Spot Gold Slumped 5%, Recording the Biggest Loss in 7 years

Spot gold price plunged $115.00 or 5.70% to $1,911 an ounce yesterday, the biggest daily dollar slide in over seven years, as investors turned optimistic that a coronavirus vaccine would come soon.

Russian President Vladimir Putin said the world's first Covid-19 vaccine are ready to use, even before clinical testing has finished.

Besides, U.S. President Donald Trump said he is seriously considering a capital gains tax cut, which also increases the investors risk appetite.

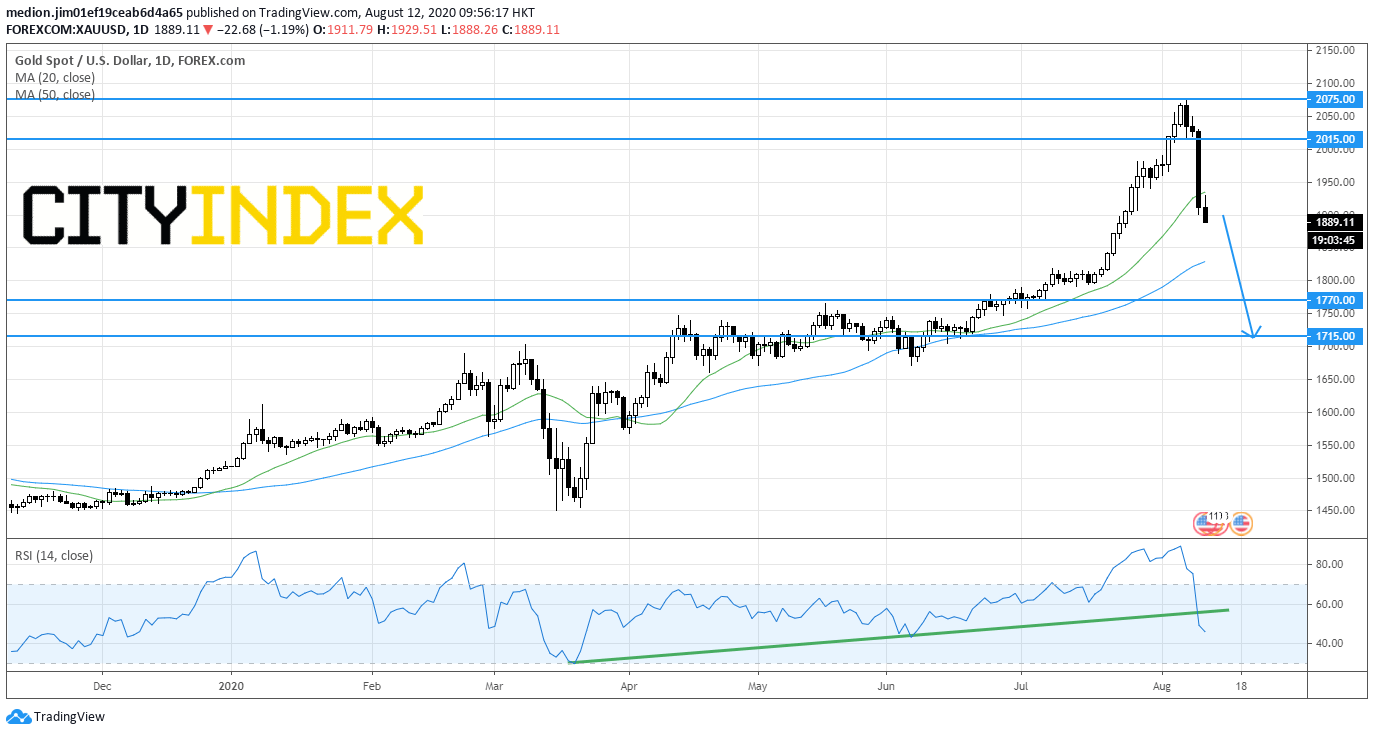

Spot Gold (Short Term): Turning Down

Source: GAIN Capital, Tradingview

Technically, the spot gold prices sharply retreated with a long range bearish candlestick on a daily chart. Currently, the prices broke below the 20-day moving average.

The relative strength index dramatically fell from the overbought level and also broke below the rising trend line drawn from March.

Bearish readers could place the nearest resistance level at $2,015, while support levels would be located at $1,770 and $1,715.

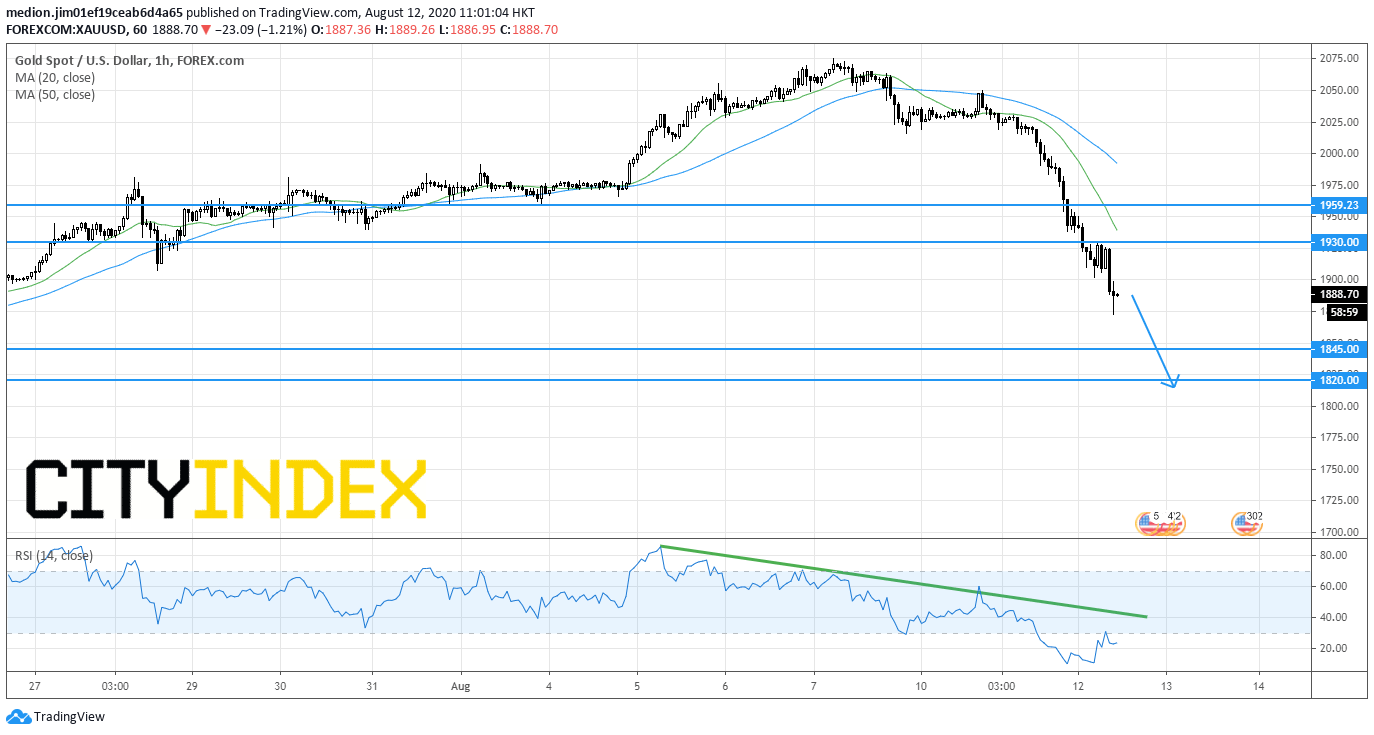

Spot Gold (Intraday): Further decline expected

Source: GAIN Capital, TradingView

On a 1-hour chart, Spot gold has recorded a series of lower tops and lower bottoms since August 7, indicating a bearish outlook.

The relative strength index is capped by a declining trend line drawn from August 5, suggesting the downside momentum for the prices.

