Sterling has turned weak as Boris Johnson begins to look unstoppable

Matt Hancock’s decision to drop out of the Conservative leadership contest, after receiving 20 votes in the first-round is the latest development. 33 votes are needed to make it through the second next week. Hancock hasn’t immediately announced which of the remaining 6 candidates he will support.

Yet with 114 votes secured against 105 required and miles ahead of former Health Secretary Hunt’s 43, Boris Johnson is beginning to look unstoppable. And sterling is behaving differently than it did when his ‘campaign’ proper began this week. The pound rose to the week’s highs on Wednesday. It was interpreted as more ‘straight-down-the-line’ than usual. Johnson said leaving the EU wasn’t his intention. But he still noted he would steer the UK out without arrangements if necessary.

So the pound’s extension of gains at the time looked like a signal. Sterling Boris bets would have to assume he could lead the Tories to election victory if crashing out resulted in a general election. Alternatively, that he would renege on his pledge or that Parliament would block him.

With the pound against the dollar reversing 170 pips off Wednesday’s top, the market now looks less bullish Boris. Note the dollar was boosted by decent U.S. Retail Sales prints earlier. But sterling is also offside against the euro. The single currency’s uptrend since early May is clear. Also note the ECB’s preferred gauge of inflation expectations hit a record low on Friday. The lack of strong euro reaction suggests such expectations are already priced. So sterling may just be weak as Tory leadership prospects become clearer.

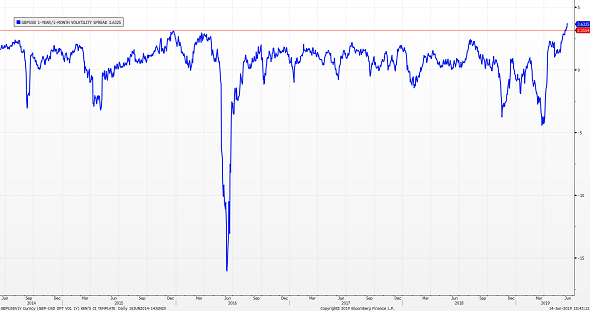

Elsewhere, option volatility continues to plumb annual lows, showing the market still isn’t pricing in a chaotic British exit from the EU. But the spread between one-year at the money GBP/USD volatility and its one-month counterpart is rising off its long-term baseline. This suggests expectations about what happens after Britain’s 31st October deadline, are darkening ahead of further ballots and a TV debate next week.

Implied volatility chart: One-year/One-month sterling/dollar implied volatility spread

Source: Bloomberg

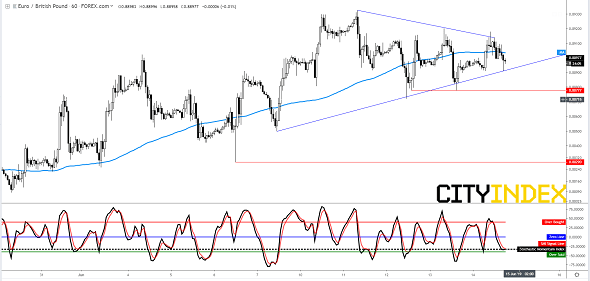

EUR/GBP chart thoughts

Consolidation of the 5%-plus euro rally since early May is underway. But the symmetrical wedge (or ‘coil’) forming would normally be a continuation pattern, so sterling relief may be relatively brief. The pound looks to have room up to euro support of 88.77, assuming the lower rising line of the wedge gives. Achievement of sterling’s 88.29p high from 6th June looks far less plausible. The euro advance looks formidable in daily intervals.

EUR/GBP – hourly

Source: City Index