The overnight 2% intraday fall in the S&P500 appears to have been sparked by fears that newly approved Covid19 vaccines would be ineffective against the new UK strain of Covid19. As well as suggestions the latest US fiscal stimulus package was already priced into equities, prompting a “buy the rumour sell the fact” type reaction.

The subsequent bounce in the S&P500 coming after the chairman of the European Medicines Agency stated that the new strain of Covid-19 isn’t different enough from earlier strains to elude vaccines and renewed hopes of a last-minute Brexit deal.

Stepping back for a moment, the backdrop between Christmas 2018 and Christmas 2020 is vastly different.

In December 2018 the S&P500 fell over 15% on fears that the Federal Reserve would deliver on its intention to hike interest rates in 2019, at a time the US-China trade war was putting the handbrake on global growth.

The outlook for 2021 is that unprecedented fiscal and monetary stimulus and the rollout of vaccines is expected to help support economic growth and help traders look through the short term uncertainty of Christmas lockdowns and hastily reintroduced international travel bans.

For this reason, our view of the S&P500 is similar to the one outlined in last week’s article on the ASX200 here. The Christmas rally has been postponed rather than cancelled.

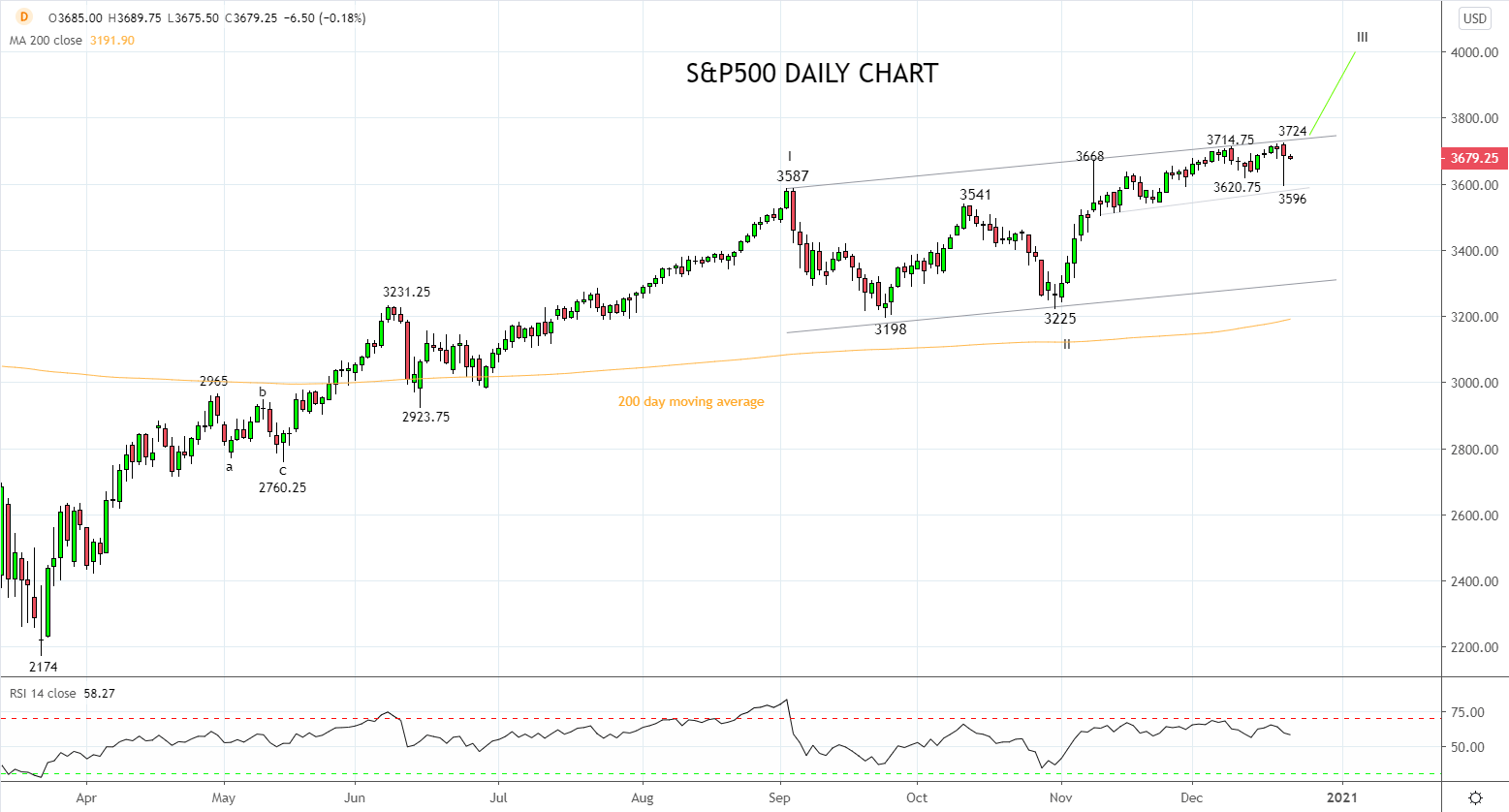

A sustained break/daily close above the top of trend channel resistance currently at 3730ish would be an initial indication the Christmas rally has commenced towards 3800, with scope to 4000.

However, until a sustained break of the trend channel resistance occurs, allow for the current period of consolidation to continue.

Keeping in mind, should the S&P500 break/close below near term support 3600/3570ish it would be an indication a deeper correction is underway and that the 2020 Christmas rally likely been cancelled.

Source Tradingview. The figures stated areas of the 22nd of December 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation