In last week’s article titled “Headwinds increasing” we noted that the most recent leg higher in the S&P 500 had been aided by a patch of stronger than expected economic data in early April, including better than expected PMI data in both the U.S. and China.

This week, we have seen a reverse of that pattern, starting with China on Tuesday. Both the NBS and Caixin manufacturing PMI disappointed relative to expectations. Then overnight, the U.S. ISM manufacturing data also disappointed, falling 2.5pts to 52.4, its lowest reading since October 2016.

Based on respondents comments the driver behind the fall in ISM was the result of President Trumps threat to close the southern border if action isn’t taken to halt illegal immigration. While it would be fair to say the drop in the ISM may not directly be related to a sudden deterioration in economic fundaments, investor confidence can be a fragile commodity and supply chains once broken can take a long time to mend.

Finally, to this morning’s FOMC meeting, the outcome of which was mostly as expected. However, in the press conference that followed, Governor Powell repeatedly referenced the “transient” nature of low inflation. With the market’s hopes of an easing bias dented, sellers were quick to move in on the S&P 500 which finished -1.30% lower on the day.

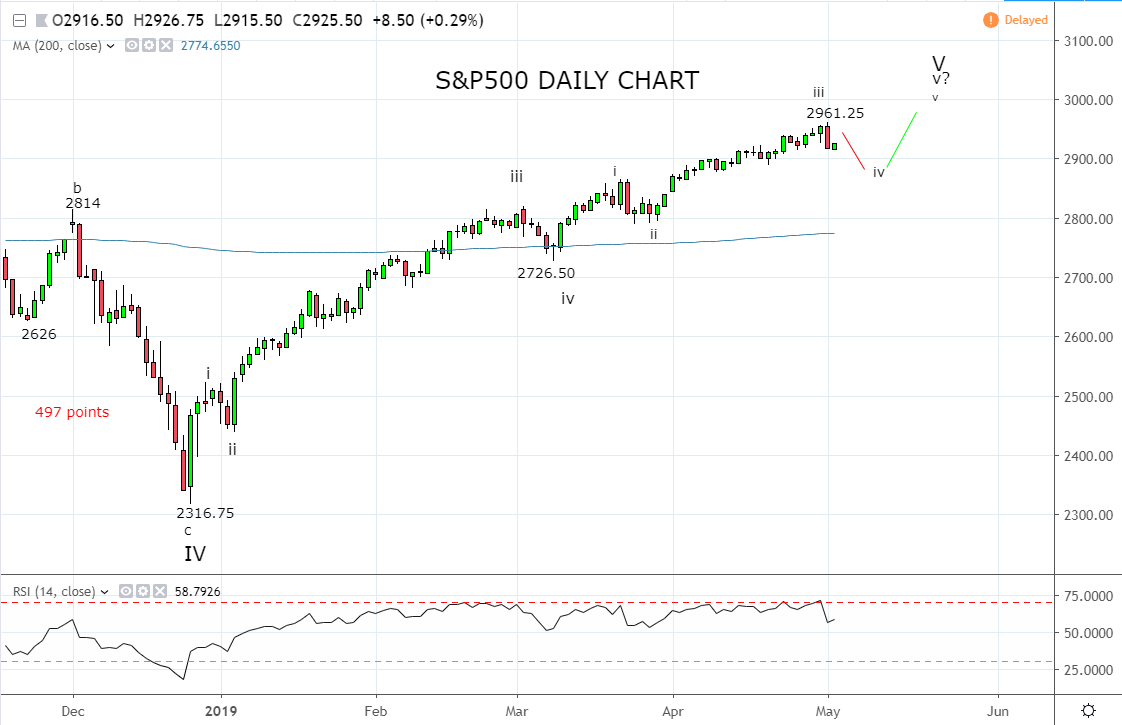

The price action has left a rather ugly bearish engulfing candle on the daily chart, the type often viewed before meaningful turns. However, further evidence is required to confirm this is the start of a more significant pullback.

In the first instance, I would need to see a break and close below near-term support 2910, followed by a break and close below interim support 2865/55 support. Should this occur, it would project a move back to the 200-day moving average at 2770. A break/close below 2865/55 would also rule out the possibility that the current pullback is a minor Wave iv retracement, before a final push towards 3000 to complete Wave v of V.

In summary, while the combination of factors outlined above suggests headwinds to the S&P 500’s rally have increased, we remain cautious and will focus on the key support levels highlighted above.

Source Tradingview. The figures stated are as of the 2nd of May 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.