Sterling buyers show their hand as Boris shows face

The bookies favourite to win the Conservative Party leadership contest has finally shown his face, after a notable stretch of deliberately avoiding public comment. Boris Johnson was, perhaps predictably, still light on detail about his merits compared to other candidates to succeed Theresa May as Prime Minister, particularly how he would succeed where she failed in getting a Brexit deal through a sceptical House of Commons. How much more getting it over the line in Brussels.

The stand out of a speech which was, admittedly delivered in the usual colour Bojo style, was an assertion that he is “not aiming for a no-deal Brexit”. The line was seized on by the press and flashed on the wires, even though it clearly doesn’t negate the position Johnson aimed to make a unique selling point just before campaigning got underway: that he would be prepared to leave the EU by the 31st October deadline with no-deal if necessary.

Despite the lack of illuminating content revealed during his press conference though, purposeful sterling traders also showed up for the first time in weeks, giving the pound against the dollar its first clear reaction to the contest yet. True, sterling has been on a fair run higher since marking a bottom on the $1.26 handle last week, but it unmistakeably extended gains to the highest since 7th June during Johnson’s comments. In other words a clear cohort of sterling bulls have revealed their hand. Up till this point the prevailing assumption had been that any political influence that brought the possibility of a no-deal Brexit nearer was anathema to the pound, due to the potentially corrosive impact on the economy. Now, perhaps, sterling’s perceived buy case is changing. The pound has flagged the upside in reaction to comments from the Tory candidate who had been synonymous with ‘crash-out’ risk. The reckoning that a possible resolution of similarly economically corrosive Brexit stalemate was bought.

More broadly, this week’s sterling tailwind may get a boost from U.S. inflation data due out shortly, if the prints are as lacklustre as recent top-tier economic readings Stateside.

Chart thoughts

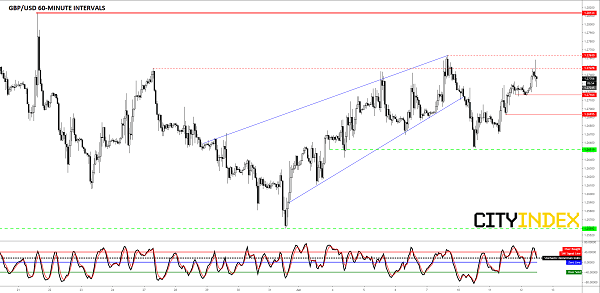

A fresh uptick could enable GBP/USD to confirm Wednesday’s $1.2758 spike highs, though $1.27630 resistance from the June top still doesn’t appear a credible target. Keeping our view on the near horizon only, consolidation to Tuesday’s $1.2716 floor or even the lower $1.2693 low tested earlier that day, would be reasonable if upside progress falters.

Sterling/U.S. dollar – hourly

Source: Tradingview/City Index