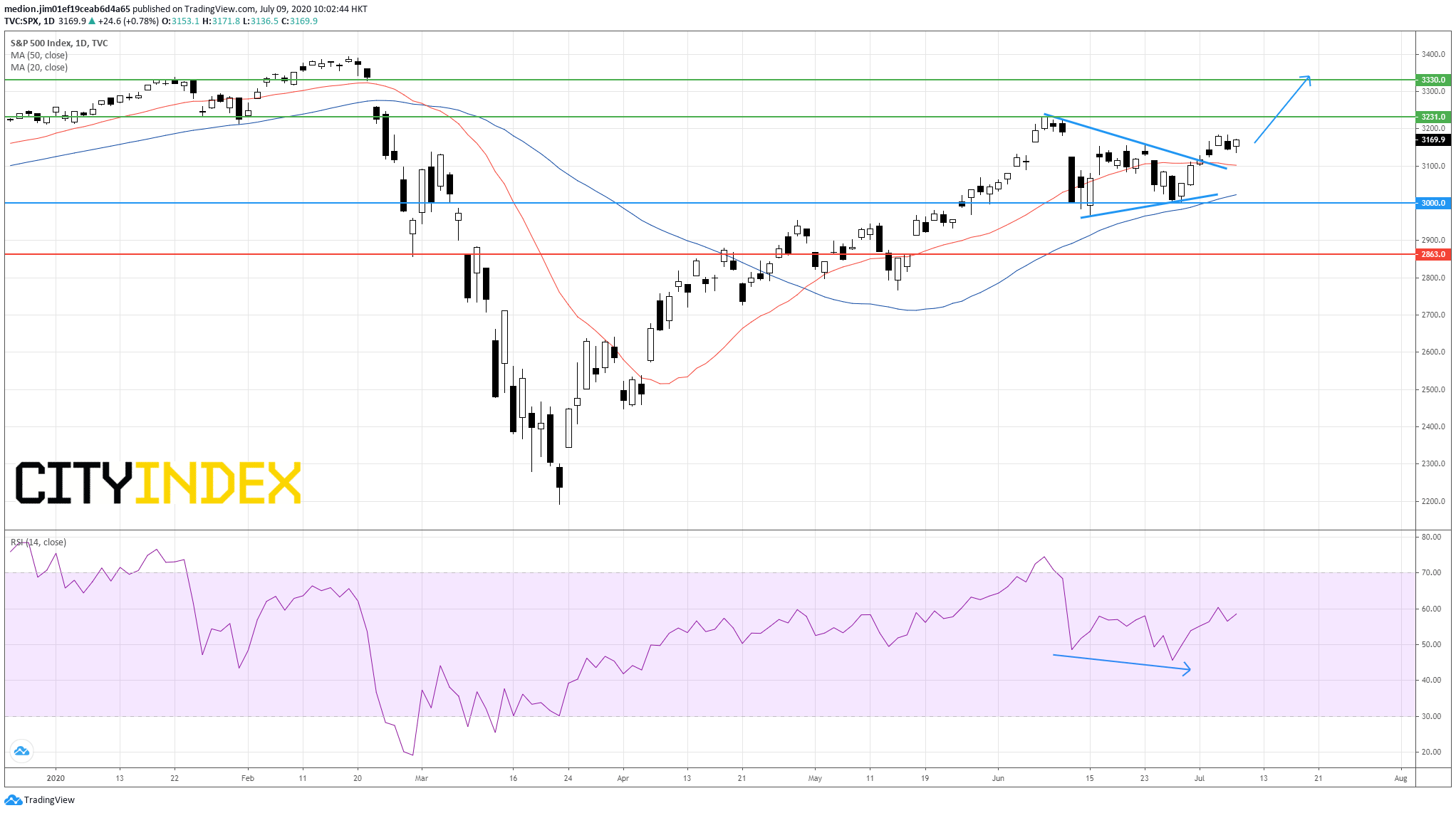

S&P 500 Index (Short Term): The Resumption of Previous Up Trend

On Wednesday, the S&P 500 gained 24 points (+0.78%) to 3169 despite potential consequences of spiking coronavirus cases across the country. The number of COVID-19 cases in the U.S. surpassed 3 million, according to the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University. Besides, the new cases added 62,000 yesterday, marking the highest increase level in a single day.

However, market sentiment was lifted by comments by St. Louis Federal Reserve Bank President James Bullard that the U.S. jobless rate would likely decline to 7% by the year-end.

Investors should focus on Initial Jobless Claims for the week ended July 4 (a decline to 1.375 million expected) and Wholesale Inventories for May (final reading of -1.2% on month expected).

From a technical point of view, the S&P 500 index broke above the triangle pattern and filled the gap occurred on June 11 on the daily chart.

The 50-day moving average remains on a positive slope, suggesting the bullish outlook for the prices.

The RSI also indicated a positive reversal signal, which provides evidence to resume the up trend.

