localised sentiment caused by the on-going mass demonstrations seen in Hong Kong to protest the “soon to be passed” controversial China extradition bill. It has underperformed the Hang Seng Index (HSI) as at today’s mid-session where it tumbled by -4.10% versus a drop of -1.7% seen in the HSI. Click here for an analysis on the Hang Seng Index by my colleague, Matt Simpson.

- Also, external factors are also not in favour towards AAC Tech because it is a key supplier to both Apple and Huawei where these two tech giants are now being drawn into the “crossfire” of the on-going trade war between U.S. and China.

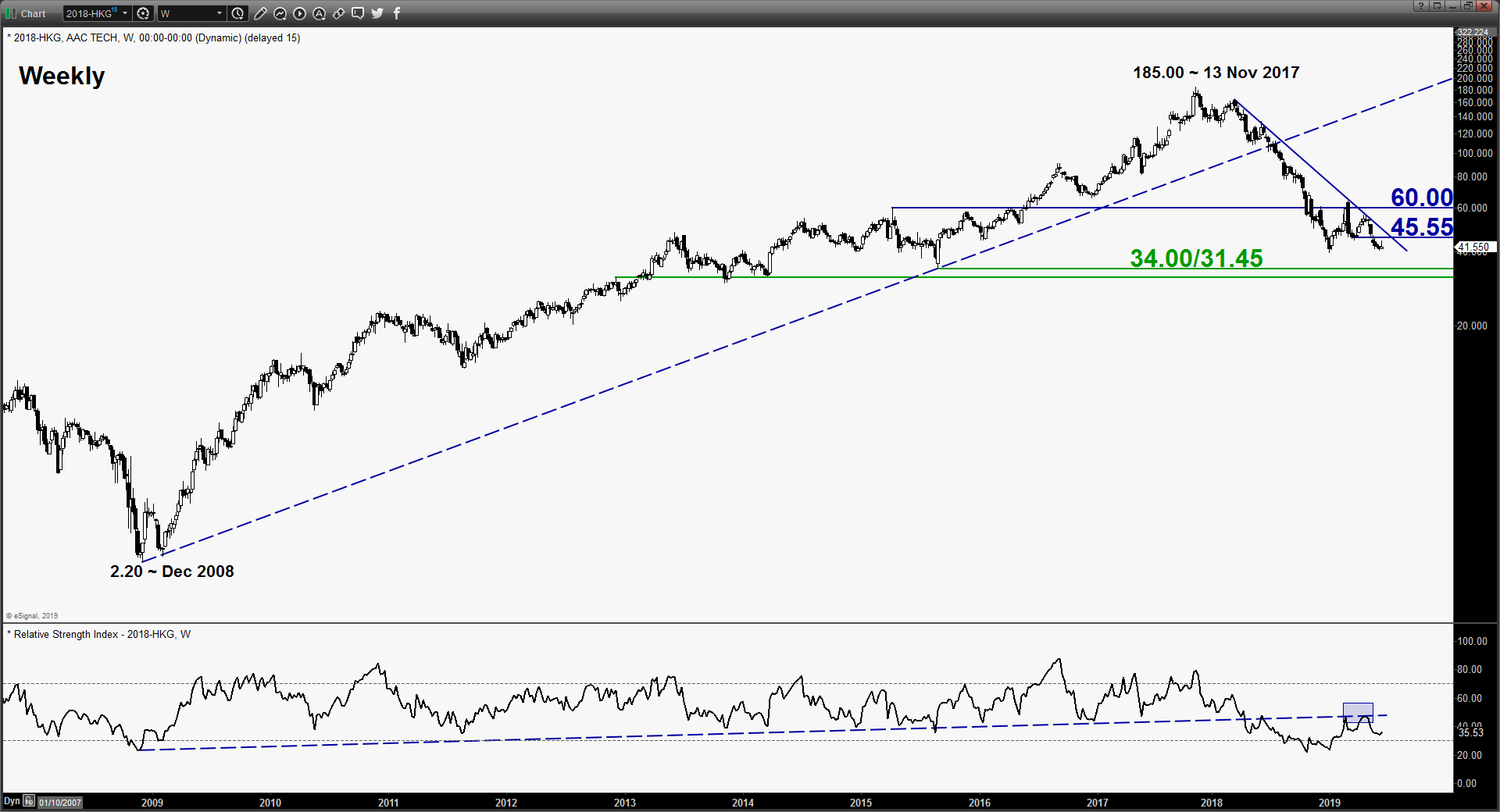

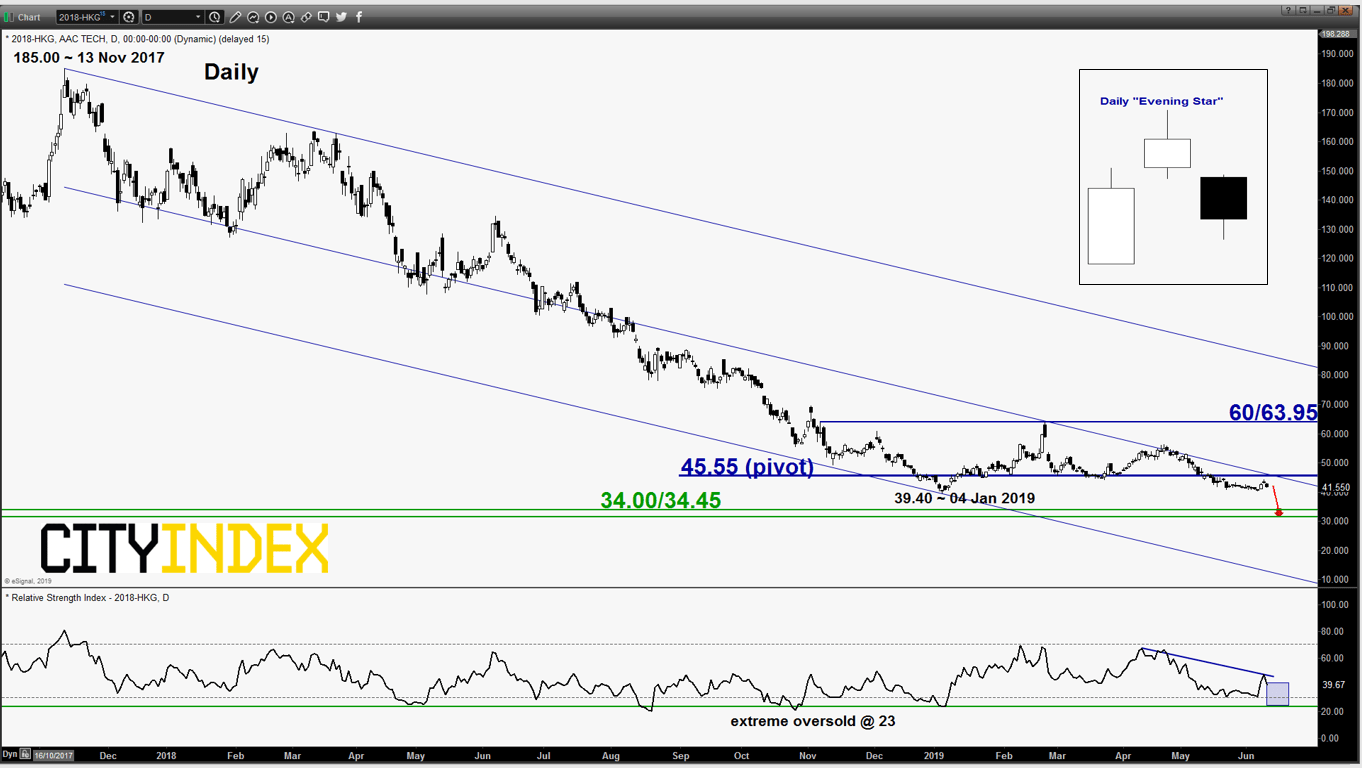

- The long-term cyclical downtrend in place since 13 Nov 2017 high of 185.00 remains intact and showing no signs of a bullish reversal.

- Its share price has started to form an impending daily bearish “Evening Star” candlestick pattern coupled with negative momentum seen in both the weekly and daily RSI oscillators

- Key medium-term resistance stands at 45.55 which is defined by the median line of the long-term descending channel and the former swing low areas of 01/19 Mar 2019.

Key Levels (1 to 3 weeks)

Pivot (key resistance): 45.55

Support: 34.00/34.45

Next resistance: 60.00/63.95

Conclusion

If the 45.55 key medium-term pivotal resistance is not surpassed, the corrective rebound from its 04 Jan 2019 low of 39.40 is likely to be over and AAC Tech may resume its impulsive down move to target the next support at 34.00/34.45 in the first step.

However, a daily close above 45.55 invalidates the bearish scenario for an extension of the corrective rebound towards the next resistance at 60.00/63.95 (25 Feb 2019 swing high).

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM