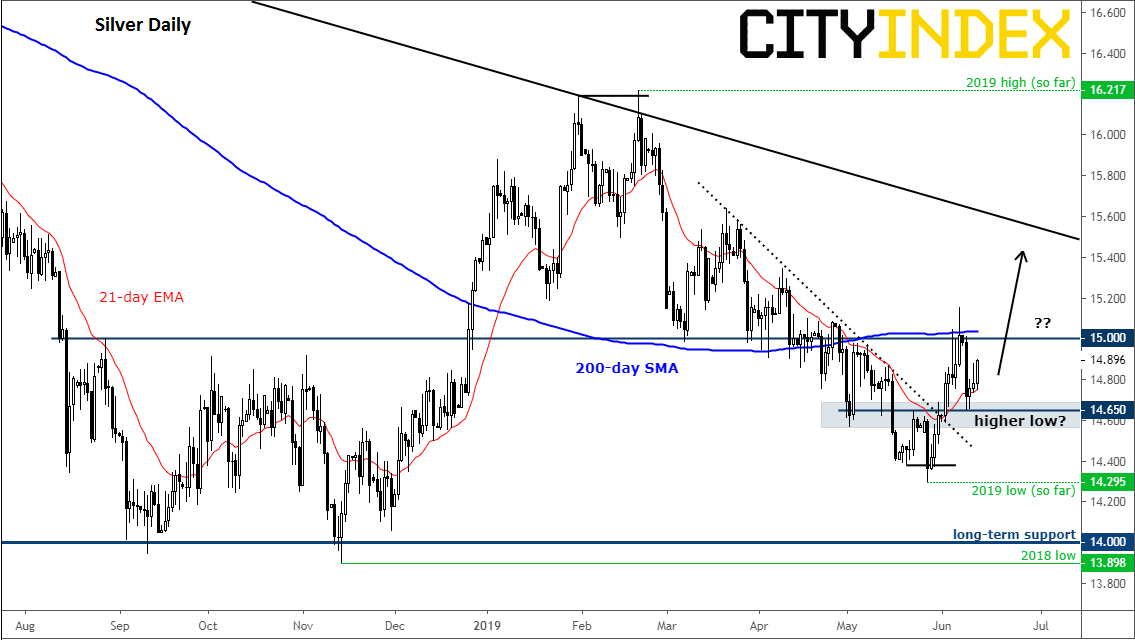

With interest rate expectations continuing to fall, noninterest-bearing precious metals have been able to shine of late. Concerns over weak growth and tame inflation have helped to boost expectations that central bank monetary policy will remain extremely accommodative for longer than previously expected. Many analysts are fully expecting the Federal Reserve to cut interest rates this year, with economists at Deutsche Bank, for example, now forecasting three cuts – at the July, September and December FOMC meetings. Other central banks have likewise turned dovish, most notably the ECB and RBA. Out of the two precious metals, gold has performed better until now given that stocks and base metals had come under renewed selling pressure on US/China trade concerns. But with risk assets finding some support again, silver has been able to shine more brightly over the past couple of days. In fact, with the gold/silver ratio being at extremely elevated levels of around $90, it wouldn’t come as major surprise if the grey metal were to enjoy some bargain hunting soon. However, the immediate focus will now turn to top-tier data from China, one of the biggest consumer nations of precious metals along with India. In the early hours of Friday, the world’s second largest economy will report its latest estimates on retail sales, fixed asset investment and industrial production. Of these, the latter will be the most important one given silver’s dual roles as a precious metal and an industrial material. If industrial production comes in well above the 5.4% y/y rate expected by analysts, then this should help to boost the demand outlook for industrial metals, including silver. Conversely, a number weaker than 5.4% could derail the mini rally. Technical market participants, meanwhile, will have liked the fact that silver has broken its short-term bearish trend line and as price is currently residing above the 21-day exponential. As things stand, therefore, the path of least resistance is to the upside for silver.

Source: Trading View and City Index