Bullish readers should consider the nearest support level at 3000 (the previous low), while the resistance levels would be located at 3231 (the previous high) and 3330 (the gap created on February 24) respectively.

Source: TradingView, GAIN Capital

However, market sentiment was lifted by comments by St. Louis Federal Reserve Bank President James Bullard that the U.S. jobless rate would likely decline to 7% by the year-end.

Investors should focus on Initial Jobless Claims for the week ended July 4 (a decline to 1.375 million expected) and Wholesale Inventories for May (final reading of -1.2% on month expected).

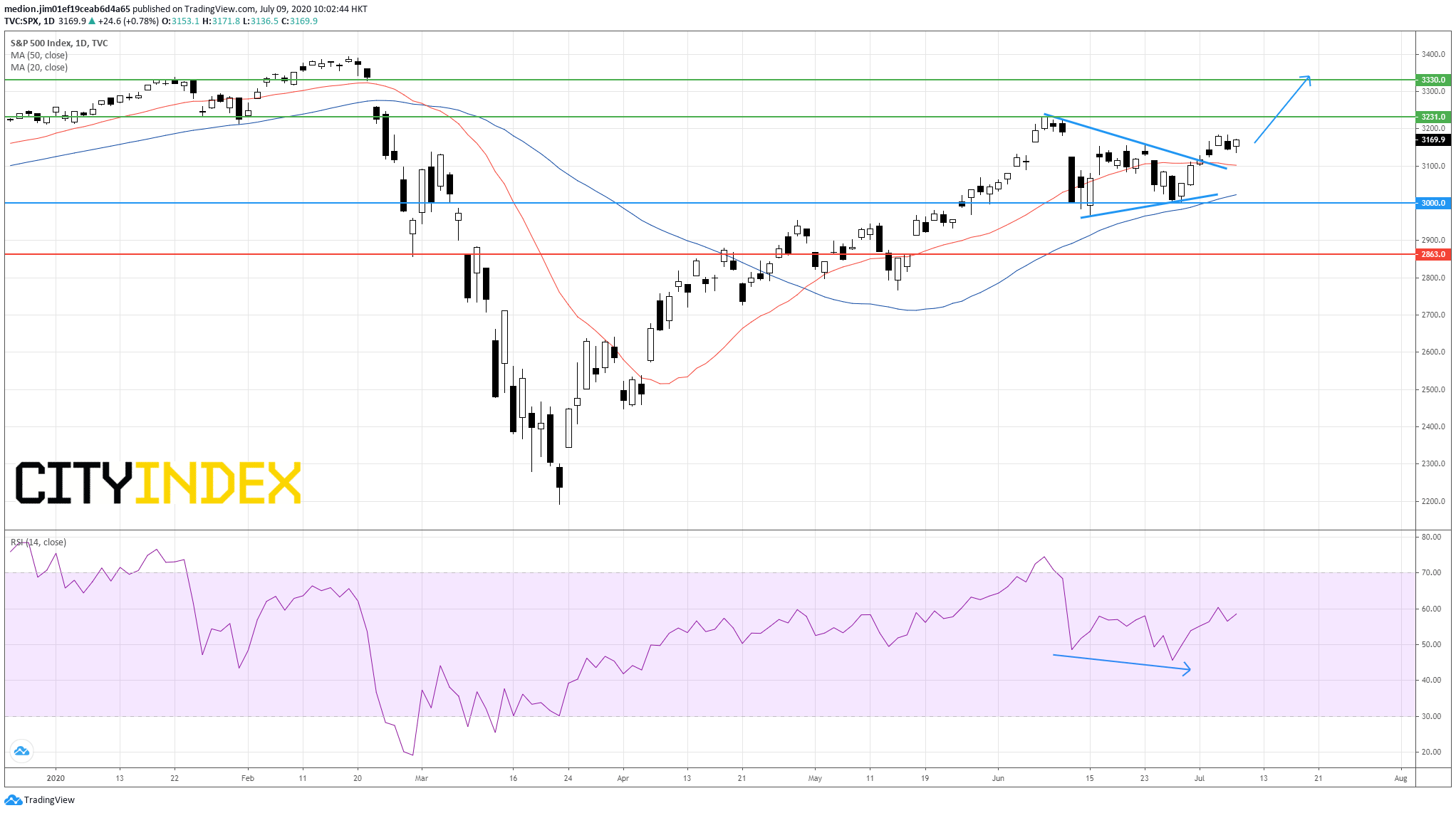

From a technical point of view, the S&P 500 index broke above the triangle pattern and filled the gap occurred on June 11 on the daily chart.

The 50-day moving average remains on a positive slope, suggesting the bullish outlook for the prices.

The RSI also indicated a positive reversal signal, which provides evidence to resume the up trend.

Bullish readers should consider the nearest support level at 3000 (the previous low), while the resistance levels would be located at 3231 (the previous high) and 3330 (the gap created on February 24) respectively.

Source: TradingView, GAIN Capital

Latest market news

Today 08:33 AM

Yesterday 11:48 PM

Yesterday 11:16 PM