Silver: Threaten Long Term Rising Trend Line

Spot silver's price slump was even more exaggerated than gold, as it has plunged 16.9% in the last five trading sessions.

We mentioned that investment demand has been one of the key drivers that pushed up precious metals’ prices. However, it becomes more clear that investors’ appetite has eased and the recent decline in prices has not triggered a rebound in demand. Bloomberg data showed that total know ETF holdings of silver has fallen 2.2% in September, on track to mark its first monthly decline this year.

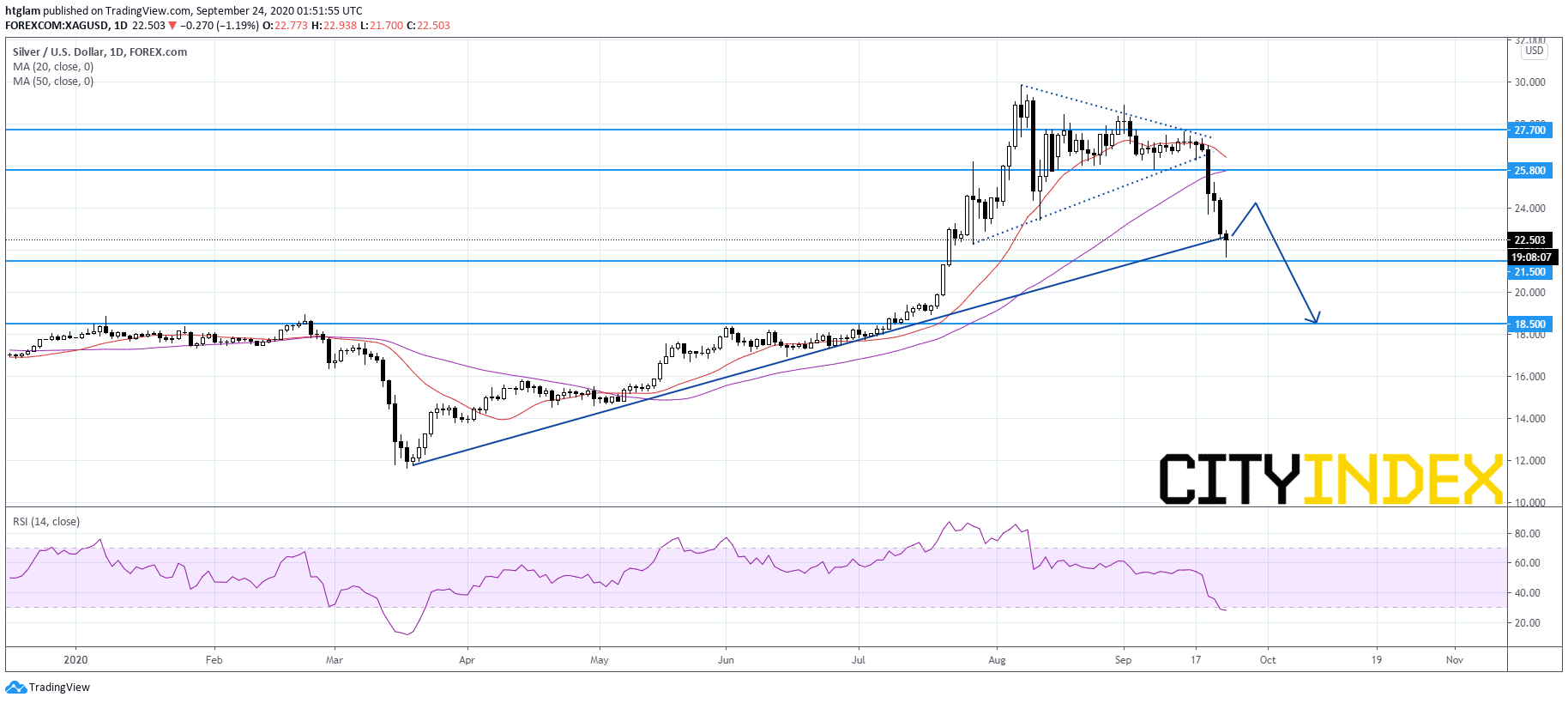

On a daily chart, spot silver is threatening a rising trend line drawn from March. The 20-day moving average has turned downward and is about to cross below the 50-day one, suggesting a bearish technical outlook. The level at $25.80 might be considered as the nearest resistance, while a break below the nearest support at $21.50 would open path to the next support at $18.50.