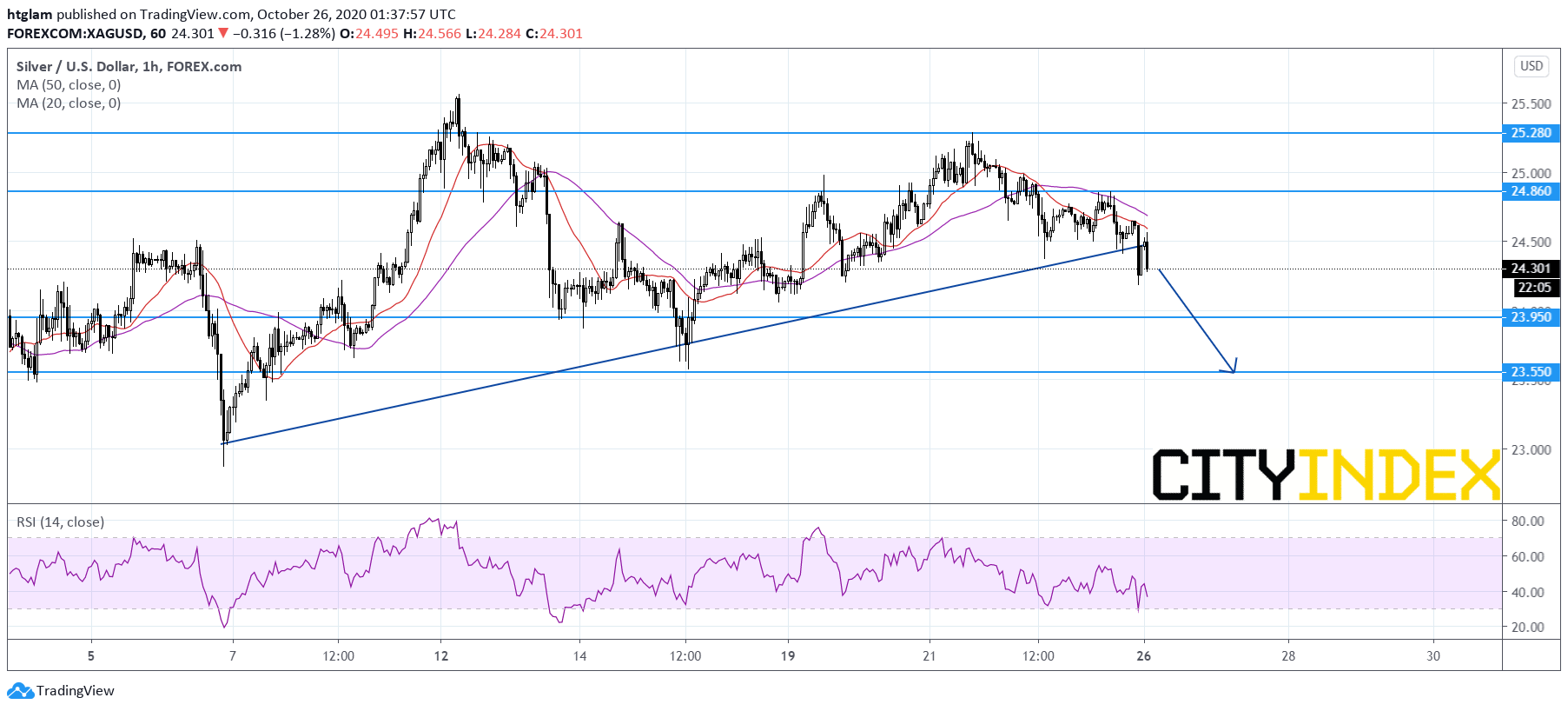

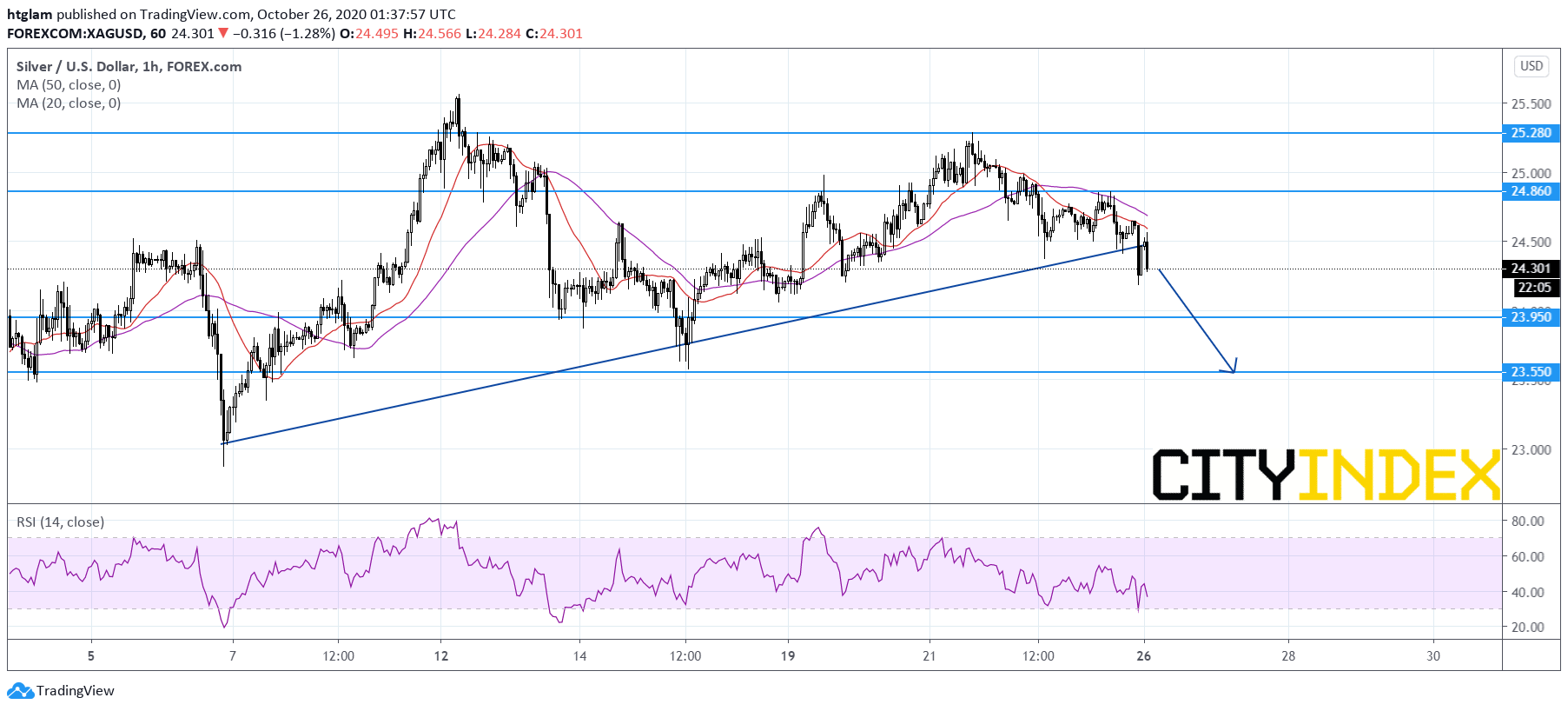

Silver Intraday: Downside Risks Persist

Last Friday, spot silver fell 0.4% on day to $24.61, as the three major U.S. stock indices closed mixed. The white metal was down for a second straight session, erased some gains made earlier in the week.

This week, investors would focus on the U.S. September durable goods orders (+0.5% on month expected) and October Consumer Confidence Index (101.9 expected), both due on Tuesday. Also, the first estimate of U.S. 3Q annualized GDP will be released on Thursday (+31.8% on quarter expected).

From a technical point of view, spot silver's downside risks persist as shown on the 1-hour chart. Currently, it has broken below a rising trend line drawn from October 6, while the 20-period and 50-period moving averages have turned downward. The level at $24.86 might be considered as the nearest resistance, with 1st and 2nd support expected to be located at $23.95 and $23.55.

Source: Gain Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM