Despite the Feds dovish message of ongoing highly accommodative support that saw the NASDAQ close the session at fresh all-time highs, a far more cautious tone has emerged during the Asian time zone. Risk assets across the board are under pressure including the S&P 500 futures contract, is currently trading at 3154 down -1.00% while the Australian equity market, the ASX200 is down over 3.00%.

When asked by a colleague this morning if the broader risk market rally had finally hit a wall, my reply was I tend to tread warily after FOMC meetings. Often a spike in volatility follows the FOMC meeting as markets digest the implications of the Feds message for individual asset classes and sectors.

An example of this - the Feds forward guidance of 0% interest rates until 2022 does not bode well for bank earnings. This is best illustrated by the share price of the “Big Four” Aussie banks that have fallen harder than the broader market today, trading down between 4% and 6%.

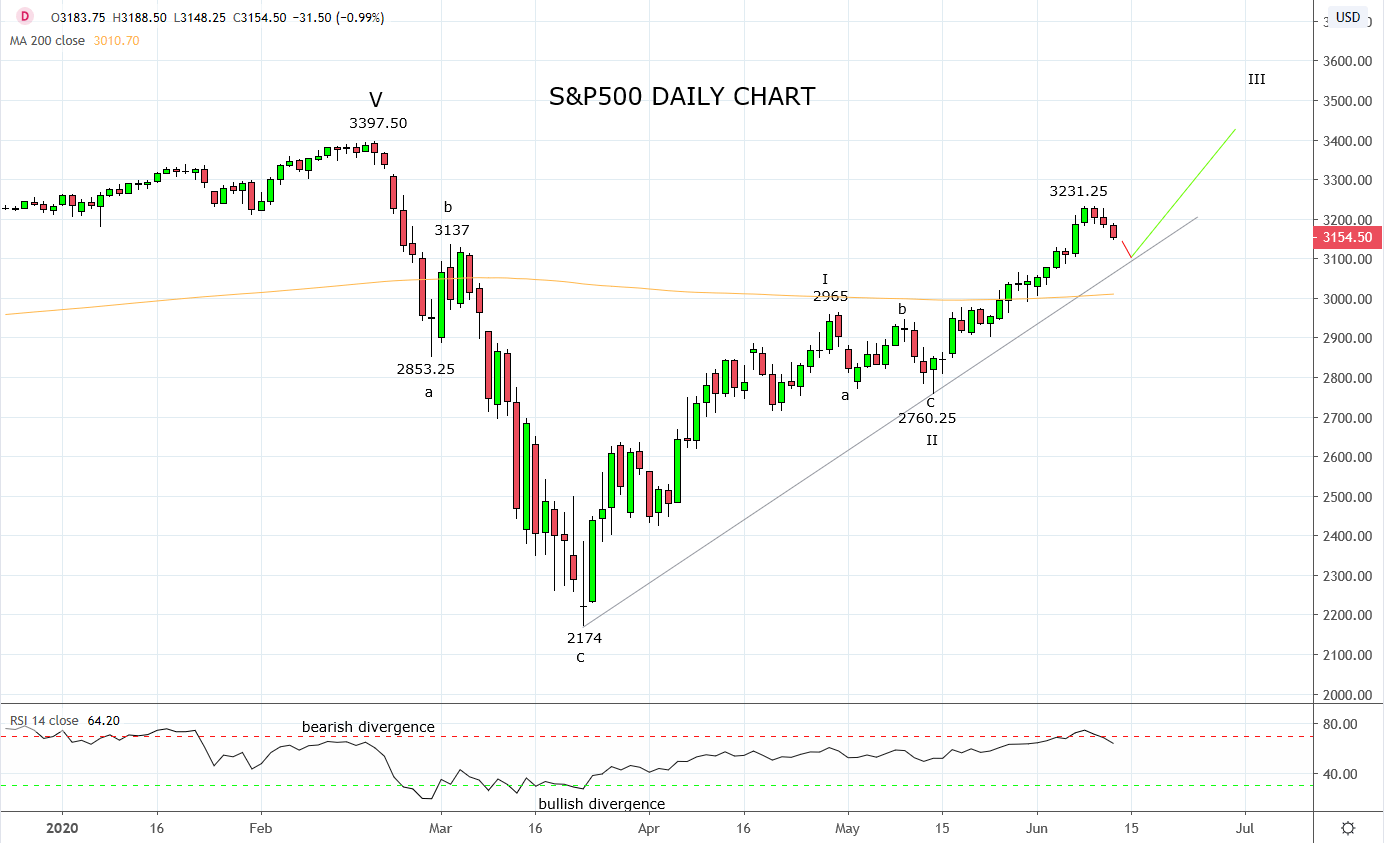

Returning to the subject of the S&P500. After the very strong run higher that followed the break above 3000 highlighted in this article here today’s pullback is viewed as countertrend or part of a correction. It is not viewed as the start of a reversal.

In this context, buyers are expected to emerge on dips initially back towards the March highs, 3130/20 area, before more meaningful support 3070/60 that comes from the trendline from the March 2174 low. In this instance, a clear stop loss on longs would be offered on a daily close below the aforementioned trendline support.

Source Tradingview. The figures stated areas of the 11th of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation