SPDR Gold Trust (GLD): Potential Reversal Signal

According to Bloomberg's data, total known ETF holdings of gold slipped 0.1% to 108.65 million troy ounce, down for a third straight session, the first time since early June, suggesting that there might be some profit taking actions.

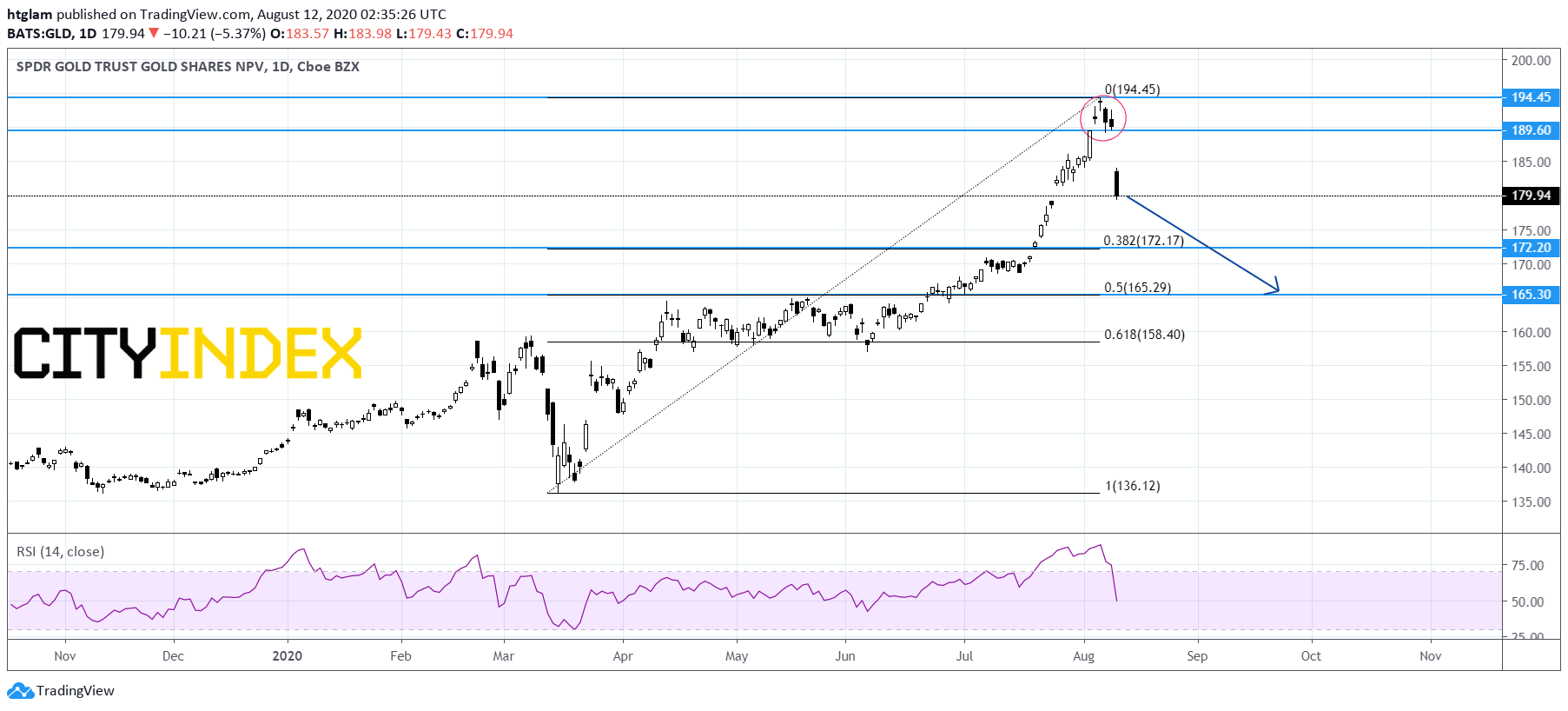

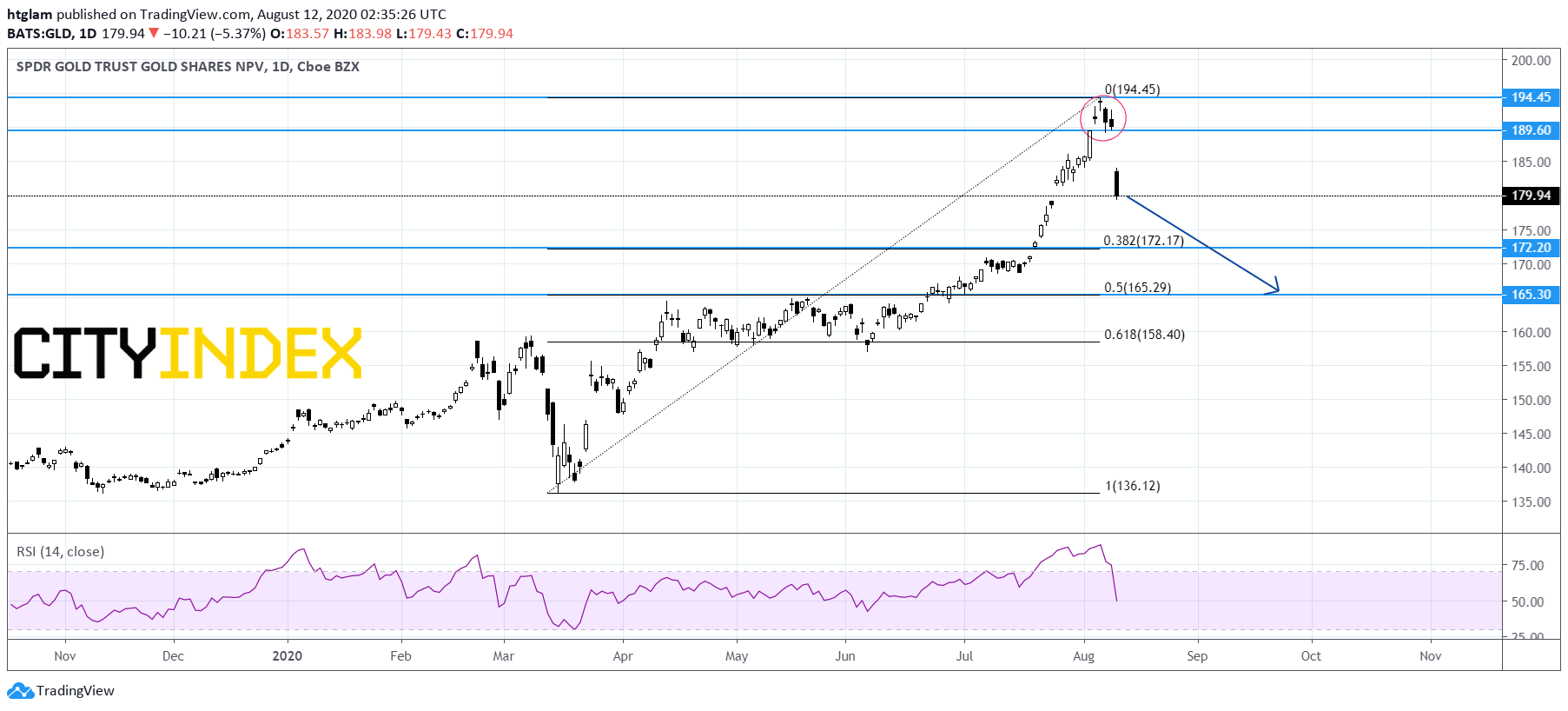

As shown on the daily chart, SPDR Gold Trust (GLD) has potentially formed a reversal signal after a recent rally. It has formed a bearish evening star pattern last week, and following by a 5.4% decline on Tuesday. The level at $189.60 may be considered as the nearest resistance, while the 1st and 2nd supports are expected to be located at $172.20 and $165.30 respectively. Alternatively, a break above $189.60 would suggest that the next resistance at $194.45 might be challenged again.

Source: TradingView, Gain Capital

Latest market news

Today 07:55 AM

Today 04:47 AM