So you want to trade the DXY?: EUR/USD, USD/CHF

The US Dollar Index (DXY) is a measure of the value of the US Dollar relative to a basket of foreign currencies. The current breakdown of the DXY is as follows:

- EUR 54.6%

- JPY 13.6%

- GBP 11.9%

- CAD 9.1%

- SEK 5.2%

- CHF 3.6%

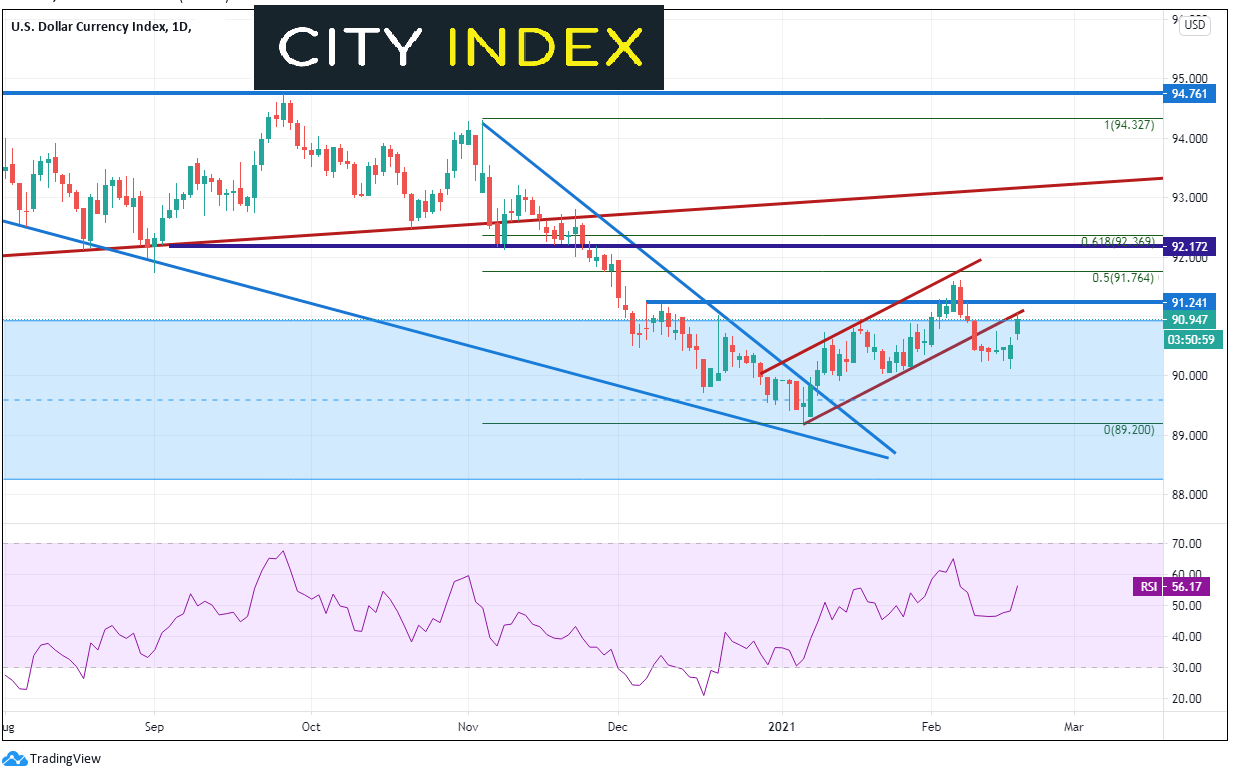

Below is a daily chart of DXY:

Source: Tradingview, City Index

Since the US economic data on Wednesday, the DXY is trying to push higher through trendline resistance. Some people may want to take advantage of trading the DXY, but don’t have access to it, because it is a not a currency “pair”. It is a currency index.

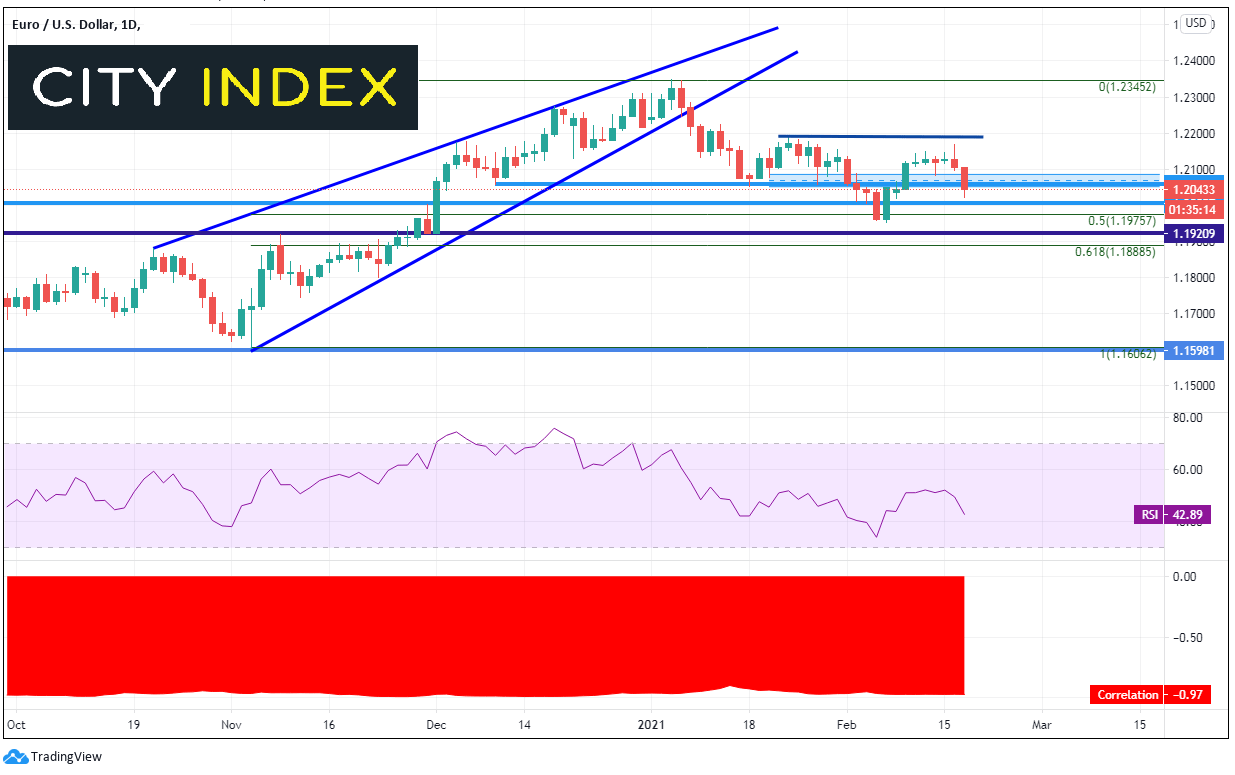

Since Euro makes up over half of the US Dollar index, one can trade the EUR/USD to take advantage of the DXY moves. Typically, EUR/USD and DXY move inversely to each other. That is, when one instrument moves higher, the other moves lower, and vis a versa. Notice, at the bottom of the EUR/USD daily chart below, that the correlation coefficient between EUR/USD and the DXY is currently -0.97. For reference, a reading of -1.00 would mean the 2 assets are perfectly, negatively correlated. -0.97 is pretty close! Therefore, if one believes DXY may go higher, that person may wish to consider selling EUR/USD as a proxy for the DXY. (See our current EUR/USD analysis here.)

