Trade deal optimism lifted the FTSE along with other European bourses on Friday, even after Trump’s trade tariff increases came into effect and China vowed to retaliate.

Whilst stocks in Europe rebounded, snapping a four-day losing streak, traders on Wall Street saw the glass half empty, sending stocks lower for a fifth consecutive session.

The markets have been relaxed about the trade war over the last few months. The S&P and the Nasdaq hit record highs within the last month, in part owing to the assumption that a US – Chinese trade deal was just around the corner. Over the past few days, serious cracks have appeared in that theory. Traders are pricing in the increasingly real possibility that the trade dispute will become a long-term risk factor with a potentially severe impact on global growth.

Whilst we are not seeing investors sell out of US stocks with the same vigor, as earlier in the week, investors are clearly nervous as to how these tariffs will impact on the US economy. The bottom line is that traders believe that the US – Sino trade dispute will eventually end in a deal, but not before both sides feel some economic pain.

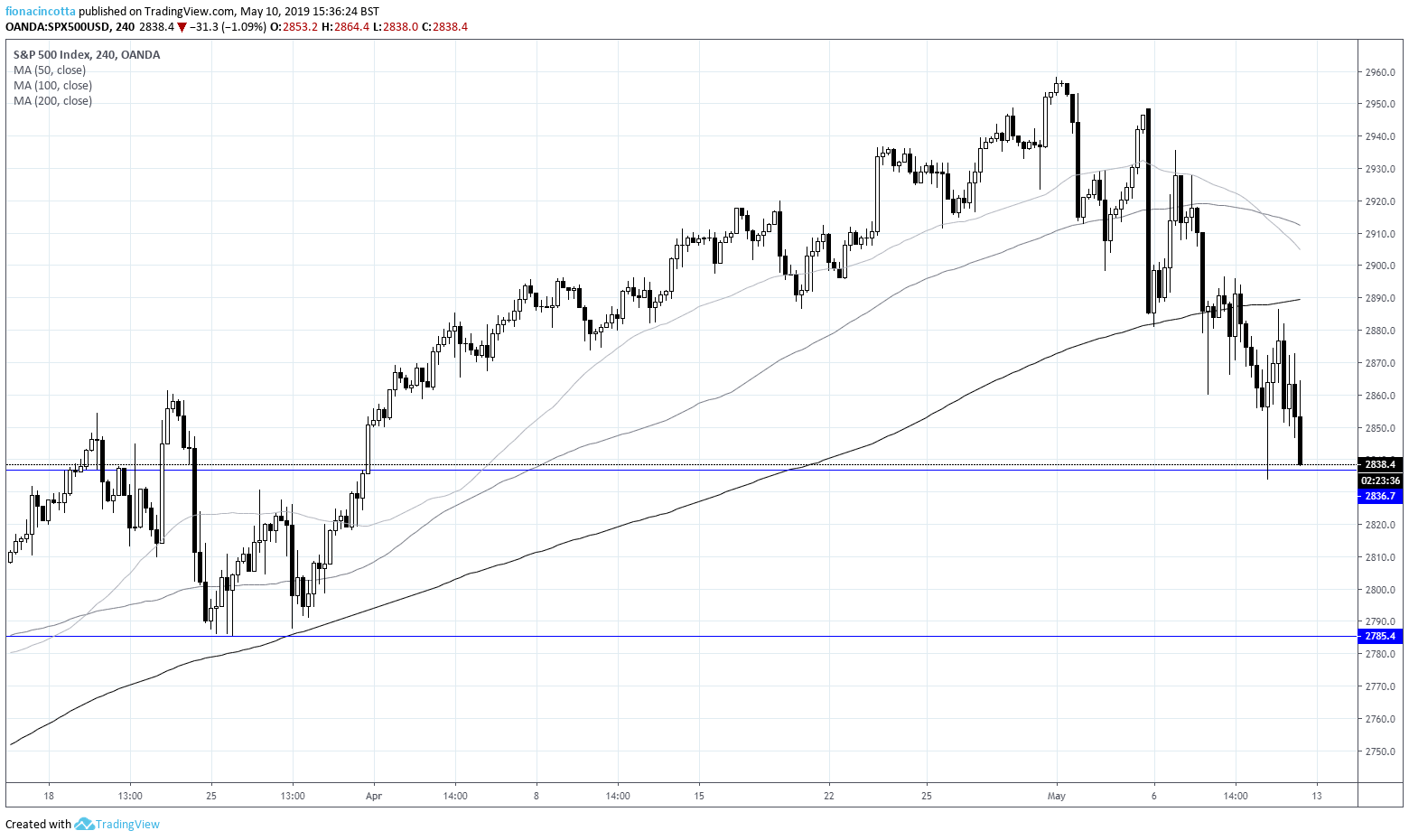

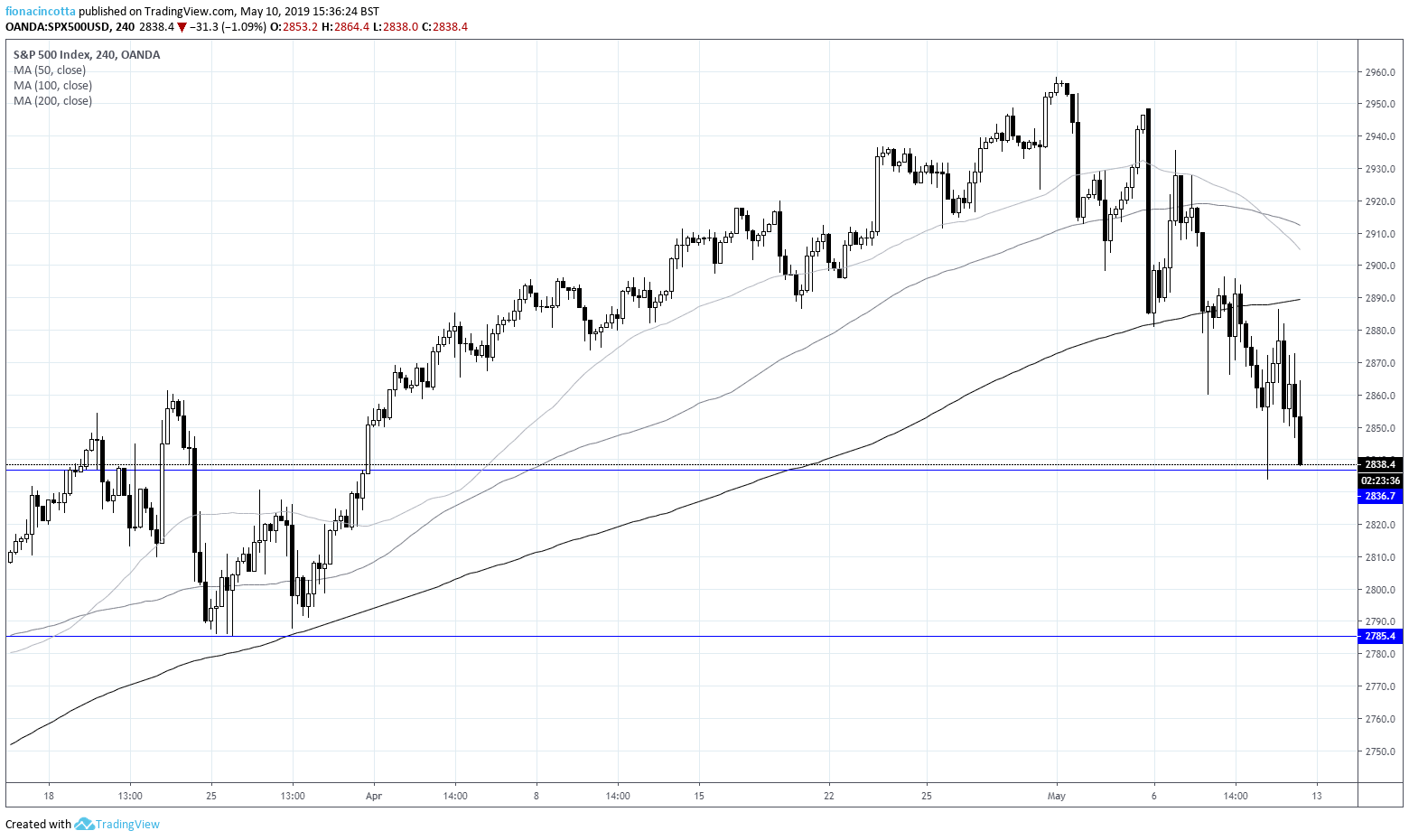

Will 2836 hold?

The S&P is trading down 0.8% at 2845. A drop below yesterday’s low of 2836 will greatly increase the chances of 2775 being reached, or worse. On the other hand, should we see the S&P hold above 2836, the market could turn natural or even bullish.

Latest market news

Today 08:15 AM