In this case, as long as the resistance level at $1,930 (the previous high) is not surpassed, gold prices could consider a further downside to the support levels at $1,845 and $1,820.

Russian President Vladimir Putin said the world's first Covid-19 vaccine are ready to use, even before clinical testing has finished.

Besides, U.S. President Donald Trump said he is seriously considering a capital gains tax cut, which also increases the investors risk appetite.

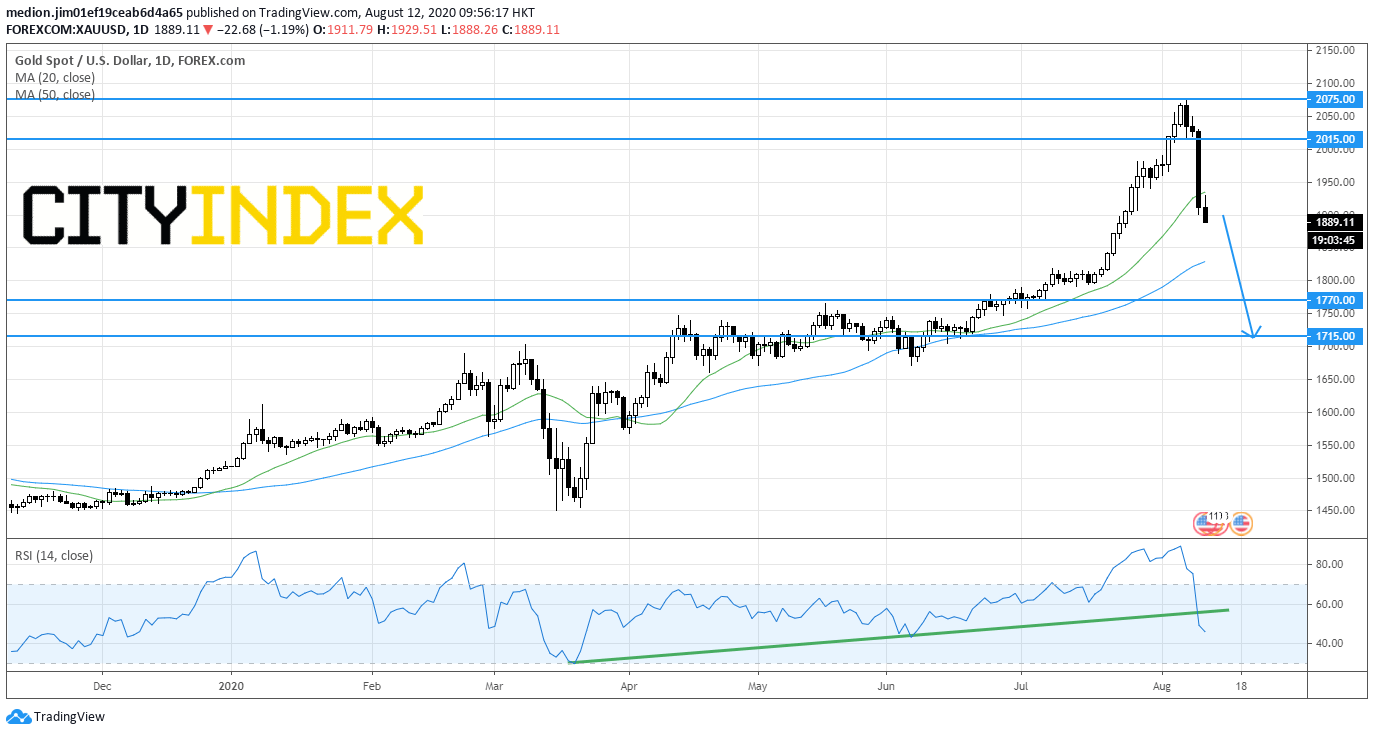

Spot Gold (Short Term): Turning Down

Source: GAIN Capital, Tradingview

Technically, the spot gold prices sharply retreated with a long range bearish candlestick on a daily chart. Currently, the prices broke below the 20-day moving average.

The relative strength index dramatically fell from the overbought level and also broke below the rising trend line drawn from March.

Bearish readers could place the nearest resistance level at $2,015, while support levels would be located at $1,770 and $1,715.

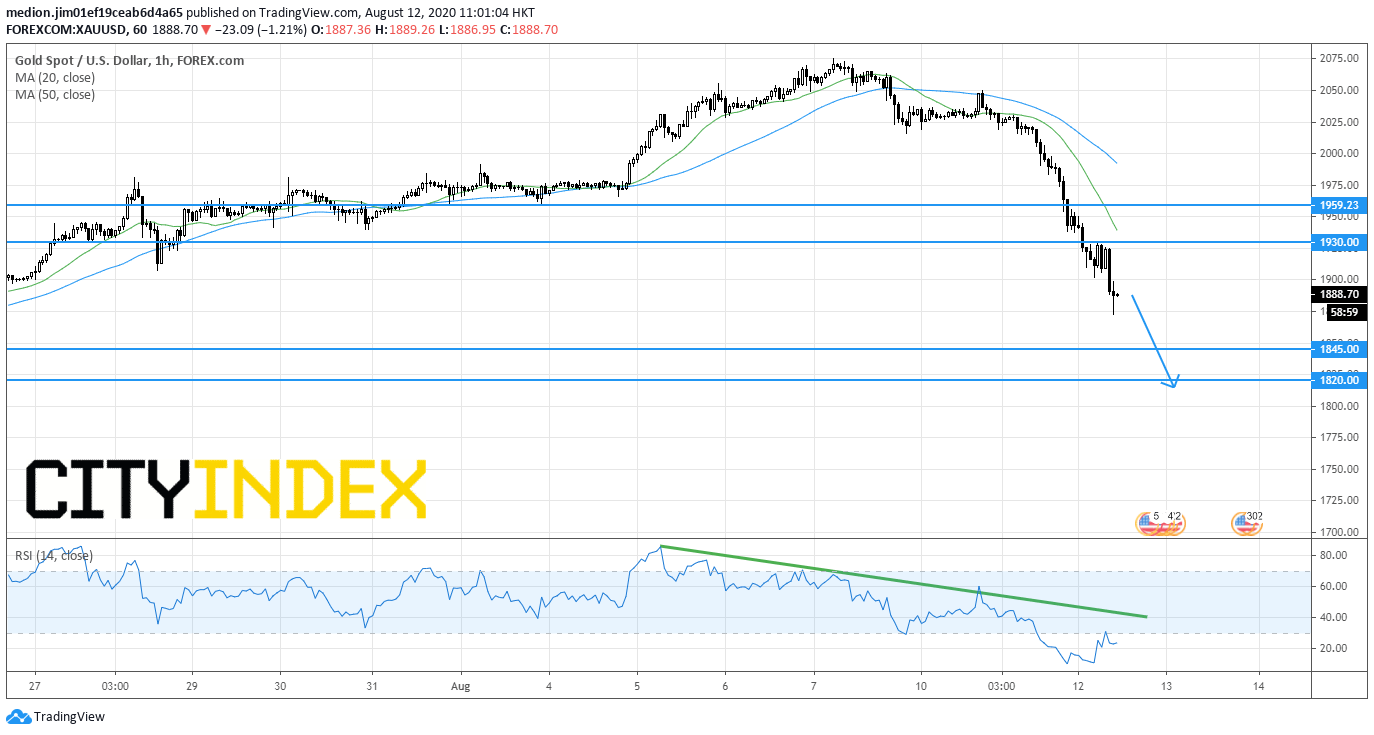

Spot Gold (Intraday): Further decline expected

Source: GAIN Capital, TradingView

On a 1-hour chart, Spot gold has recorded a series of lower tops and lower bottoms since August 7, indicating a bearish outlook.

The relative strength index is capped by a declining trend line drawn from August 5, suggesting the downside momentum for the prices.

In this case, as long as the resistance level at $1,930 (the previous high) is not surpassed, gold prices could consider a further downside to the support levels at $1,845 and $1,820.

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM