In our last update on the S&P 500 on October 22nd, we noted that while October had proved to be an eventful month for currency and bond markets, the key U.S. equity index, the S&P 500 had remained strangely becalmed.

The oddity of this event was more pronounced because the selloff in the U.S. dollar and an easing in macro tail risks was in theory supportive of U.S. stocks. We went on to write that should the S&P 500 break/close above the 3020/3030 resistance area, it would signal the uptrend had resumed.

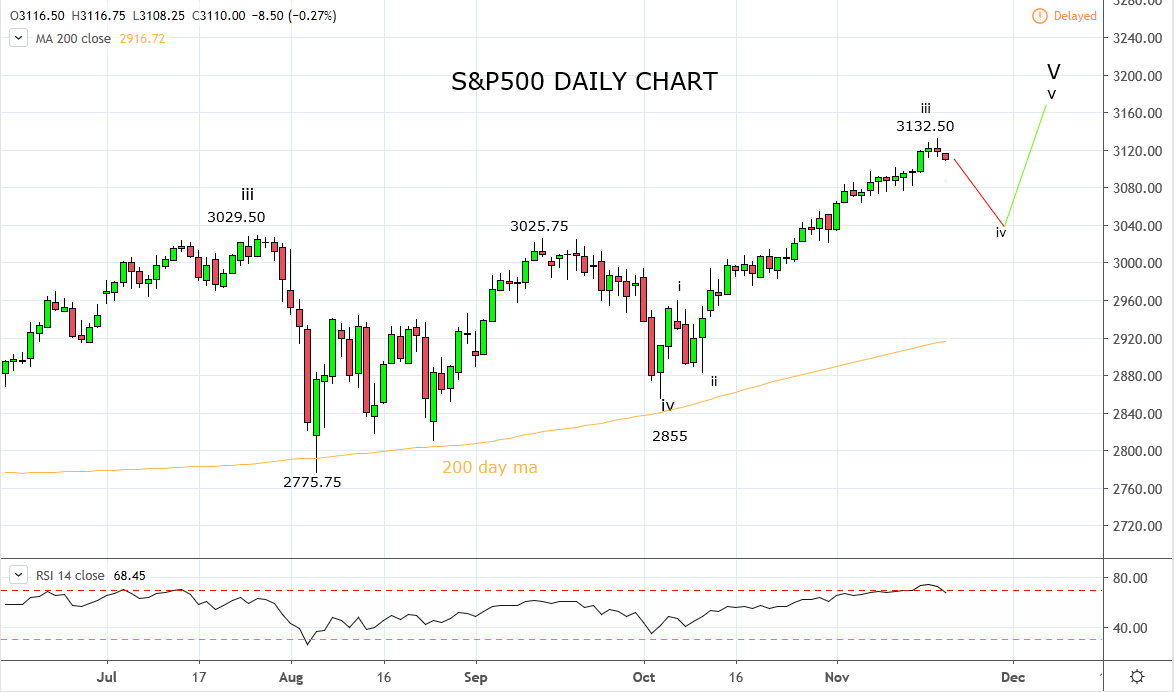

Here we are almost one month later with the S&P 500 almost 120 points or 4% higher. However, while the rally has been impressive, the risks of a corrective pullback appear to be rising.

As discussed in yesterday’s note on gold, U.S.- China trade negotiations appear to have reached a stalemate. President Trump telling reporters overnight that China “is going to have to make a deal that [he] like[s], if they don’t that’s it.”. This was followed shortly after by the U.S vice president linking trade negotiations to events in Hong Kong and the U.S. Senate passing a bill to support protestors in Hong Kong.

Sentiment wise, the Daily Sentiment Index (a survey of futures traders' sentiment) for both the S&P 500 and Nasdaq show that about 90% of traders are bullish. When the DSI rises to the 85% area or higher, the odds of a top increase.

From a technical perspective, the RSI indicator reached overbought territory earlier this week and overnight a bearish Doji candle formed that often warns of reversals/pullbacks. This combination suggests that a Wave iv pullback is close by.

Providing the Wave iv pullback holds above the October breakout level and now key support 3030/3020 area, it would be viewed as a buying opportunity in anticipation of the S&P 500 commencing a Wave v rally into year-end, towards 3200.