The second most anticipated stock market debut of the summer is going far better than the first, so far.

The enterprise chat platform that aims to overthrow email culture has surged on its New York Stock Exchange debut. Its choice of a direct-listing route to public markets, as opposed to a conventional IPO, hasn’t hurt

Slack Technologies Inc. at least has the look of a successfully launched stock. In line with direct-listing practice, investors were offered a ‘reference price’ on Thursday morning, U.S. time, of $26 a share. A couple hours into trade the stock launched with a huge 48% leap to $38.50. It went on to extend the pop to as much as $42 or 61.5% above the reference price. Just ahead of publishing Slack retained most gains, hovering around $39.

Compare this with Uber, which has still not sustainably regained its initial price of $45, six weeks after the taxi app’s IPO. It is clear Slack has done better relative to expectations. Again, unlike Uber, the messenger app’s new market valuation of almost $20bn compares favourably with the valuation implied by its last private funding round, around $7bn. Private valuations are hardly scientific. But if Slack closes with a higher valuation, that will do sentiment on the stock no harm.

Defining how it’s achieved this isn’t easy. It helps that Slack was flashing positive signals by the mere choice of a direct offering. Companies that sell shares direct to investors don’t necessarily raise equity capital as no new shares are issued. The tacit message is that Slack doesn’t actually need the money. With around $800m in cash on the books, there’s something to that view. CEO Stewart Butterfield has acknowledged that the listing will offer more financial flexibility. Even so, cash burn of some $100m in the prior financial year looks manageable.

So for now, the proof in Slack’s pudding is more about the viability of its central proposition rather than whether it can survive financially.

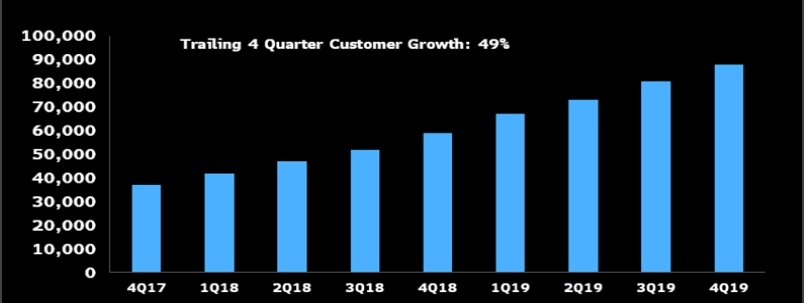

That’s no small luxury for a unicorn. But after ramping revenues by over 300% between 2017 and its last financial year, further growth isn’t a given. From $454m, investors see sales at $600m in 2019/20 and $827m in 2020/21. Sustainable profitability looks to be around the $1bn mark. The pace of enterprise adoption continues to look promising for that goal, though Microsoft, Slack’s main competitor with its Teams product; could yet slow the smaller company’s current customer growth rate of around 50%.

Slack’s trailing four-quarter customer growth - Q4 2017 to Q4 2019

Source: Bloomberg Intelligence

Still, all the signs suggest that there is room for at least two competitors in the email replacement market. At the very least, Slack will simply need to maintain strong financial discipline for a shot at taking a share. As for the stock, given that Thursday’s benign market conditions almost certainly played a part in its strong debut, the watch will be on to see whether volatility buffets the shares in coming days. The ratio of Slack equity plus debt over sales is now 34 times, a massive bump over the median of close peers—around 6 times. The big gap is sure tempt sellers in the near term.