Just eight days later, the dovish hit the market was craving was delivered by Fed Chair Powell at the Jackson Hole Symposium. The Chairs speech confirmed that while the Fed remained of the view that the benefits of YCC implementation in the current environment were limited and costly, the Fed would formally adopt an Average Inflation Targeting (AIT) framework.

Essentially an AIT framework allows the Fed to keep rates at zero for a longer period and without having to raise rates to counter the re-emergence of inflation. There had been some speculation that the Fed would adopt this framework and the actual confirmation now has the S&P500 eyeing a remarkable 8% gain for August.

Elsewhere, the Feds tolerance towards higher inflation prompted a rally in both U.S 10-year nominal and real yields, although the moves were not significant enough to disrupt the low yield regime in which markets currently thrive. Should U.S 10 year nominal yields break above technical resistance at 0.80%, it might be another story and something to keep an eye on.

Until then, the S&P500 appears well placed to benefit from the latest instalment of accommodative central bank policy, the effects of which are likely to last until a few weeks before the U.S. election.

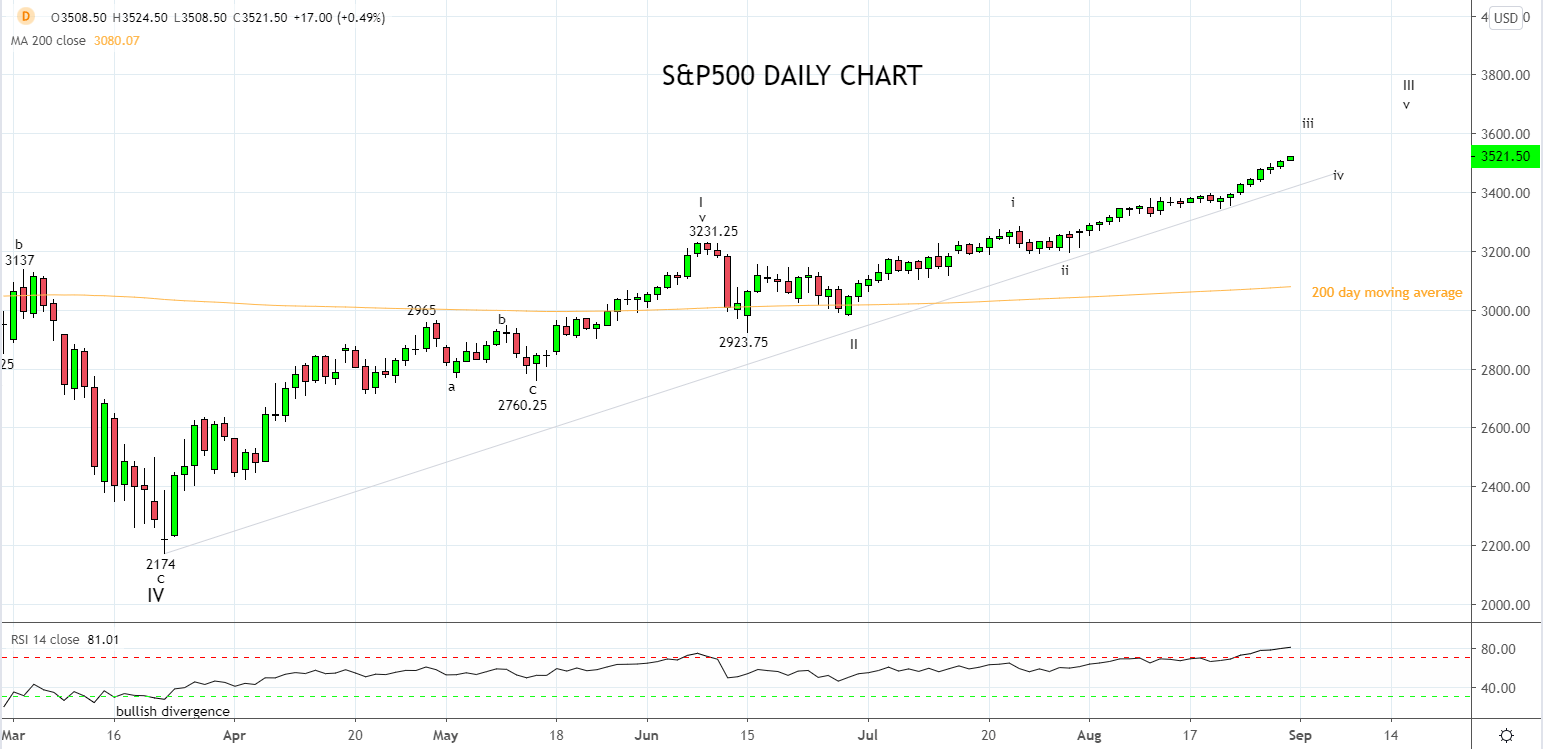

Technically, last week's acceleration higher was a positive development and opens the way for the rally to extend above 3600. The preference is to buy dips towards the short term support 3420/00 area that comes from the February high and the uptrend support from the March 2174 low. Keeping in mind, a sustained break below 3490/80 would suggest a deeper pullback is underway towards 3300.

Source Tradingview. The figures stated areas of the 31st of August 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation