Silver: What has happened to the Industrial Metal?

On Wednesday, spot silver climbed 7.9% on day to the highest level since 2013 at $23.00, and was up about 20.0% in the last four trading days. The agreement on a 750 billion euros aid package reached by European leaders and optimism regarding a new round of U.S. fiscal stimulus and coronavirus vaccine boosted the sentiment for industrial metals, as investors expect a strong recovery in industrial and infrastructure demand.

According to Bloomberg, one the largest silver ETF, the iShares Silver Trust recorded a fifth day of inflows on Monday, while the Global X Silver Miners EFT posted a ninth straight day of inflows.

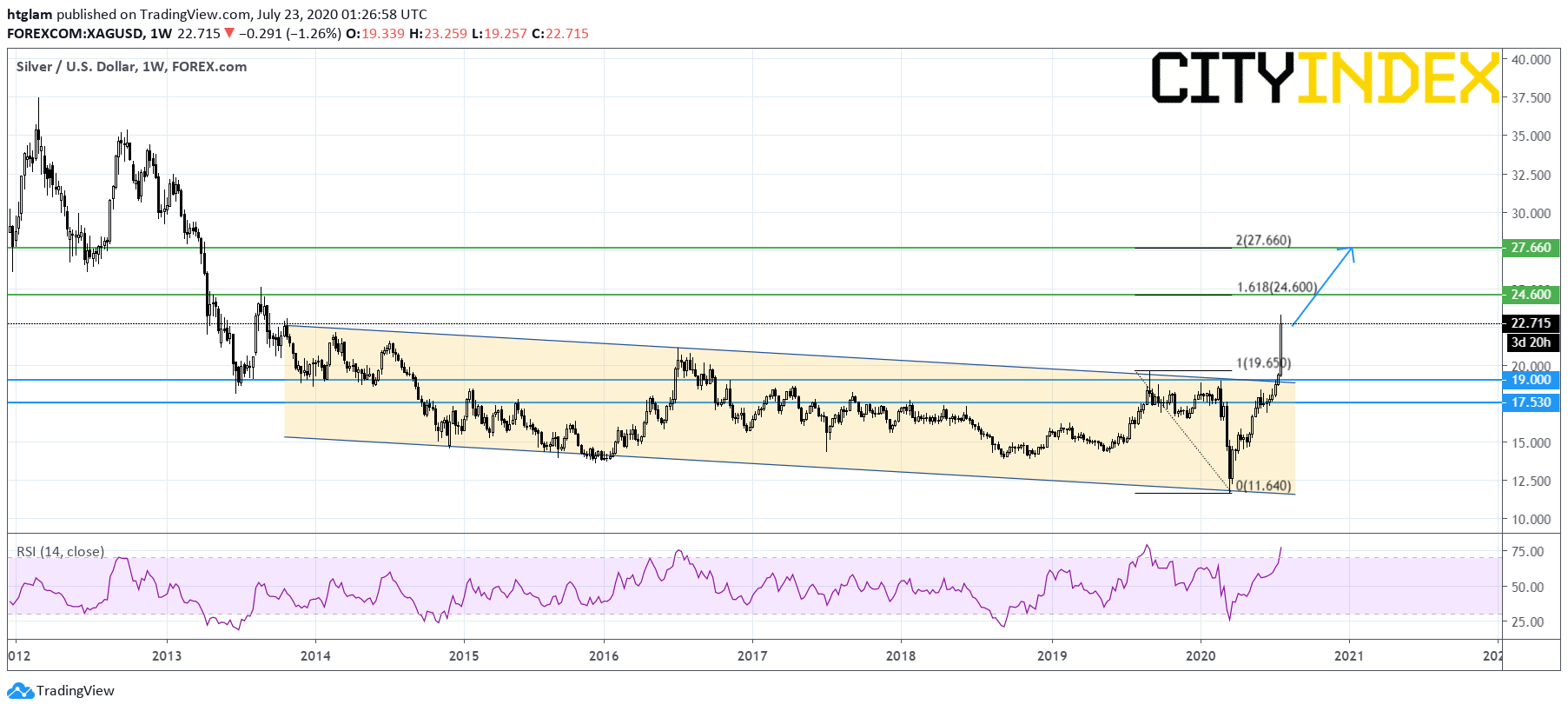

From a technical point of view, spot silver has shown a critical upside breakout in the long term as shown on the weekly chart. It has posted a V-shaped rebound from March-low and quickly broken above a 6-year consolidation range. Bullish investors might consider $19.00 as the nearest support, with prices trending to test the next resistances at $24.60 and $27.66. Alternatively, a break below $19.00 might suggest that the next support at $17.53 would be challenged.