“We are going to see economic data for the second quarter worse than anything seen.”

Lots of takeaways from the overnight session for traders in Asia to mull over today, including the beauty above from Federal Reserve Chairman Jerome Powell following this morning’s FOMC meeting.

Despite this, U.S. stock markets surged higher, partly boosted by “hope” that a COVID-19 vaccine might be available before yearend and partly by a commitment from the FOMC to use its “full range of tools” to support the recovery.

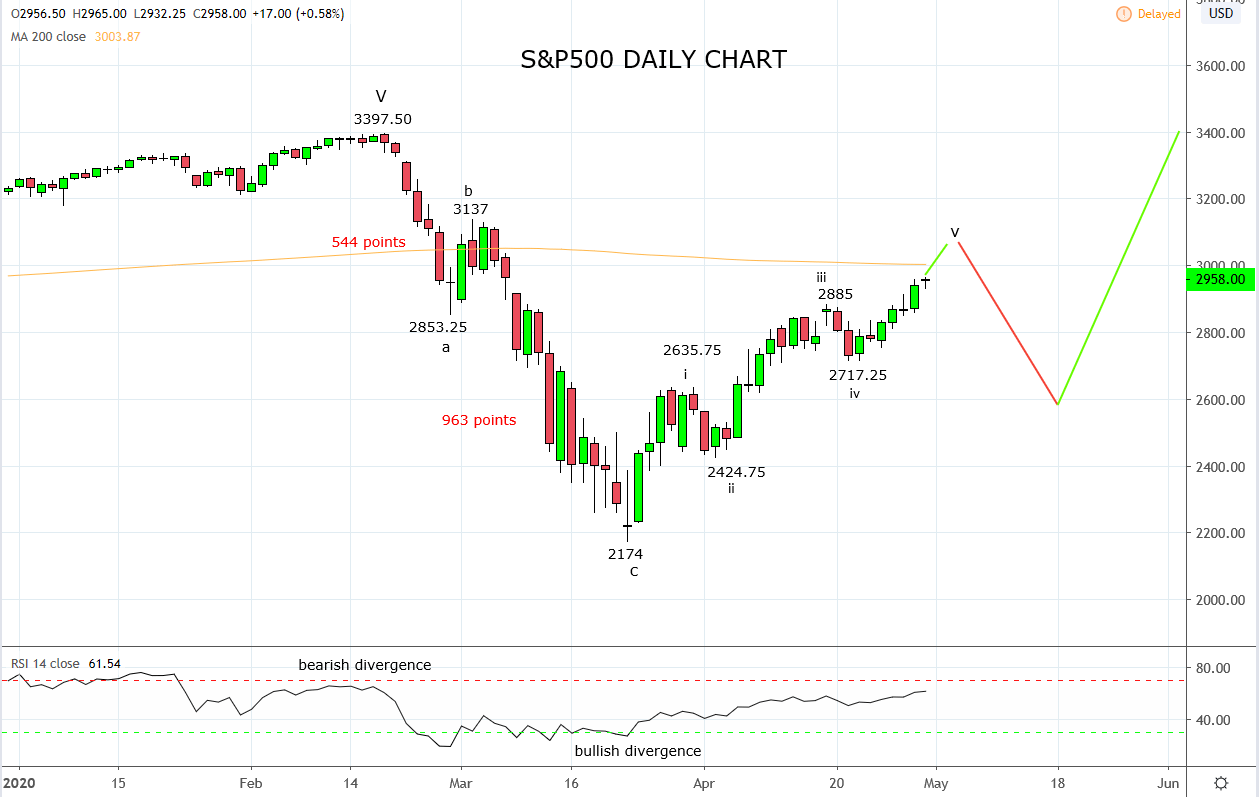

As regular readers might recall, we moved from a positive bias in the S&P500 to a more neutral bias in an update 10 days ago here when the S&P500 was trading just below the wave equality target near to 2886.

“Given the “easy” part of the S&P500s recovery is now behind us we take this opportunity to move to a more neutral stance.”

This was to allow more time for the price action to develop and to assist in answering the most important question in markets right now - have equities entered a new bull market or are they in the midst of a bear market rally?

The overnight rally in the S&P500 goes a long way to answering this question within an Elliott Wave framework which attempts to provide a longer-term perspective of the entire market cycle. The key to this is whether a market is trending (five waves) or counter-trend (three waves).

As the chart below illustrates the rally from the March 23rd, 2174 low has now unfolded in a clear five wave following a three wave decline from the 3397.50 high to the 2174 low. The appearance of a five wave movement after a three wave decline suggests the medium-term uptrend has returned.

Keep in mind that after this five wave rally is completed, a pullback is likely before the uptrend resumes. In this context, our preference in coming weeks is to buy countertrend/corrective pullbacks, looking for a retest and break of year to date highs.

Source Tradingview. The figures stated areas of the 30th of April 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation