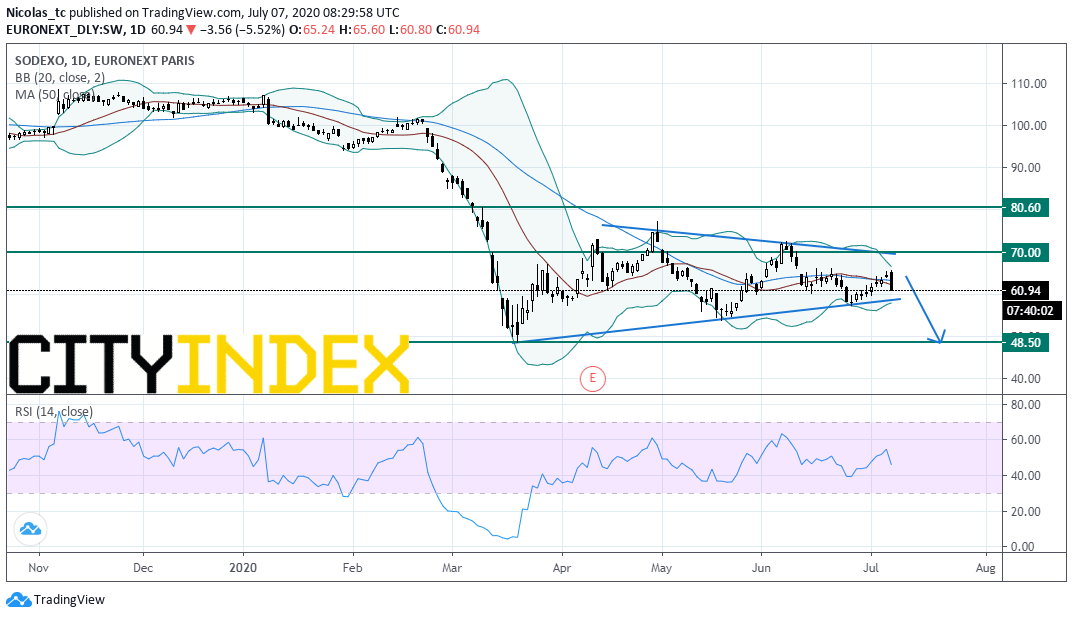

Sodexo under pressure – Symmetrical triangle pattern taking shape

Sodexo, a food services and facilities management company, reported that 3Q revenue dropped 31.2% on year to 3.91 billion euros (-29.9% organic growth). The company added: "We expect Q4 revenues to be down circa -27%, vs our original hypotheses in April of -15%. As a result, the 2nd semester decline is now expected to be -28%, or around 3 billion euro and -13.7% for the Full year."

From a chartist’s point of view, the stock price is oscillating within a symmetrical triangle pattern in place since April 2020. A break below the lower boundary of the pattern currently at 58E would trigger a bearish acceleration towards 48.5E. Alternatively, a break above 70E would call for a reversal up trend.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM