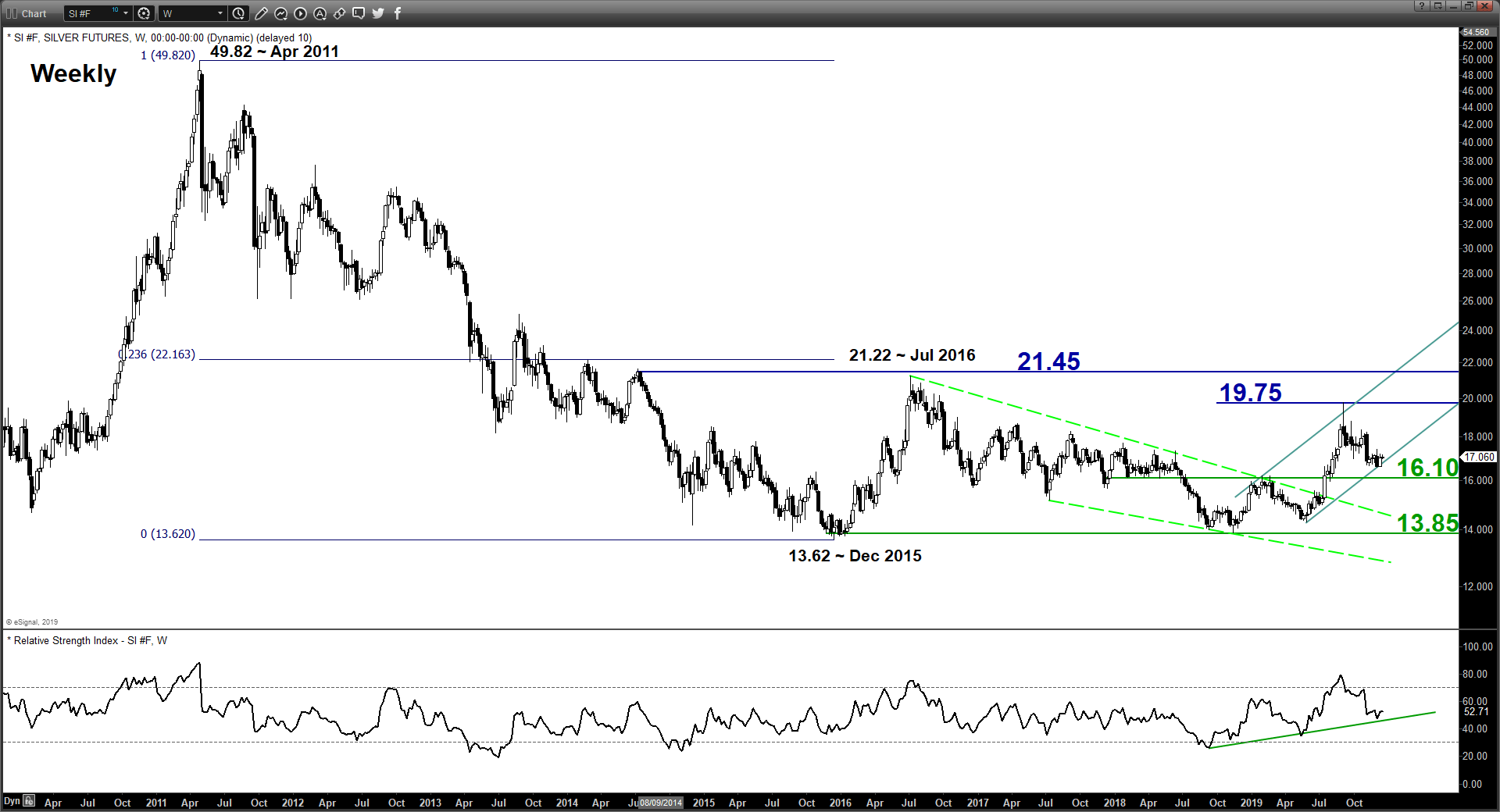

Medium-term technical outlook on Silver (futures)

click to enlarge charts

Intermediate support: 16.60

Pivot (key support): 16.10

Resistances: 18.20 & 19.75

Next support: 15.00

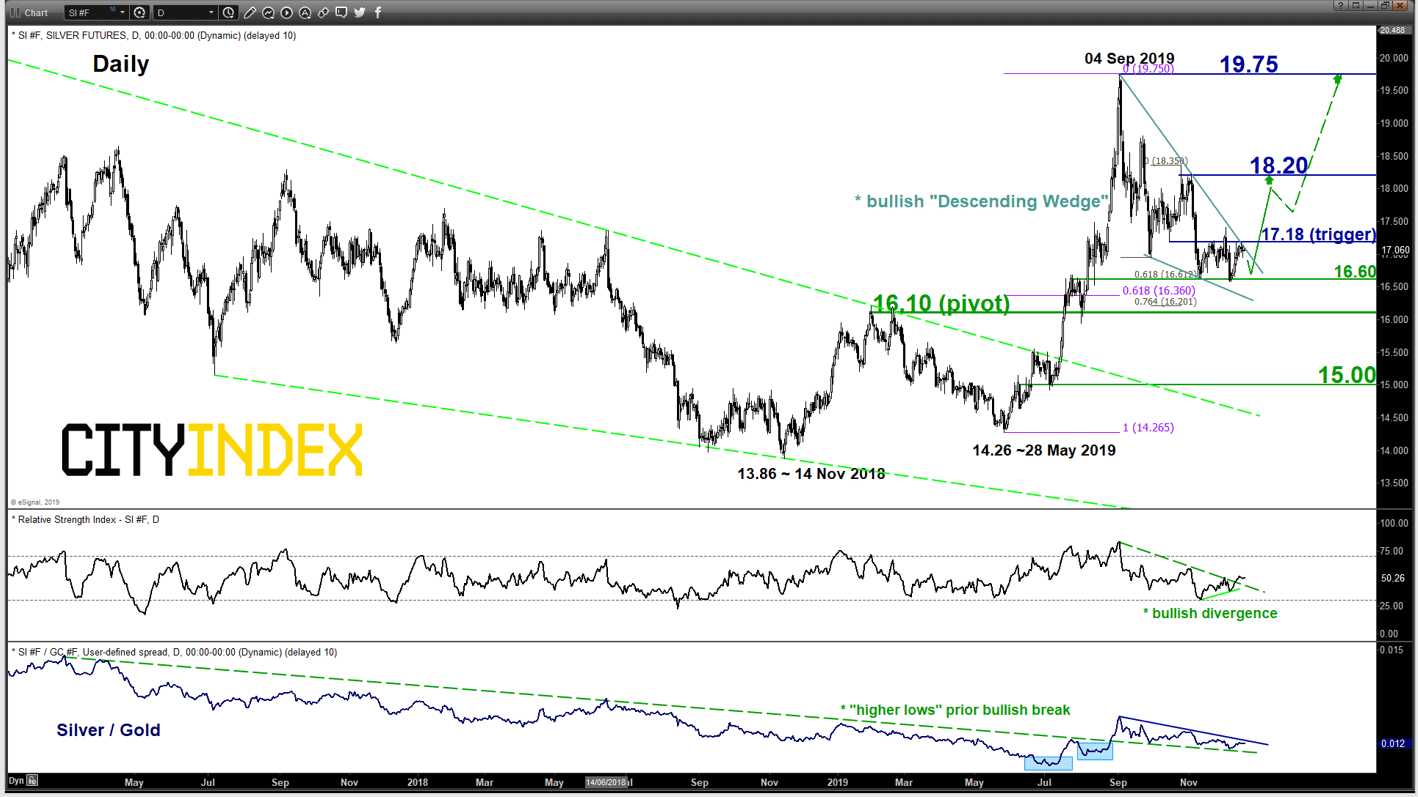

Directional Bias (1 to 3 weeks)

Bullish bias in any dips above 16.10 key pivotal support and a break above 17.18 may trigger a bullish breakout to target the next intermediate resistance at 18.20 in the first step.

On the other hand, a daily close below 16.10 is likely to jeopardise the major uptrend phase in since 14 Nov 2018 low of 13.86 for a deeper corrective decline towards 15.00 support (the former resistance of a major “Descending Wedge” from Jul 2016 high & medium-term congestion area of 06 Jun/03 Jul 2019).

Key elements

- Since its 04 Sep 2019 swing high of 19.75, Silver has staged a corrective decline of 15.80% and interestingly, price action coupled with momentum analysis do not strongly support the start of an impulsive down move sequence at this juncture.

- The decline from 04 Sep 2019 high has evolved into a bullish “Descending Wedge” range configuration where the magnitude of the “lower lows” is lesser than the magnitude of the “lower highs”. The “Descending Wedge” resistance stands at 17.18.

- The 16.60 current swing low area of the “Descending Wedge” confluences closely with a Fibonacci retracement/expansion cluster which suggests a potential bullish inflection point.

- The daily RSI oscillator has traced a bullish divergence signal at its oversold regional and broke above a corresponding descending resistance. These observations suggest that the recent downside momentum has started to abate which supports a potential medium-term revival in upside momentum.

- Relative strength analysis via the ratio chart of Silver/Gold advocates a potential future outperformance of Silver against Gold.