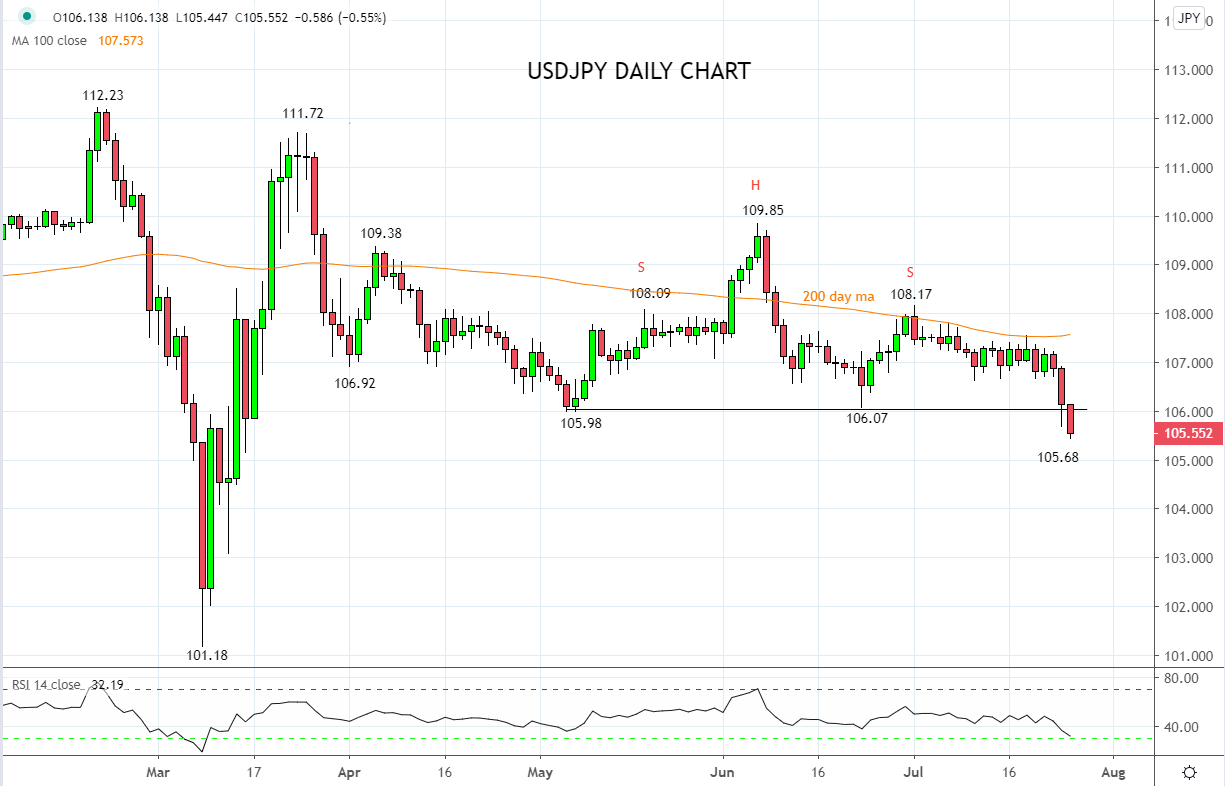

When looking for a guide as to how sustainable the break below 106.00 is, there was some reservation surrounding Fridays sell-off, as it occurred on a Japanese public holiday. Today’s sell-off goes a long way to confirming Fridays move lower was not just a result of public holiday reduced liquidity.

There is a temptation to play down the significance of last week’s closure of respective U.S and Chinese embassies as Russia and the U.S have done similar to each other in recent years without any obvious consequences. The assumption is that the U.S and China can also perfect this diplomatic dance. However, with the U.S. Presidential election entering a more critical phase and the dance rhythm like to intensify, there is a risk of miscalculation.

The strongest thematic in the currency space lately has been the selling of U.S dollars. Despite this until last Friday USDJPY remained unmoved, politely trading between 107.60 and 106.60. The JPY is now playing some catchup to other currencies, its credentials furthered bolstered by its safe-haven qualities.

In terms of positioning, the latest IMM report shows that while the market has been content to build a long EUR position of near 16bn, the market is only modestly long the JPY. This also suggests there is room for the JPY to continue to play catchup.

Technically, the break below 106.00 if confirmed on a daily closing basis, arguably confirms a head and shoulders topping pattern that sets USDJPY up for a move lower towards medium-term support 104.50ish and possibly as low as 102.00.

Bounces back towards resistance near 106.00/20 are likely to find sellers and this looks to be a good level to open shorts in USDJPY. To negate the downside risks, it would take a break back above the resistance at 106.60 coming from previous lows but more importantly above the 200-day moving average 107.50 area.

Source Tradingview. The figures stated areas of the 27th of July 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation