Silver: Bullish Consolidation Continues

On Thursday, Federal Reserve Chairman Jerome Powell said they "will seek to achieve inflation that averages 2% over time", meaning that "following periods when inflation has been running below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time."

Even though his speech may not be as dovish as some investors would have anticipated, nevertheless he signaled that the Fed's monetary stance should remain accommodative for a considerable period of time, as inflation has been subdued and below target. Industrial metals are expected to benefit from low interest rates and ongoing economic recovery.

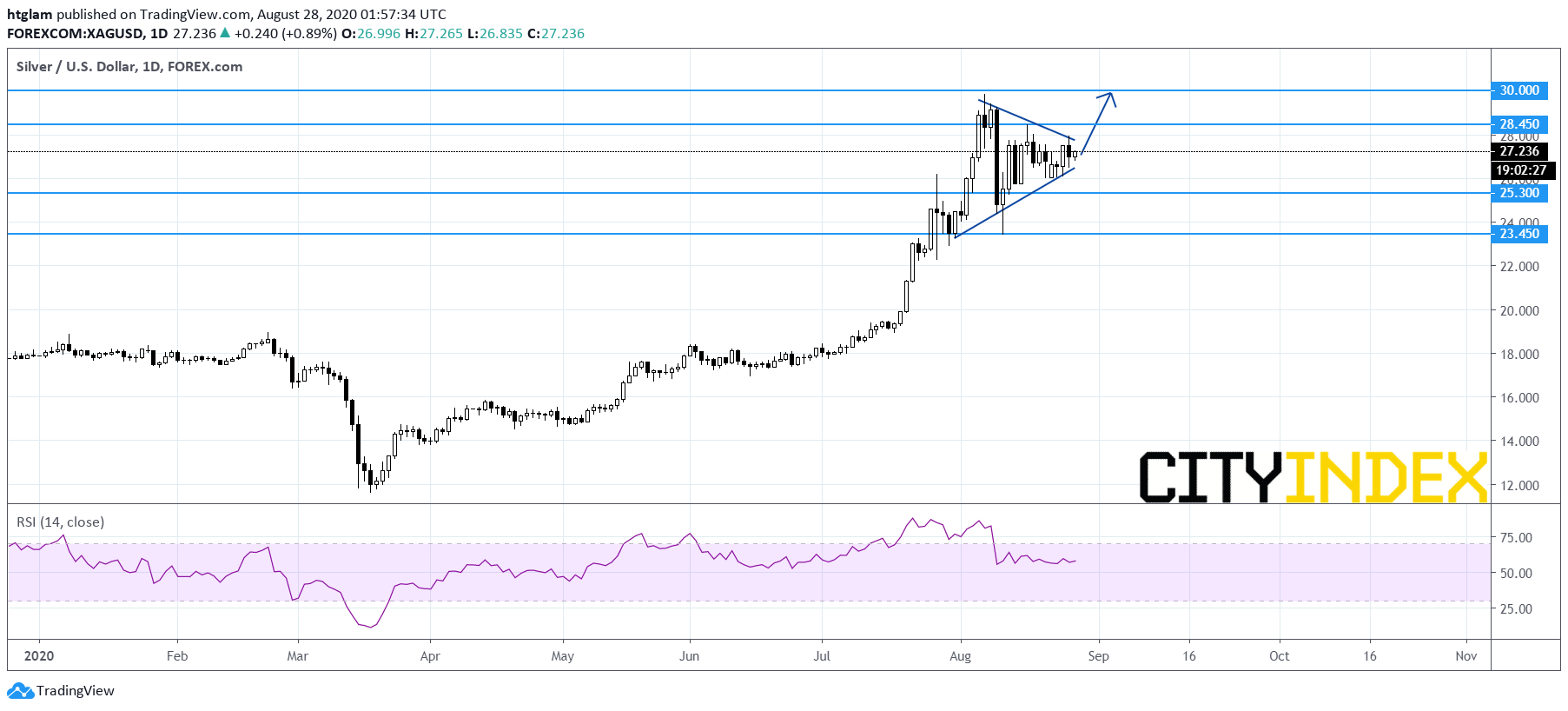

Spot silver saw volatile trading on Thursday, as it marked a day-high near $27.90 before closing down 1.8% at $27.00. However, from a technical point of view, the price swings have not damaged silver’s bullish consolidation pattern as shown on the daily chart. It remains trading within a symmetrical triangle pattern after a recent rally. The level at $25.30 may be considered as the nearest support, while the 1st and 2nd resistances are expected to be located at $28.45 and $30.00 respectively. Alternatively, losing $25.30 may suggest that the next support at $23.45 would be challenged.