Source: Tradingview, City Index

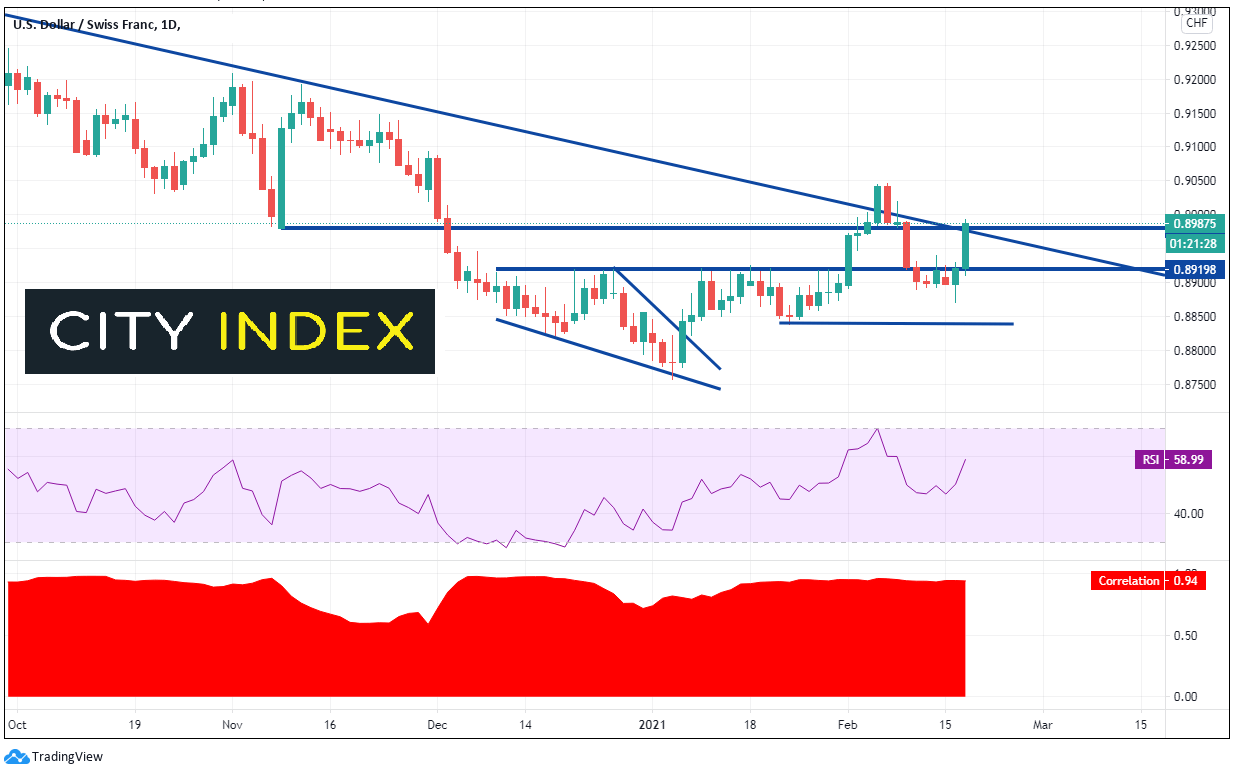

Another way to take trade the DXY , which is perhaps less obvious, is via the USD/CHF. The Swiss Franc only makes up 3.6% of the DXY, so why would this be a good proxy to use? The bottom of the USD/CHF chart below shows that the correlation coefficient between USD/CHF and DXY is +0.94. For reference, a reading of +1.00 would mean the 2 assets are perfectly, positively correlated. +0.94 is pretty close! Therefore, if one believes DXY may go higher, that person may wish to consider buying USD/CHF as a proxy for DXY.

Source: Tradingview, City Index

Notice how on all three charts above, price tried to breakout on February 4th, only to reverse on February 5th and trade back into the range. In addition, notice how all three assets recently tested support/resistance on February 16th, only to reverse and trade higher/lower on February 17th. The February 4th/5th resistance/support levels will be key for the US Dollar to move higher.

Word of caution: Use proper risk/reward when trading these instruments. If one is short EUR/USD and long USD/CHF, that person is long 2 times the amount of US Dollars.

Learn more about forex trading opportunities