After some general market chit chat, the conversation turned to a former floor trader who went on to start his own hedge fund. The fund was doing very well until it was caught out in early 2018 after a sharp 12% fall in the S&P500.

For those that don’t remember the exact details of that period, the fall in the S&P500 commenced on the 29th of January 2018, sparked by stronger data, rate hike fears and a technical break higher in US 10 year yields.

Despite a technical break higher in the US 10 year yields earlier this month, as made very clear in this morning’s FOMC meeting, the Fed does not intend to raise rates until inflation exceeds 2% on a sustained basis. Tapering will not be considered until the data improves.

In this context, the catalyst for the overnight fall appears to be that a lot of good news had already been priced into equities, leaving little room for disappointment.

Earnings reports from Apple and Tesla overnight were mixed. While new strains of the virus and squabbling over the export of vaccine supplies from within the European Union risk extending the re-opening date of major economies.

Not to mention speculative mania in some stocks where retail traders have taken large positions with little regard for fundamentals, raising questions over financial stability.

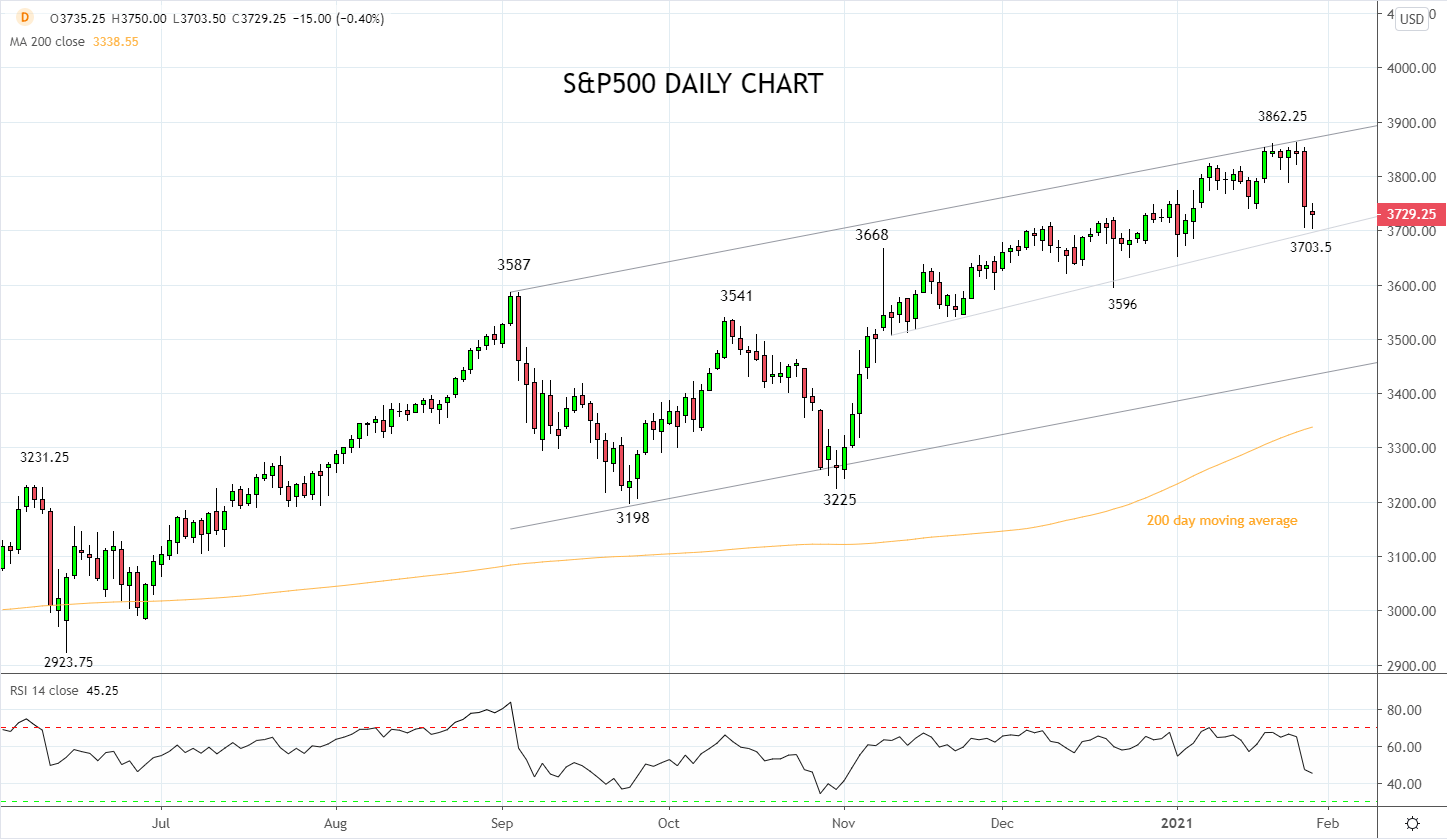

Technically, providing the S&P500 holds above support near 3700ish on a closing basis coming from the two-month old trend channel, the prospects of a quick recovery back towards this week's all-time high at 3862.50 looks reasonable.

Learn more about trading indices

However, should the S&P500 see a sustained break below 3700ish the risk is for a deeper unwind back towards 3450/30ish, medium term support from the wider trend channel that commenced in early September.

Source Tradingview. The figures stated areas of the 28th of January 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation