Sino Biopharmaceutical (1177.HK) Challenges Multi-Months High After Posting 1Q Result

Sino Biopharmaceutical (1177), a drug maker, announced that 1Q net income grew 0.6% on year to 862 million yuan on revenue of 6.22 billion yuan, up 0.2%. The company declared a quarterly dividend of 0.02 Hong Kong dollar per share.

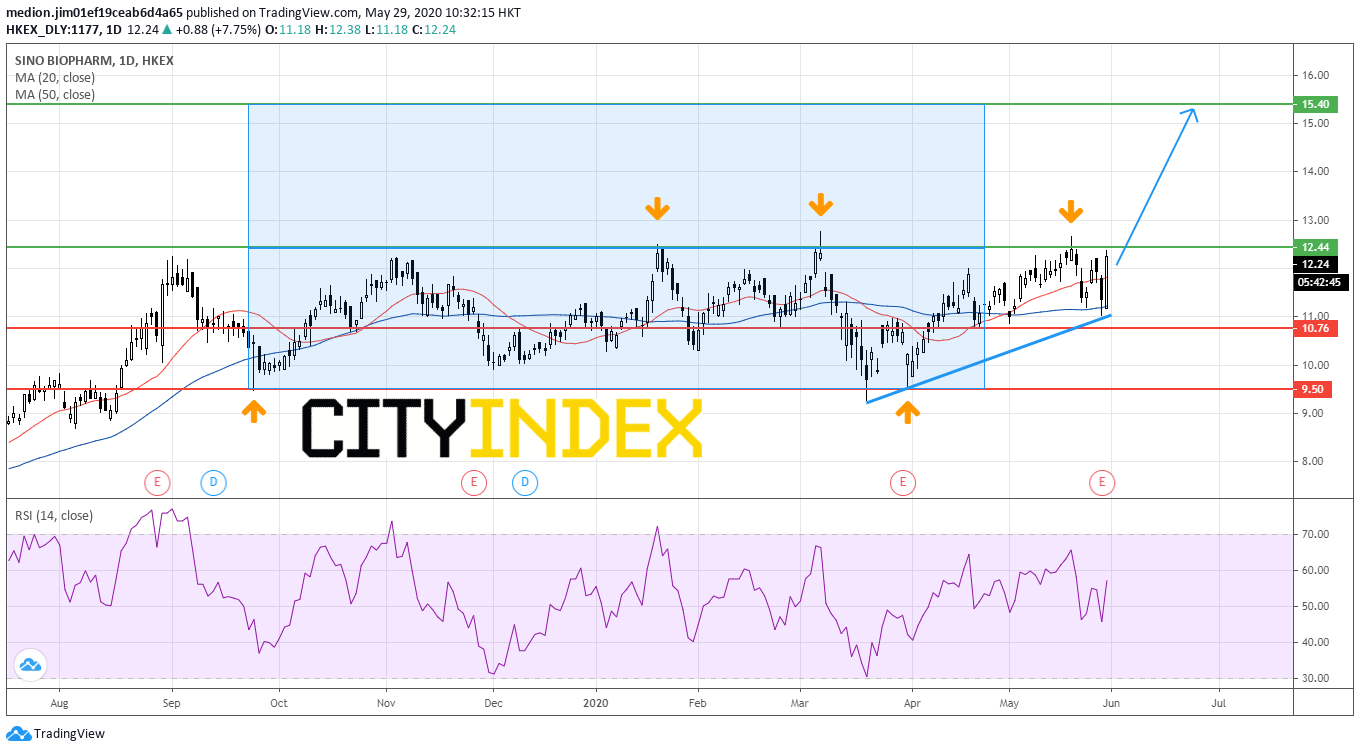

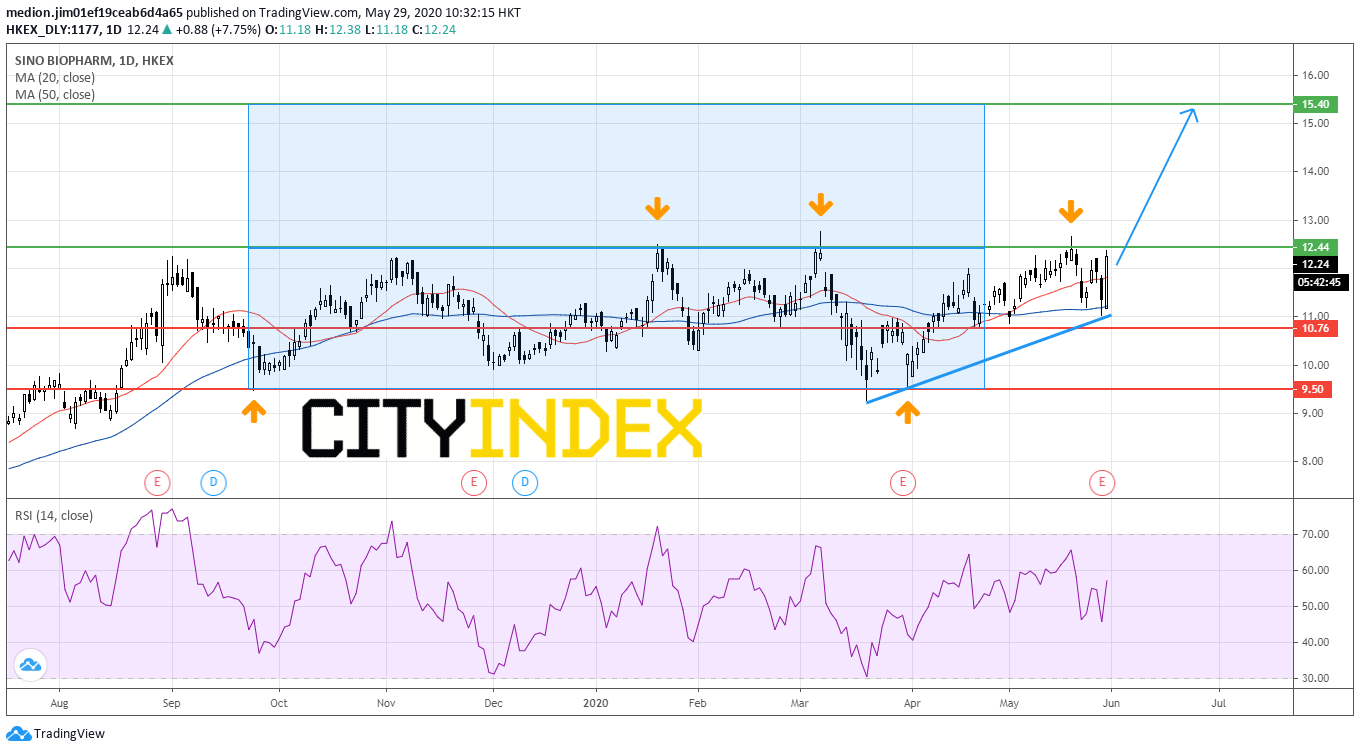

From a technical point of view, the stock has started its Range Trading since September 2019 on the daily chart. Currently, the stock posts a Long Range Bar after getting support from the rising trend line drawn from March low. The prices are expected to challenge the resistance level at HK$12.44 (the multi months reaction highs level) again.

At this momentum, waiting for a breakout signal is essential to validate that prices would go for another trading zone. A close above HK$12.44 would signal a breakout current consolidation zone and enhance the bullish outlook. The stock could consider a measured move of range to HK$15.40.

However, a break below HK$10.76 (the bottom of April 22) would break a return to HK$9.50 (multi reaction lows level)

Source: GAIN Capital, TradingView

From a technical point of view, the stock has started its Range Trading since September 2019 on the daily chart. Currently, the stock posts a Long Range Bar after getting support from the rising trend line drawn from March low. The prices are expected to challenge the resistance level at HK$12.44 (the multi months reaction highs level) again.

At this momentum, waiting for a breakout signal is essential to validate that prices would go for another trading zone. A close above HK$12.44 would signal a breakout current consolidation zone and enhance the bullish outlook. The stock could consider a measured move of range to HK$15.40.

However, a break below HK$10.76 (the bottom of April 22) would break a return to HK$9.50 (multi reaction lows level)

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM