SJM Holdings: Focus On Breakout Signal

SJM Holdings (880), a casino operator, announced that it swung to a 1Q net loss of 409 million Hong Kong dollars from a net profit of 850 million Hong Kong dollars in the prior-year period. Adjusted EBITDA loss totaled 200 million Hong Kong dollars, compared with an EBITDA of 1.08 billion Hong Kong dollars last year, on net revenue of 3.48 billion Hong Kong dollars, down 59.8%.

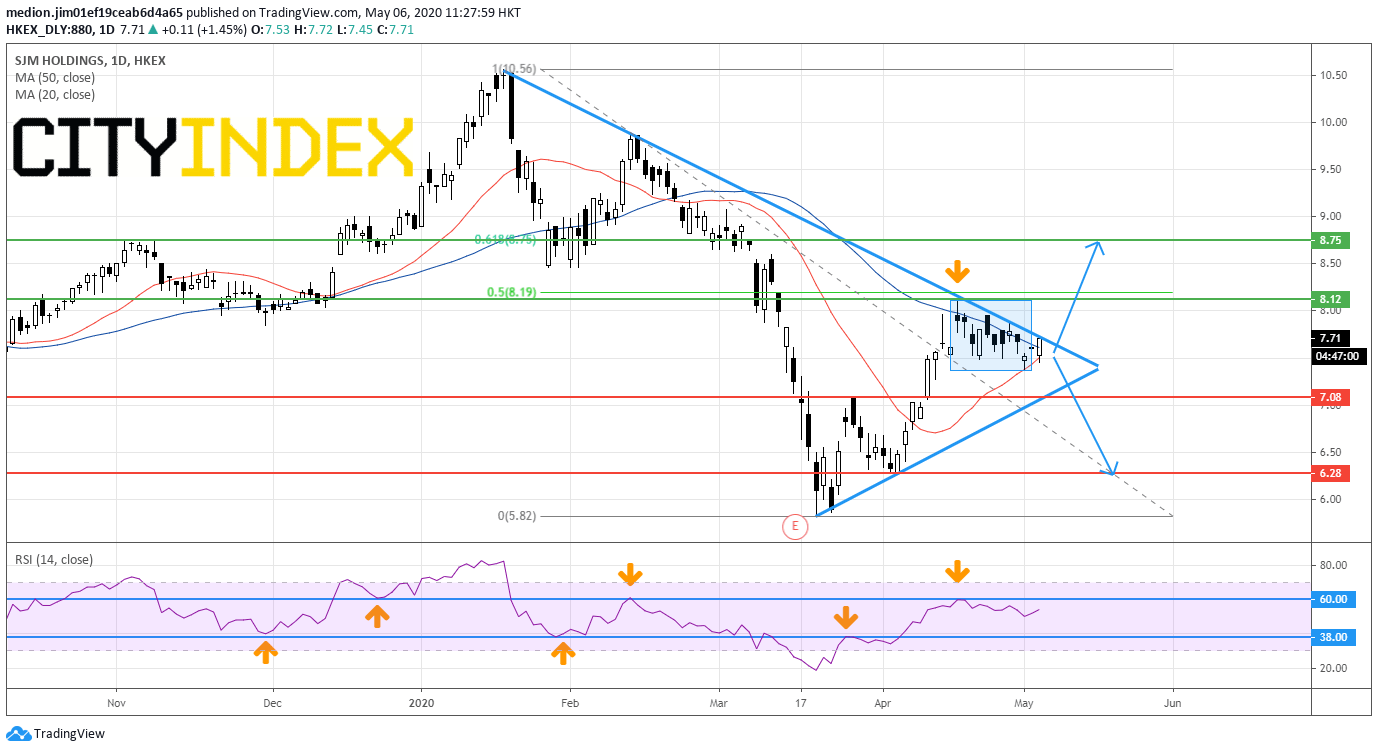

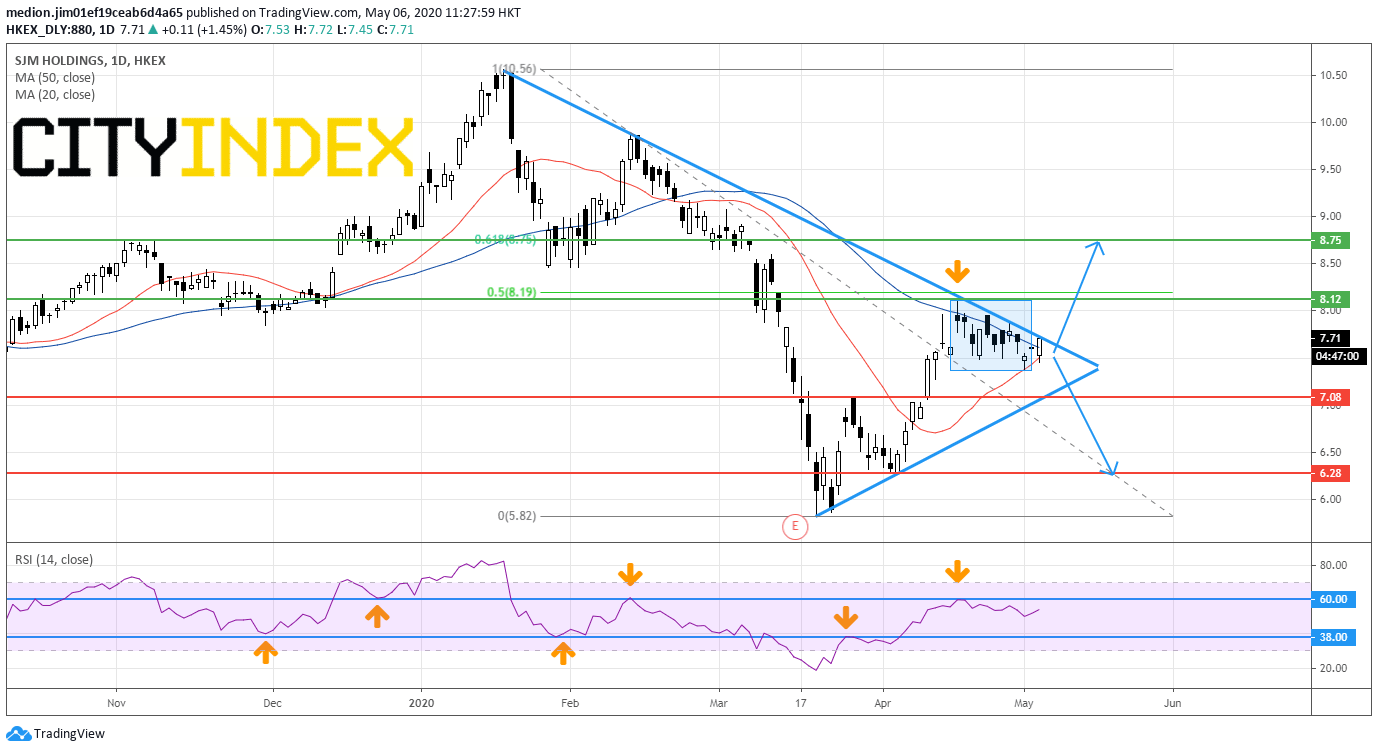

From a technical point of view, the stock retreated after touching the declining trend line on a daily chart. However, the stock does not drop dramatically and forms a consolidation zone. In addition, a rising trend line has created from March bottom. The 20-day moving average is also turning up and acting as support. The RSI is ranging within the overlap zone between 38 and 60. Those technical indicators suggest the lack of momentum for the prices.

Therefore, readers should focus on the breakout signal as the converging zone drawn by the rising trend line and declining trend line is becoming narrow. We would expect an acceleration signal when one of the trend lines is broken.

A break above the declining trend line could consider a further rise to the resistance levels at $8.12 (the previous high and around the 50% retracement level) and $8.75 (61.8% retracement). On the other hand, a break below the rising trend line could bring a return to the support levels at $7.08 (old top on March 26) and $6.28 (previous bottom on April 2) respectively.

Sources: GAIN Capital, TradingView

From a technical point of view, the stock retreated after touching the declining trend line on a daily chart. However, the stock does not drop dramatically and forms a consolidation zone. In addition, a rising trend line has created from March bottom. The 20-day moving average is also turning up and acting as support. The RSI is ranging within the overlap zone between 38 and 60. Those technical indicators suggest the lack of momentum for the prices.

Therefore, readers should focus on the breakout signal as the converging zone drawn by the rising trend line and declining trend line is becoming narrow. We would expect an acceleration signal when one of the trend lines is broken.

A break above the declining trend line could consider a further rise to the resistance levels at $8.12 (the previous high and around the 50% retracement level) and $8.75 (61.8% retracement). On the other hand, a break below the rising trend line could bring a return to the support levels at $7.08 (old top on March 26) and $6.28 (previous bottom on April 2) respectively.

Sources: GAIN Capital, TradingView

Latest market news

Today 08:18 AM

Yesterday 10:40 PM