Overshadowing the Feds renewed commitment to ultra-dovish policy, investors remain cautious due to some of the factors listed below.

- Fading hopes that a 4th stimulus package will be agreed before the November 4th U.S. election

- Brexit negotiations in Europe

- A second wave of the virus in Europe

- Uncertainty around the outcome of the U.S. election

- The Federal Reserve is not due to meet again until after the U.S election.

There is also a concern that the significant improvement in economic data that until now has helped power U.S stocks higher, has stalled and begun to decelerate.

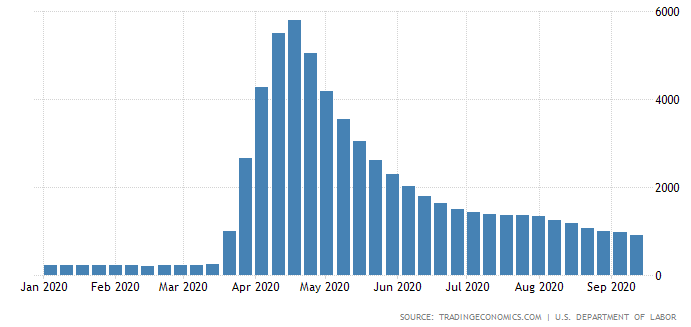

Looking at the chart of the 4 week average of US jobless claims below, it can be observed that after a sharp spike higher in April following the lockdowns, the pace of improvement has noticeably decelerated in August and September.

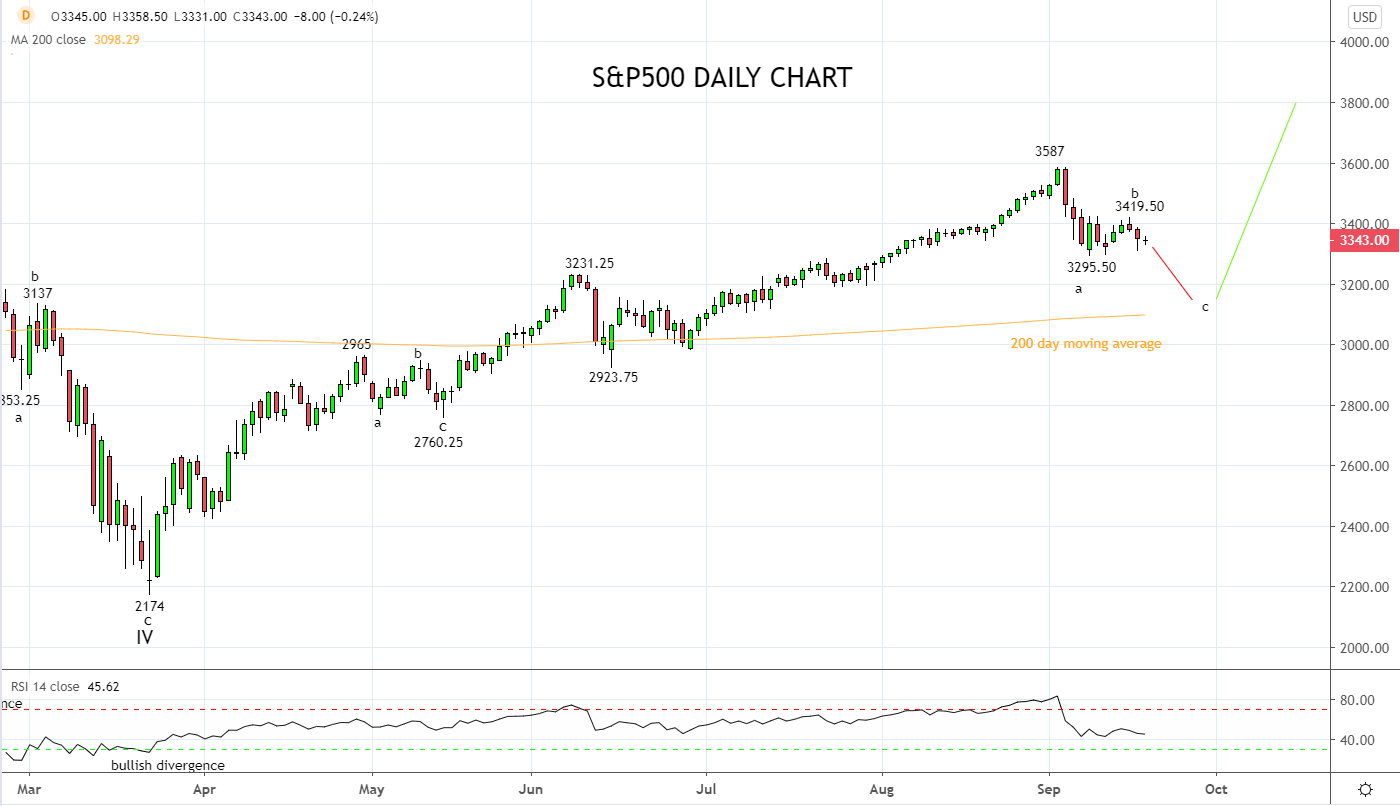

Seasonally, September is a month that usually provides its fair share of speed bumps, particularly after the expiry of U.S. equity indices which occurs tonight.

Research by US investment bank, Morgan Stanley shows that since 1998, E-mini S&P 500 futures have underperformed over the 5 days following the quarterly expiry. After the September expiry, the effect is more pronounced and exhibits a median 5-day return of -1.22%.

All in all, September will likely be the S&P500’s first negative month since it began its 65% rally in late March. The current downdraught is viewed as being part of a corrective pullback, rather than a reversal lower.

A break of short term support 3290/80 will allow the correction to deepen initially towards 3230/00 and then towards the wave equality target at 3128 and the 200-day ma 3100 area.

From the 3128/3100 support area, we will look for signs of stabilisation and for the uptrend to resume.

Source Tradingview. The figures stated areas of the 18th of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation