Silver and Gold -Which is Better to Own Right Now?

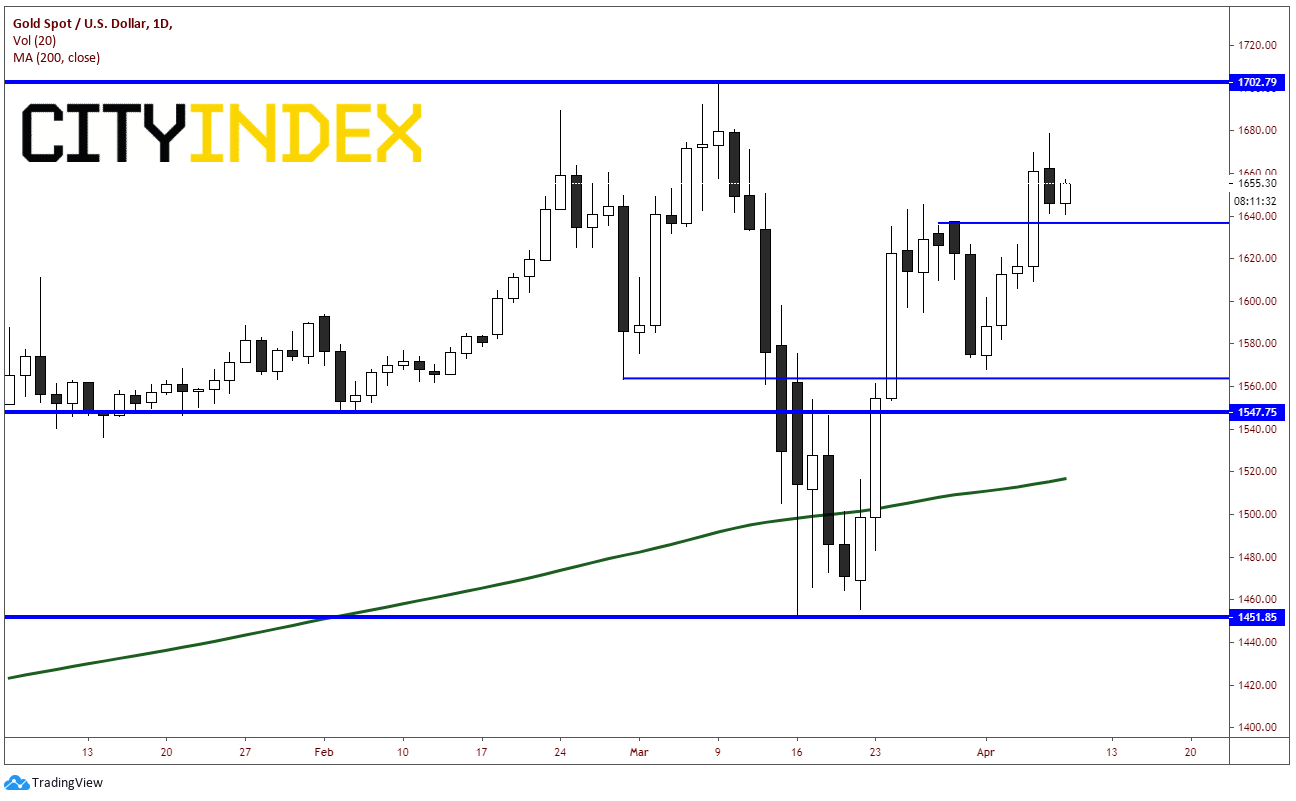

It’s been quite a ride for the two precious metals since the coronavirus outbreak began in late February. Gold (XAUUSD) up in a new recent high on March 9th and for 8 of the next 9 trading days, traded lower, down almost 15% as gold was sold to raise cash for margin in stocks as equity markets continued to sell off. However, as buying pressure came back on March 23rd and 24th, it was discovered that there was a problem in the EFP market and banks could not meet the demand for physical gold. This sent prices higher. Yesterday, price traded within 24 dollars from the March 9th highs. Also, Gold put in a bearish candle (slightly missing the true definition of a dark cloud cover, in which price would have had to have closed 50% below the prior day’s highs), however it is still within 50 dollars from the recent highs. If there is a risk off move in the markets, this may catapult Gold to new highs.

Source: Tradingview, City Index

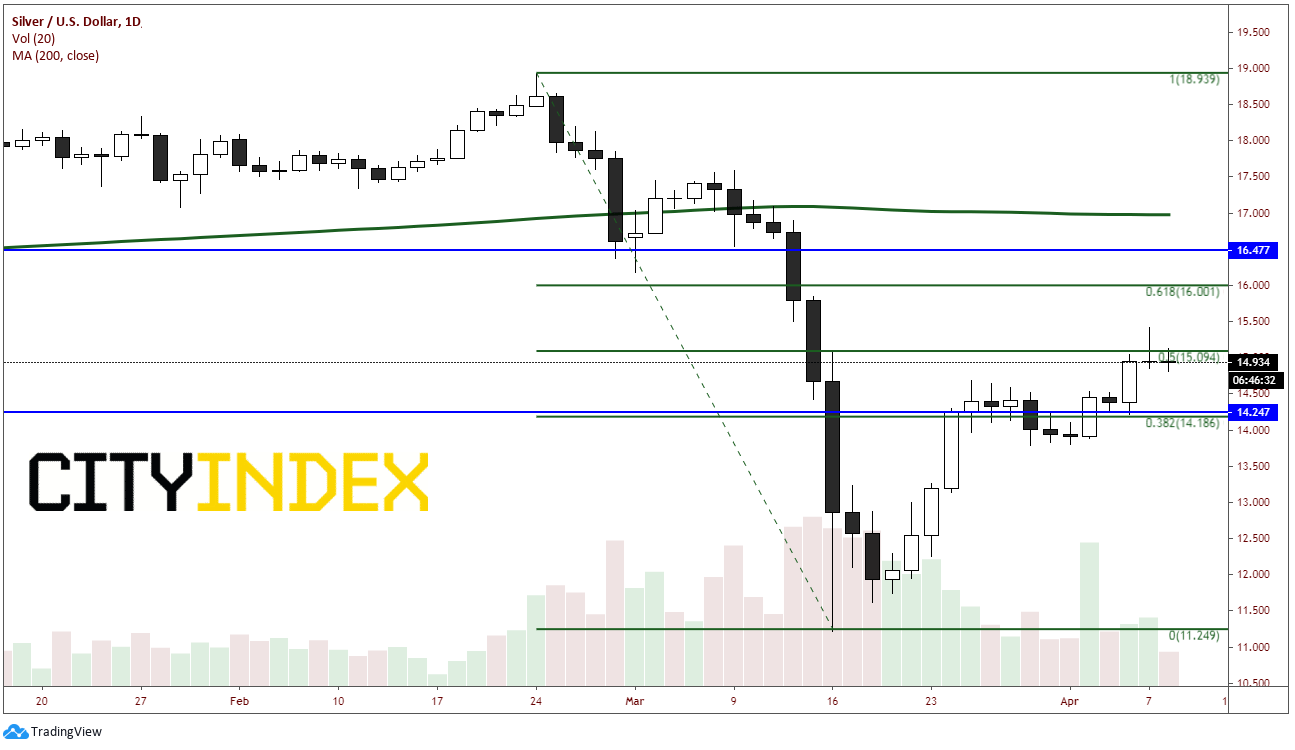

Silver (XAGUSD) has had a similar experience as Gold over the last month. Silver put in a recent high on February 24th at 18.929, however as Gold was putting in a new high on March 9th, Silver could only trade back up to 50% of its February 24th high to March 2nd low at 17.587. The metal then proceeded to sell of 40% from its February 24th highs, whereas gold only sold of 15%! Silver then bounced along with Gold over the course of the new 2 weeks. However, as Gold traded back to within spitting distance of its prior highs, Silver could only retrace 50% of its high to low move, back to 15.09. Silver put in a gravestone doji on yesterday’s daily candlestick chart. This is considered a reversal candle.

Source: Tradingview, City Index

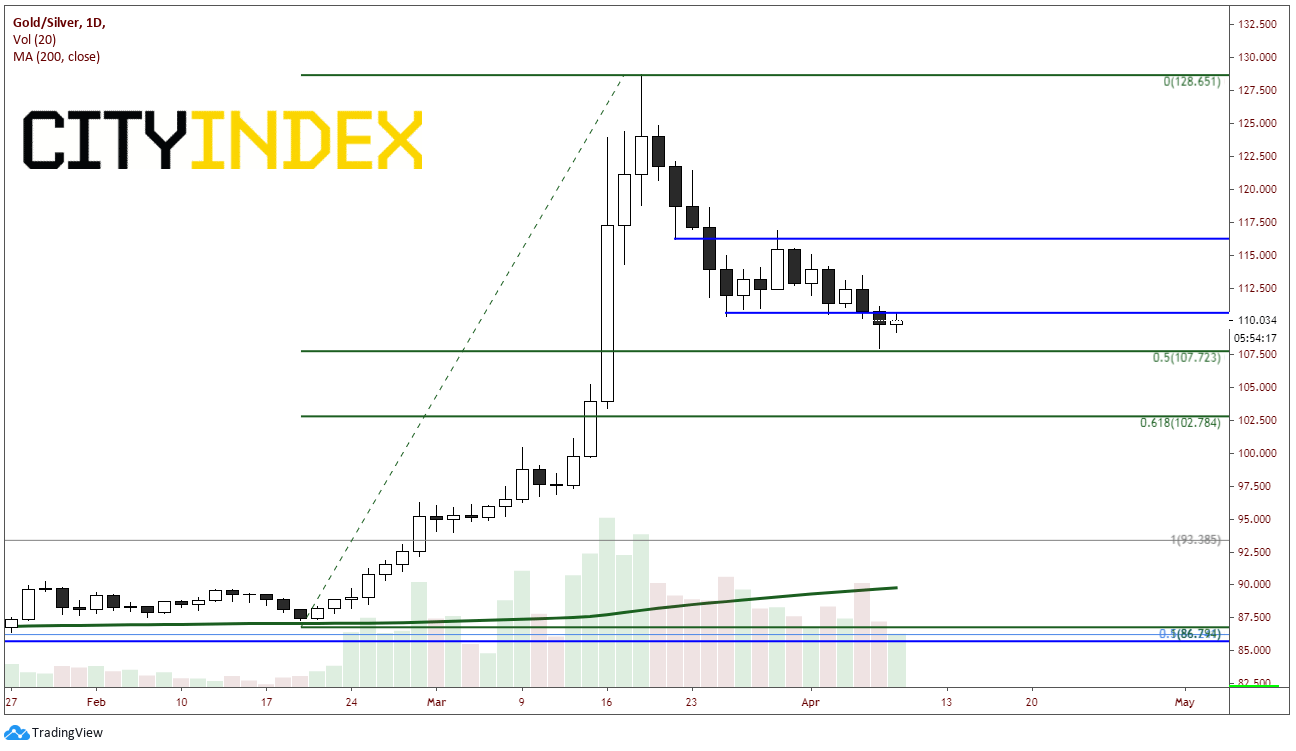

Now, let’s look at the Gold/Silver ratio (XAUXAG) and see which is performing better on a relative basis. From February 19th to March 18th, the ratio skyrocketed from 87.331 to 128.692. This is the period that silver sold off 40% while gold only sold off 15%. However, since then, the ratio has been pulling back. This is because Silver has been outperforming Gold on a relative basis. The ratio is currently at an inflection point, the 50% retracement level from the February 19th lows to the March 18th highs at 107.72. Yesterday, although the ratio broke support, the candle was a hammer, indicating a possible reversal. If the ratio breaks lower, next support is the 61.8% Fibonacci retracement level from the same time period at 102.78. However, if the ratio can close above resistance at yesterday’s highs or 111.108, Gold could outperform silver and the ratio could move to next resistance at 116, then previous highs at 128.651.

Source: Tradingview, City Index

So, which is better to own right now, Gold or Silver? The Gold/Silver ratio (XAUXAG) has recently pulled back 50%, therefore it may be due for a rebound. If that is the case, Gold would be the better buy. However, it the ratio breaks below the 50% level, further downside may be in order, which would mean Silver is the better metal to own. More evidence is probably necessary to make that decision. However regardless of which you want to own, if see we a risk off move, both should move higher!