There has been bloodbath on Wall Street. Sentiment turned sour yesterday afternoon and investors have remained in panic mode ever since. The publication of a very poor US manufacturing PMI report was a game changer. Up until now, the US manufacturing and other sectors of the economy had remained resilient despite weakness in other economic regions like the Eurozone and China. BUT now investors are worried that the world’s largest economy has also caught the cold.

So, right now, stocks and the US dollar are falling sharply, causing bond yields to weaken as investors seek the relative safety of government bonds. Dollar-denominated and safe-haven gold has found itself in unexpected demand after falling noticeably in the previous days.

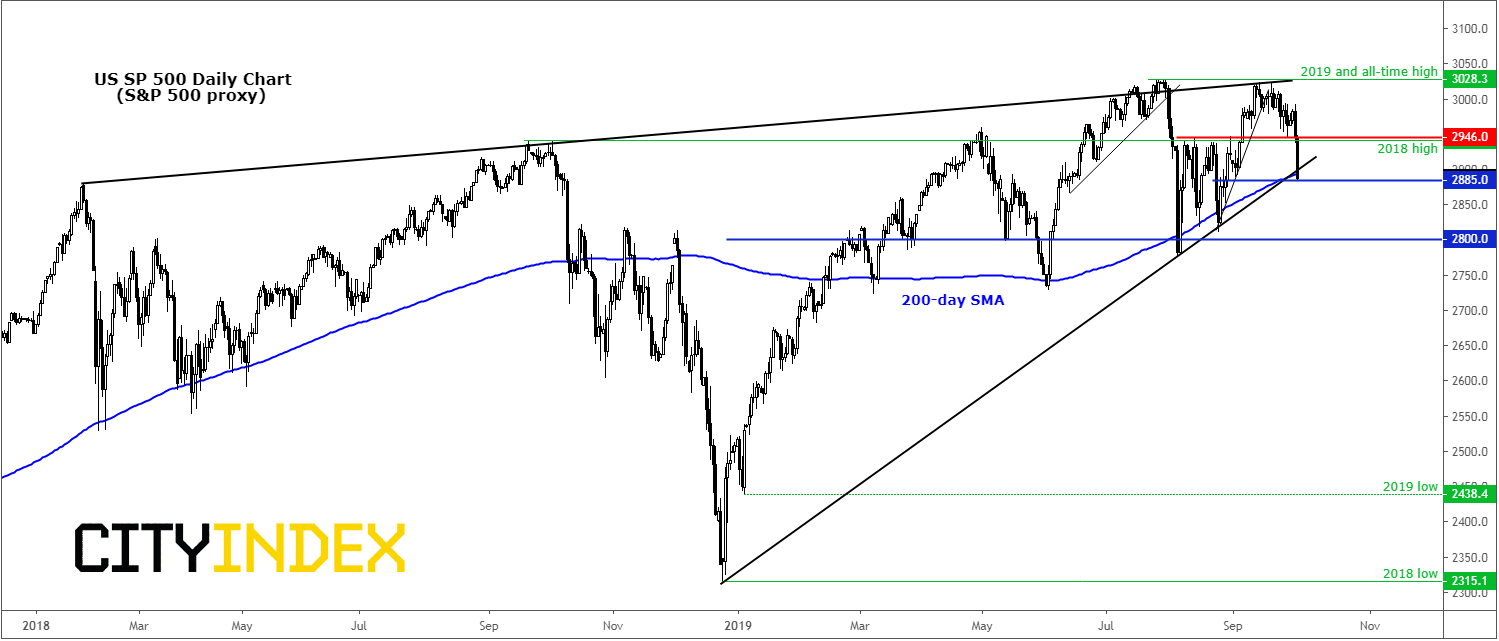

At the time of writing, the major US indices were near their lows and there were no signs of a rebound. However, the S&P 500 was testing its bullish trend line near 2885. Will we see some bargain hunting around these levels? Will the bears ease off the gas? Time will tell. For now, it is worth monitoring the benchmark index closely. Given the over-extended moves, a short-term pullback should not come as major surprise. But if the trend breaks on a closing basis then expect more selling in the latter parts of the week.Source: Trading View and City Index. Please note this product may not be available to trade in all regions.