A rough start to the week for global equities as they responded to the news over the weekend that despite China’s best efforts to contain, there had been a worrying increase in Covid-19 cases outside of China.

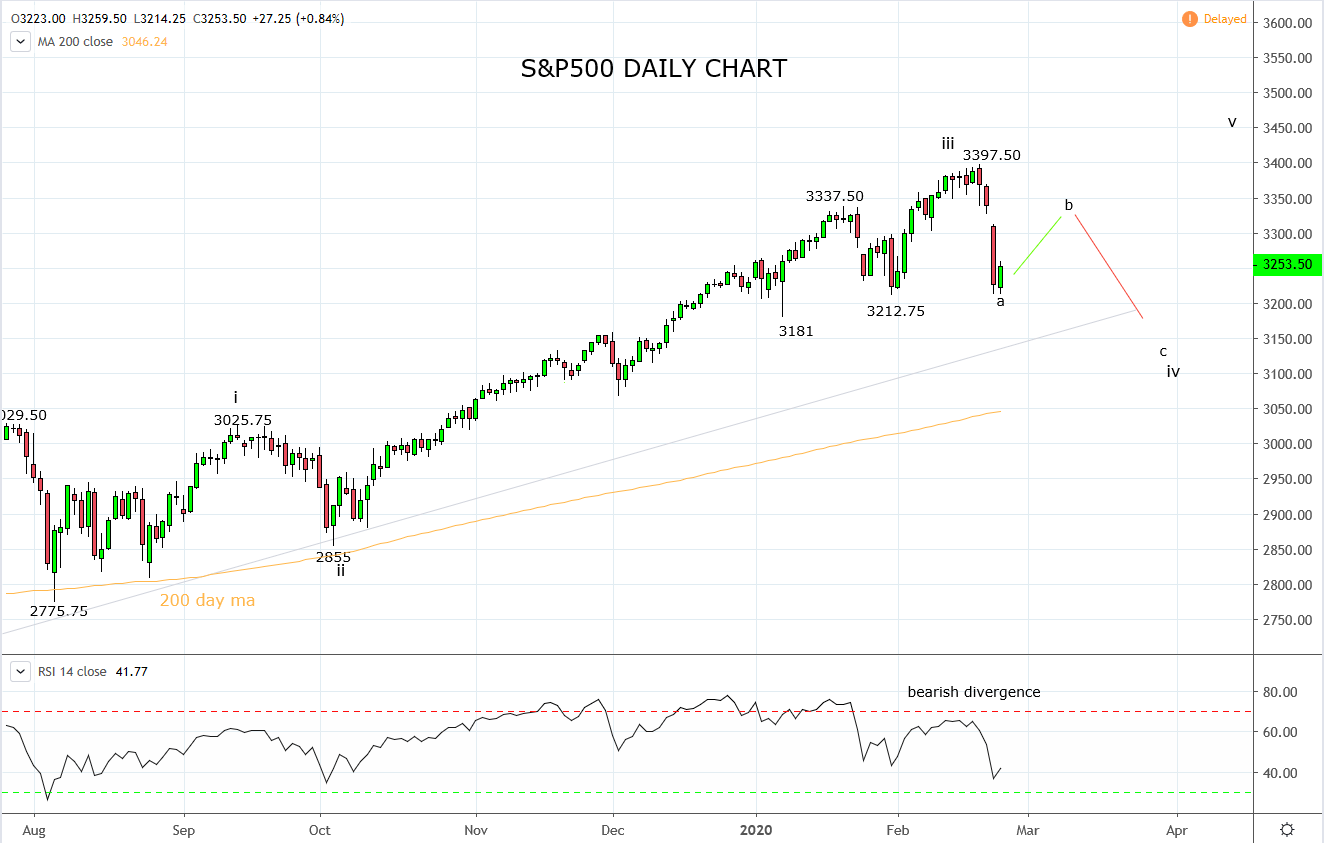

By the end of the session, the S&P 500 had erased the final remnants of its +5% year to date gains. And in the process, it answered the question we posed last Friday as to whether the S&P 500 could hold above the key 3330 support level to steady nervous markets.

In our recent articles and videos, we have alluded to the risks of a pullback in equities. Although given where markets were as news of the virus spread, it wasn’t a particularly brave call. Returning to Friday's article on the S&P 500 for a moment we said

“a break and close below 3330 would signal a retracement back to 3200 was underway.”

Similar to the USDPY move last week, the S&P 500 all but reached our 3200 target in super quick time and meeting our minimum objective. The tricky part for traders is what comes next? Specifically, should the dip be bought in anticipation of the uptrend returning or should bounces be sold?

As pointed out by the excellent Charlie Bilello on Twitter, the correction over the past few days is the S&P 500’s 26th fall of 5% or greater since the GFC March 2009 low, before the uptrend has resumed. The dispersion of the falls is varied, while most have been between 5% and 10% there have been two greater than +20%. Hence there are risks in assuming the current decline is over.

In the short term, I would expect sellers to emerge and cap rallies on bounces towards the breakdown level 3300/3320.

In the medium term, I will be closely watching the band of support between 3210 and 3180 for signs that the S&P 500 is attempting to put in a place a base. Keeping in mind, should the S&P 500 break/close much below 3180 it would open the way for the decline to extend towards the 200 day moving average 3070/3050 area.

Source Tradingview. The figures stated areas of the 25th of February 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation