When:

Wednesday 28th April before the bell

What to watch?

Spotify, a pandemic winner, is expected to report a significant slowdown in new subscribers in the first quarter. This would be another signal that the pandemic tech entertainment boom is over.

Spotify, like Netflix, saw impressive subscriber growth across the last year with 6 million new subscribers in the first three months of 2020 and a blistering 11 million in the final quarter of 2020. Subscriber numbers, including those receiving a free service, jumped from 155 million to 345 million as pandemic boredom fueled a boom in listening to music and podcasts.

However, Spotify warned that user growth was unlikely to continue to grow at such a strong rate and expects just 29 million new subscribers this year or potentially just 17 million in a worst-case scenario. If Netflix is anything to go by the slow down could be worse and could signify the end of the pandemic fueled run,

However, it may not be all bad news. Spotify’s share price surged by 8% on Friday after an analyst at Jefferies wrote an upbeat note on the stock, a buy rating and a price target of $360 representing a 27% upside. Jefferies considered that Spotify was growing into a indispensable service and that he stock price will soon catch up to that reality.

Where next for Spotify share price?

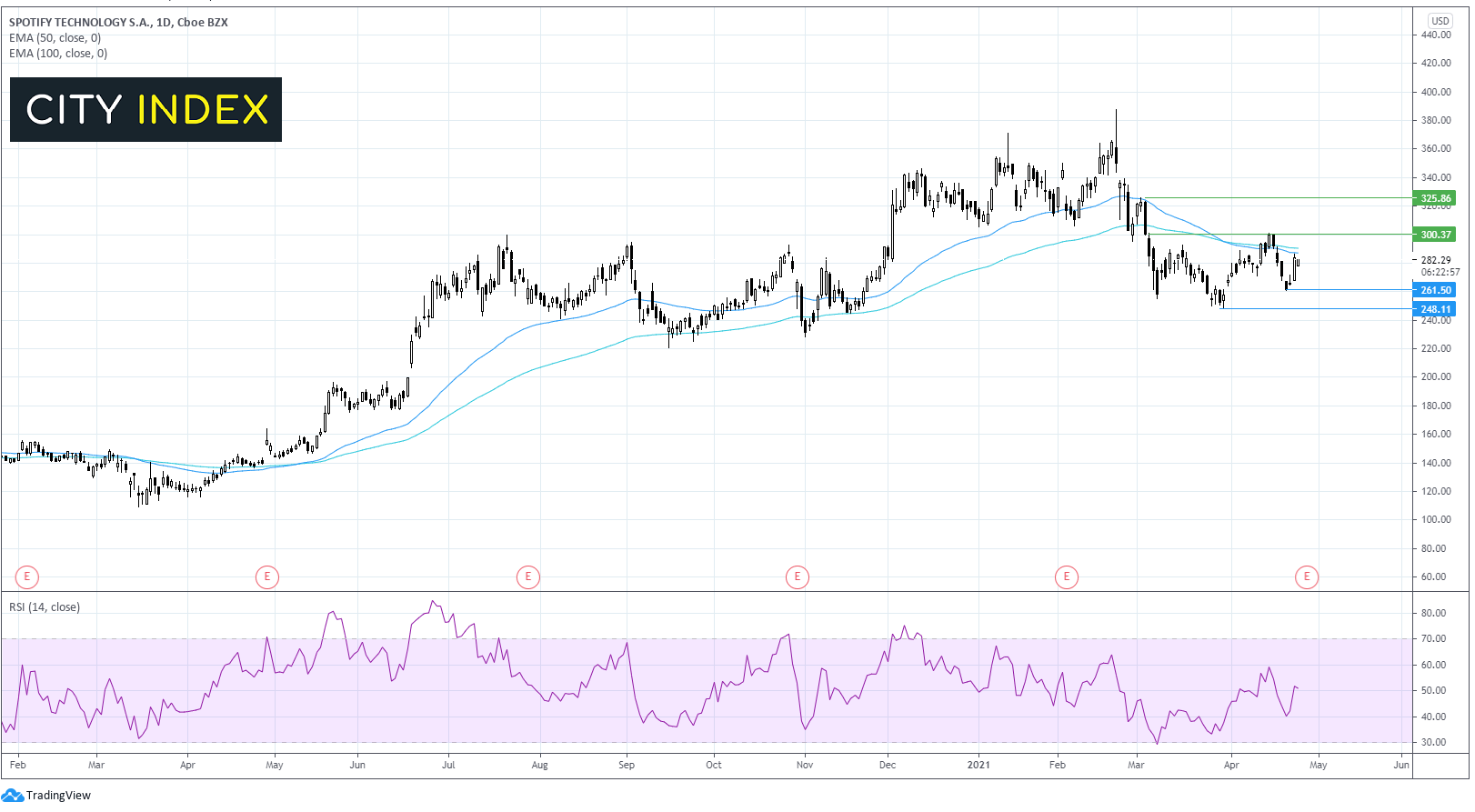

After trending steadily higher since the mid-March 2020 low, the share price hit an all time high of $388 before easing lower.

The Spotify share price has fallen through its 50 & 100 EMA on the daily chart in a bearish signal. The 50 EMA has also crossed below the 100 EMA in another bearish sign.

The rebound off $260 has so far failed to move back above the 50 & 100 EMA which offer immediate resistance at around $290.

The path of least resistance remains to the downside with support at $260 the April low, followed by $250 the year to date low.

Any recovery above $290 could look towards the round number $300. It would take a move above this level to negate the current bearish trend.