Precious metals continue to appreciate, with gold holding the breakout above last year’s high of $1557 and palladium hitting a new record high today after taking out the $2K barrier the day before. Platinum is also doing well, although silver still hasn’t taken out its corresponding 2019 high of $19.65 and remains about $1.30 below that peak. However, it has been rising nevertheless, and could join other precious metals in breaking to a fresh multi-month high soon.

Benchmark government bond yields remain depressed as central bank continue to keep a very loose monetary policy stance. Meanwhile, the US dollar’s rally has faded thanks to the recent rate cuts by the Fed, not to mention the re-start of their bond purchases (i.e. the “not” QE 4 stimulus programme). On top of this, expectations are rising that China will avoid a hard landing as it gets closer to agreeing a phase one trade deal with the US. The agreement could help support economic growth at the world’s second largest economy, and in turn boost demand for industrial materials including copper and silver. Furthermore, the recent escalation of the tensions in the Middle East is providing additional haven demand for gold and indeed silver. Against this fundamental backdrop, silver stands ready to appreciate further in the weeks ahead.

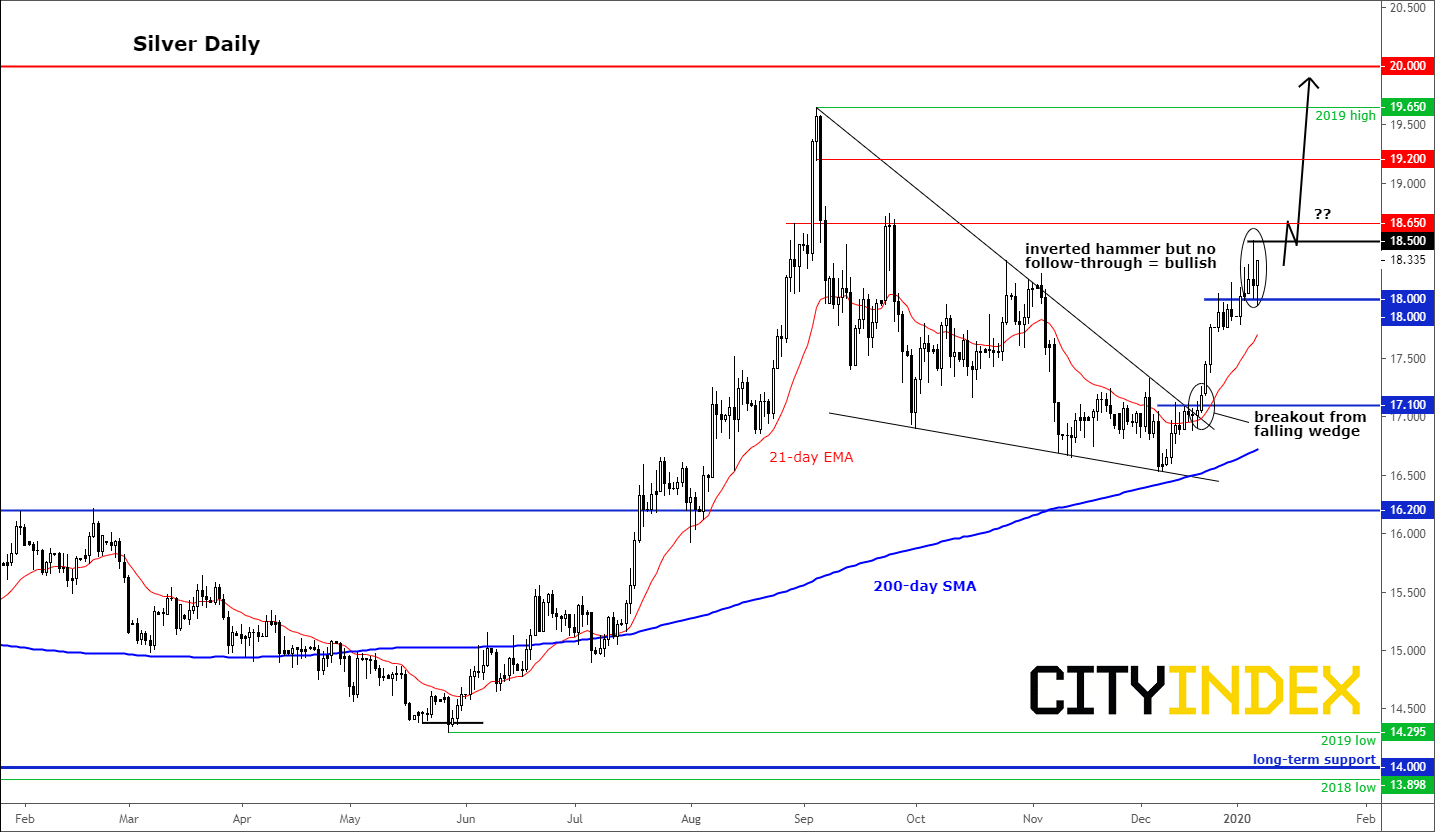

Technically, silver’s motion to move higher had already commenced in the summer. But after hitting a peak at $19.65 in September, the grey metal then moved into a consolidative period when it gave back a significant chunk of its gains made in 2019. From September until the end of 2019, the precious metal was contained inside a falling wedge pattern. But at the back end of the year, prices broke out of this bullish continuation pattern, resulting in fresh buying momentum which has carried on into the new year.

More recently, on Monday, silver formed an inverted hammer candle on its daily chart as it fell from its highs, presumably on profit-taking after the other major precious metal – gold – had gapped above its prior swing high in response to the US-Iran situation. Now, if that inverted hammer was a bearish signal, we should have seen further weakness in silver prices today. However, after a brief break below Monday’s low, silver has pushed higher, suggesting the candle from the day before was a ploy to trap the bears. Thus, a close around current levels, or higher, will indicate more gains are likely to be seen over the coming days.

Given gold’s move to clear liquidity above last year’s high, and given the above fundamental and technical considerations, I think silver is likely to follow the yellow metal and take out its 2019’s peak of $19.65 in the days ahead and hit the $20-per-troy- ounce mark.

Source: Trading View and City Index.